Are you saving aggressively or 'petiks lang'?

When did you start saving? How do you do it? How much are you saving?

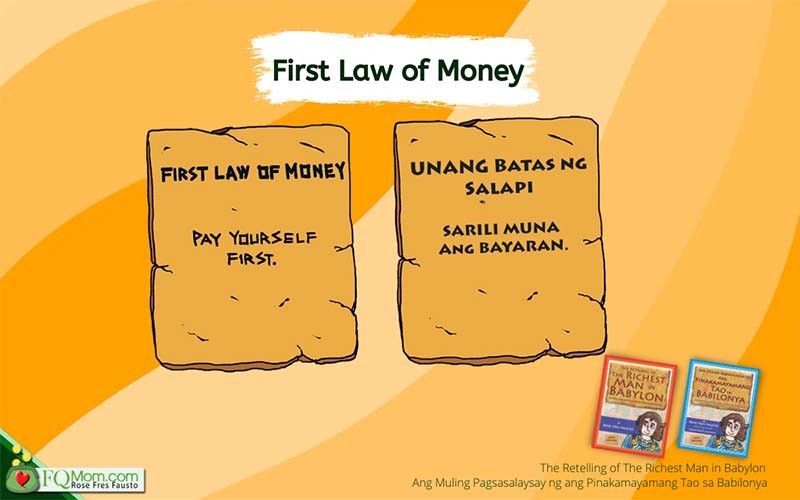

In "The Retelling of The Richest Man in Babylon," we talk about the first basic law of money as pay yourself first. It is essentially shifting the mindset on savings – instead of thinking of it as depriving oneself, it is actually prioritizing oneself. In the same book, it says “It should not be less than one-tenth, no matter how little you earn. It can be as much as you can afford.”

What then does it mean to save as much as you can afford?

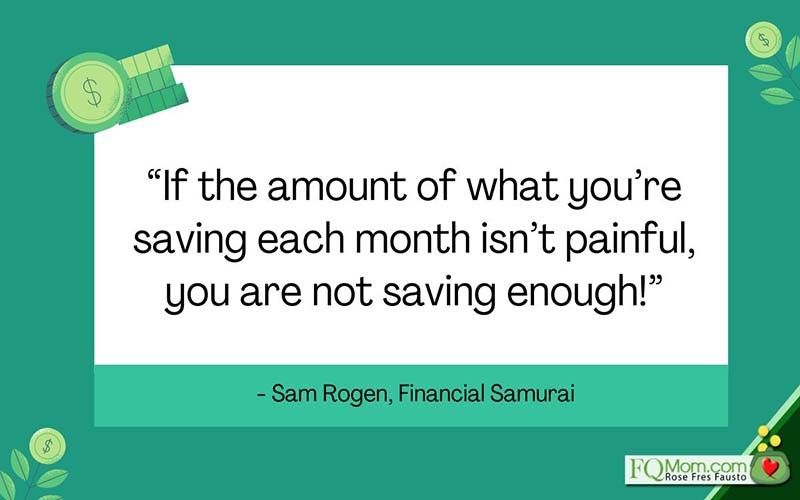

I wish to answer this by taking what I have learned so far from Sam Dogen of Financial Samurai who recently released his book "Buy This, Not That," the book I’m reading right now. This is what he says about how much one should save.

Yes, my dear reader, you read that correctly, it should be painful. You should feel the pinch and not “petiks lang.” And this is very true when you are young.

Here is his analogy. It’s like wearing braces, it feels uncomfortable but you endure the pain because you know that you need to do so in order to have beautiful teeth. It’s a necessary pain of formation.

To those who cannot relate with the braces analogy, maybe a more apt one would be tightening the belt or the Pinoy saying of “habang maikli ang kumot, matutong bumaluktot!” We have to teach our children and train ourselves to endure the discomfort of both braces or the short blanket.

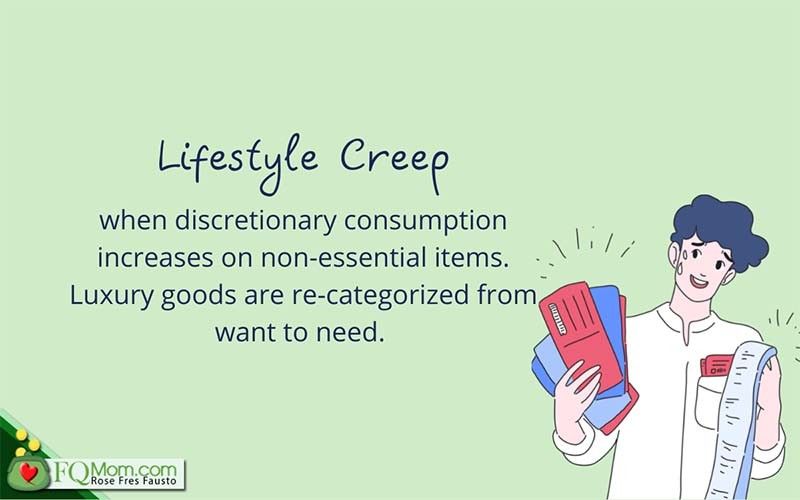

If you have to start your savings rate at a low 10%, please increase it, (take note, the savings rate, not just the absolute amount) as you earn more. The increase in income should be diverted more to the savings and investments and only a small portion to the increase in standard of living. If you don’t do this, you are letting the phenomenon of lifestyle creep interfere in your preparation of your financial freedom and happiness.

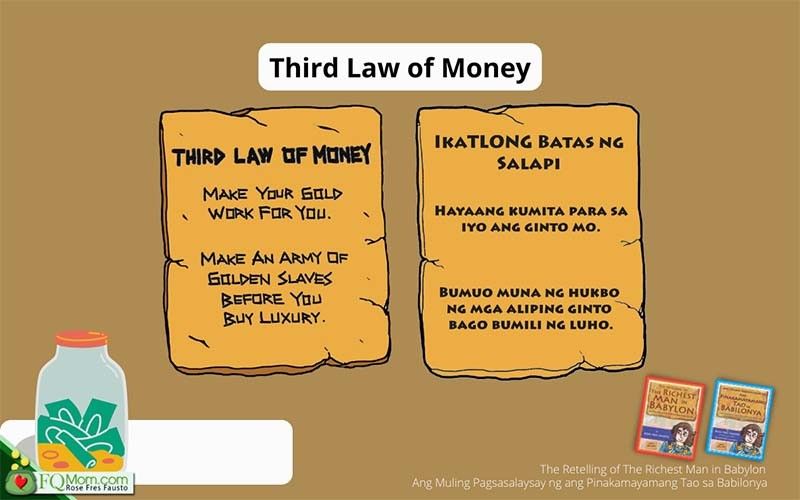

Don’t get me wrong. I also believe in enjoying the fruits of your labor. That’s what my Mamang used to tell me, “Live within your means but enjoy the fruits of your labor.” This is essentially observing the third basic law of money.

And I came up with an easy to remember guide for everyone to observe the third basic law of money, the law about delaying gratification.

Back to the savings rate. If you stop at only 10%, you will not go far in building your nest egg. It will not be enough when you reach 60 or whatever age you plan to retire. (Note that retirement should now be re-invented. You may read "Why We Should Re-invent Retirement" to know more about it.)

The amount you’re saving has to hurt like your braces while you are young. Increase it, gradually, if you want to soften the blow, but by no means, don’t get stuck with the minimum of 10%. Based on experience, we increased our savings rate all the way to 50% by the time we reached mid-life. When you receive bonuses and other windfall income, set them aside as savings and investments and just allow yourself to enjoy a small portion of them.

When you hear someone warn you of over-saving, don’t easily be swayed and start cutting down on your savings. Over-saving, if it happens, is a sweeter and much easier problem to solve than its opposite. Just don’t allow yourself to look shabby and be over stingy to the point of losing meaningful relationships with others and even with yourself.

The good news

They say “compound interest is the 8th wonder of the world” and we have to make sure that we are on the earning, instead of the paying side of this equation. So, if you have high interest consumer debts, please get rid of them first before you start investing. And here’s good news, there’s an nth wonder of the digital world that can help us save. It is called automatic saving and investing!

Remember that in the same way as online shopping has made it easier for you to spend, you can also be on the other side of the fence of this digital innovation in order to benefit yourself. You can program your saving and investing to be automatic, no more excuses. This will help you avoid saving petiks lang and a looming financially sad old age.

And you know what? Even if you abide by the Financial Samurai’s advice of saving until it hurts, the pain is somehow eased when it is done automatically. Make use of this nth wonder of the digital world to save aggressively. Remember this:

If your savings is petiks lang,

Kulang!

Cheers to saving enough! Cheers to high FQ!

ANNOUNCEMENT

1. As we celebrate Buwan Ng Wika this August, we are having a buy 1 – take 1 free promo for our Tagalog book, "Ang Muling Pagsasalaysay ng Ang Pinakamayamang Tao sa Babilonya." Click here to get your copy.

2. To know more of FQ hacks and tips visit FQ Mom Channel, click here.

3. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click here.

4. After the test, make them understand the basic laws of money, understand their relationship with money, including their own money biases, so they can improve their FQ, their money knowledge and behavior. Give them the gift of any or all of the FQ books. Click here.

This article is also published in FQMom.com.