ANCHORING EFFECT (Psychology of Money)

Today I wish to discuss another Behavioral Economics principle, which affects the way we deal with money. The rational belief is that we analyze factors such as supply, demand, materials and labor used, etc. in determining the value of a good or service. However, there is a common human tendency to rely too heavily on the first piece of information offered (which we will refer to as the "anchor") when making decisions. In terms of pricing, we are affected by an initial number suggested to us, no matter how unrelated it is.

Dan Ariely, George Loewenstein and Drazen Prelec conducted an experiment among MIT (Massachusetts Institute of Technology) students on this principle. They showed various products – cheap wine, expensive wine, keyboard, trackball mouse, book and Belgian chocolates – and allowed the participants to examine them while they listened to the descriptions given by the experimenters.

The products used for the experiment

Then they distributed a list of the products to the participants and asked them to write the last two digits of their Social Security Number on the upper right hand of the paper. Next, they asked the participants to write their respective two-digit numbers with a dollar sign next to each of the six products on the list.

Left photo: The participants were asked to write the last 2 digits of their Social Security No. on the upper right side of the list. Right photo: The participants were asked to write the same last 2 digits with dollar sign beside each product.

Then they were asked, “Hypothetically, would you pay this amount of dollars for each of the six products?” So they answered yes or no beside each item. After which, the participants were asked to submit their real bids for each product.

After they submitted their bids, they were asked, “Do you think your Social Security Numbers had any influence on your bids? They answered, “Of course not!”

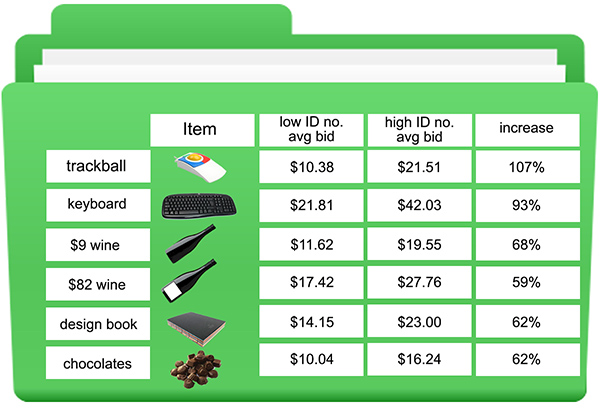

Guess what happened? Those with high last two digits (above 50) in their Social Security Numbers submitted significantly higher bids than those with lower numbers (below 50). The difference in the average bid ranged from 59% to 107%!

The experiment’s auction results showing how significantly the bids were affected by the participants’ SS No., a number with no connection to the prices of the products.

This experiment was done several times using different sets of participants and yielded similar results.

Once we are exposed to a certain price and consider it as the value of something, the number stays in our mind and we tend to use it as an anchor in our ultimate valuation, regardless of its relevance.

So do you now see the psychology that TV shopping channels use? After talking about their amazing product, they give you exorbitant anchor prices. Then they follow it up with mumbo jumbo add-ons to the product. Finally they deliver the hook, “And you can get this for only $ XXX if you call now!” They repeat those prices – the stand-alone price of the product, then the value of the add-ons, then they cross out those high numbers on the screen to show the now substantially lower price!

Hypnotized, the TV shopper calls to grab that chance of a lifetime.

The succession of high anchor prices and add-ons, followed by “Call now to avail of the special price!” has a hypnotic effect on tv shoppers.

It’s the same for stores that advertise sale. They write the supposedly regular price with matching cross outs then show the sale price. The sad thing is that there are a lot of stores, even known establishments, that deceive their customers by adjusting the supposed regular price upward just so they can write 30% or 50% or 70% off on their price tags. So unless you’ve really known the regular price of something, do not base your purchasing decision on the discounts being offered, because there is a big chance that they are not true.

Huge discounts and high anchor prices drive the shopper crazy and persuade actual purchases.

Here’s one more thing to remember when doing your shopping. Go to the sections that offer the cheaper items first. This way your anchor prices are on the low side.

“Nagngina!” (“Too expensive!”)

My octogenarian father is also trapped in this cognitive bias called anchoring effect. Papang was not only brought up the Ilocano way but he also experienced the war, so being frugal was a natural consequence. However, I remember him as the parent who was more relaxed with spending while we were growing up. Mamang was the one who would put the stops on unnecessary spending.

But things have changed, it’s now the other way around. Let me share a story. Early this year my sister accompanied our father to buy his piña barong for their Diamond Wedding Anniversary, he happily tried on a few pieces with his usual kengkoy (funny) antics of pogi posing and dancing. They picked a nice one, which was fortunately on sale. Then he asked, “How much is it?” When he heard the net price, he exclaimed, “Nagngina!” (“Too expensive!”) and refused to buy it! My sister really wanted to buy it already because it was beautiful and reasonably priced, but it was impossible to do so because of the vehement reaction from our father who even said, “You may buy it, but I won’t wear it!”

When the story was narrated to the family, it was decided that we should just allow him to cool down and not force the issue that it was impossible to buy a piña barong with the price he had in mind, not even a jusi one.

In a recent conversation I had with my mom, I asked why Papang seems to be more kuripot (miserly) now than he was before. My mom said, “Well, your Papang is stuck in the price levels of his pre-retirement days, when he used to buy things for the family.” His prices are anchored in the levels of three decades ago!

Are your old folks also stuck in the price levels of yesteryears?

If you’re wondering what happened to the piña barong, my sister ended up buying it on her own. And yes, Papang wore it handsomely on his nth wedding to his bride of 60 years!

Here’s one more thing about my father. He also enjoys signature stuff, especially the ones he receives as gifts from his children. I remember how fondly he always wore his Prada shoes and Ralph Lauren jacket. I think it’s because there’s another Behavioral Economics principle on the psychology of money at work here. It’s called the Pain of Paying, which is removed when he’s not the one making the purchase. (Click link to learn more about this principle.)

******************************

ANNOUNCEMENTS

1. Do you want to know your FQ Score? Click link below to take the test.

2. I will speak at the UST Financial Literacy Campaign and Promotion on October 24, 2016 at the Thomas Aquinas Research Complex Auditorium, University of Santo Tomas

3. I will speak at the Ateneo Paradigm Entrepreneurship Crash Course on November 11, 2016 at the Oakwood Joy Nostalg Center, Manila, Pasig City

4. I will speak at the Kerygma Conference on November 17, 2016 at the MOA Arena. My talk is entitled “AWESOME FAMILY, BY DESIGN (Applying Behavioral Economics in Raising a Great Family)”

5. Watch out for the continuation of my FQ talks in cooperation with Security Bank. Dates and venues to be announced.

Rose Fres Fausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples - Books of FQ Mom Rose Fres Fausto. She is a Behavioral Economist, Certified Gallup Strengths Coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter & Instagram as theFQMom.

ATTRIBUTIONS: Photos from ergovancouver.net, dir.indiamart.com, dragonink.co.th, filipiknow.net, freeiconspng.com, freevector.com, icons.mysitemyway.com, makandimanaya.files.wordpress.com, pinterest.com, s-media-cache-ak0.pinimg.com, swaygrantham.co.uk, thebookdesignblog.com, wallcreations.com.au, wallpaperfolder.com, winefolly.com, wonderfulengineering.com put together to deliver the message of the article.

Study taken from “Coherent Arbitrariness:” Stabel Demand Curves Without Stable Preferences – by Dan Ariely, George Loewenstein, Drazen Prelec