Mental Accounting

Question: What is your opinion on how to handle “once in a blue moon” or irregular income – e.g. from commercials, speaking engagements, contest prizes, award money? How much of it should you save? How much should you spend? – Gerardo via Facebook

Your question is best answered by discussing the Behavioral Economics (B.E.) concept of Mental Accounting. To those who have not read my past articles on B.E., this is a relatively new field that studies the decision-making process of consumers and how they are not always based on rational and utility maximizing principles, but are mostly affected by emotional and psychological factors. It is a combination of Economics and Psychology.

Among the key principles in B.E. is Mental Accounting. It refers to our tendency to separate accounts based on a variety of subjective criteria, like the source of the money and intent of each account. According to the theory, individuals assign different functions to each group, which usually has irrational and detrimental effect on the consumer – i.e. utility is not maximized.

The very rational premise of money is that it is fungible, interchangeable. Regardless of the source of your cash, it gives you the same value and purchasing power, so if you were an Econ (the term coined by Father of Behavioral Economics Richard Thaler to refer to the rational consumer being assumed in traditional Economic models, vs. the usually irrational human which is what is assumed in B.E.), you wouldn’t differentiate how you will spend or save your income from your commercials, speaking engagements, prizes, etc., from your regular cashflow. That means that if you save a certain percentage of your regular income, then you do the same for your “once in a blue moon income.”

However, since we are only human, we tend to treat this income differently. We always rationalize to ourselves, “Anyway, this is not expected, so I can freely spend it to give myself a treat…” If we keep on doing this, we won’t be able to take advantage of these windfall income sources in terms of our asset accumulation.

On the other extreme, the more frugal ones will actually save everything since it’s not an expected income and take the opportunity to accelerate asset accumulation. Check yourself, what inspires you to do more of those extra income activities. Will a save and invest it all behavior make you happy or will a little treat move make you happier? I sometimes get the kick out of investing everything (Ilocana ngarud) but sometimes we like to buy something out of the proceeds of the windfall that will serve as a remembrance of that blessing. But at the very least, save the same percentage that you would on your regular income.

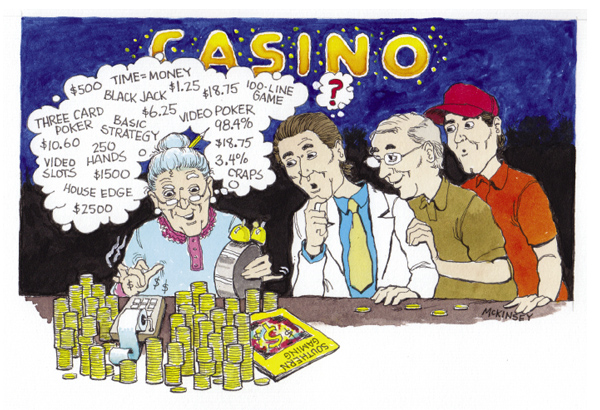

The House Money Effect. This was first described by Richard Thaler and Eric Johnson in a paper written in 1990 (Click to download). In casinos, it is observed that when one wins while playing, the profits are made separate from the original capital. Then the gambler is more willing to bet all his profits because he feels that the money is “house money.” This is also observable in people investing in the stock market. They view their profits as disposable and take greater risk, which usually brings them back to zero profits, if not negative. So this mental accounting tendency is what makes us spend windfall income more freely.

Another Danger of Mental Accounting. This is best described by Thaler in his books by citing a conversation between legendary actors Dustin Hoffman and Gene Hackman (Click Dustin Hoffman's Mental Accounting).

Because of the categories we assign to our money, we sometimes act irrationally. Why do some people keep a significant balance in their savings account (which is not earning anything) and continue to pay interest on their credit card? This is obviously irrational but those who do it would defend it saying that at least they have cash in case of emergency. Well, they’re better off paying their credit card loan and save on interest first, then if an emergency comes, that’s when they access their credit card facility. (Actually, the best solution to this is never to have credit card loans because their interest rates are ridiculously high, but that’s another article.)

The Upside of Mental Accounting. Given that money is fungible, the rational way of spending our money is to think of opportunity cost. If I buy this 6-figure bag, what am I foregoing? Well that’s pretty obvious, so let’s try a harder one. When I eat out everyday instead of bring baon to school or work, what am I foregoing? So you can relate this to the investments that you could have made, or the pair of shoes that you tried on and was a perfect fit last month. But can our human mind systematically do all these immediate assessments of opportunity costs? Nope, unless you’re Mr. Spock.

So we resort to mental accounting. We assign buckets to our expenses. It is our way to guide ourselves to stay within budget. The jar system (similar to what Dustin Hoffman learned from his mom) is a handy tool to teach kids how to handle their money, how to allocate their funds according to what they value. If it works for little kids, it sure works for us! Just beware of the negative effects that rigid application can bring.

So to answer your question how much should you spend and save from your “once in a blue moon income,” the answer is this: It’s your call. But knowing what you learned from the above, should the source really matter?

***************************

ANNOUNCEMENTS

1. I will be a speaker at the Truly Rich Club’s Wealth Summit 2016 entitled Millionaire Makers on March 4-5, 2016. Click this link to register. http://trulyrichclub.com/wealthsummit/

2. I will speak at the Women Empowerment Fair in Taguig on March 15 to talk about financial empowerment.

Rose Fres Fausto is the author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples - Books of FQ Mom Rose Fres Fausto. She is the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter &Instagram as theFQMom.

ATTRIBUTIONS: Images used from bri-willimans.blogspot.com, gaminganddestinations.com, caritasplans.com, zastavki.com, dreamstime.comput together to help deliver the message of the article.