Duterte’s advice to Marcos to pay debts: New taxes, cut 'unnecessary' spending

MANILA, Philippines — President Rodrigo Duterte, who embarked on a borrowing spree to fund a costly pandemic response, is leaving his successor with a plan to tackle the huge debt pile, one that includes imposing new taxes and controlling spending.

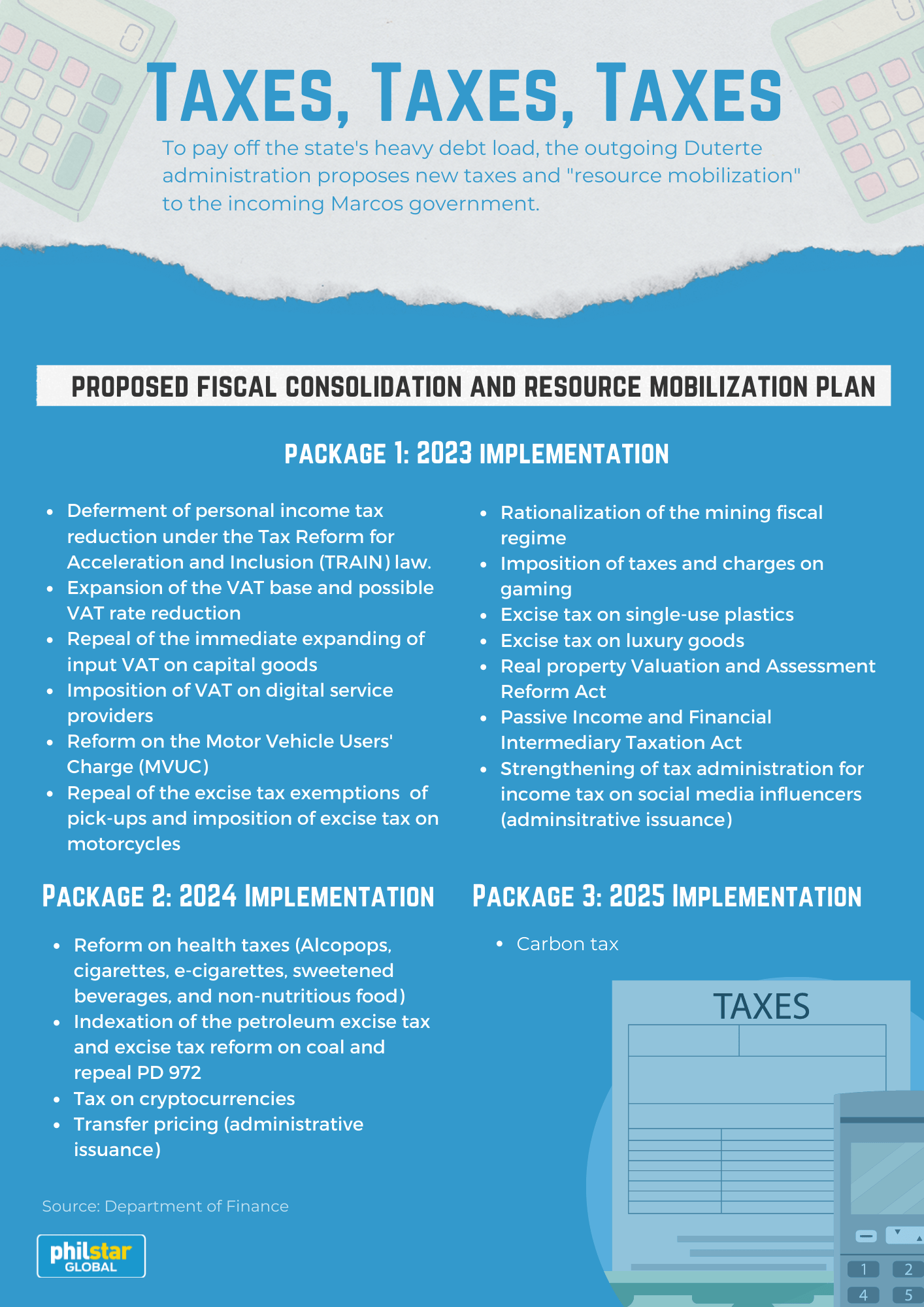

On Wednesday, outgoing officials of the Department of Finance presented to the media their proposed “fiscal consolidation” plan that they hope would be adopted by president-in-waiting Ferdinand Marcos Jr.

Should Marcos decide to go with Duterte’s plan, Filipinos would see new taxes imposed on them in the next three years while some existing tax exemptions would be removed to improve government revenues.

“The plan is doable and is designed to secure the gains that we have made under the Duterte administration,” Finance Secretary Carlos Dominguez III said.

Delayed tax cuts, more excise levies

Perhaps among the salient measures proposed by Duterte is the deferment of personal income tax reduction under the Tax Reform for Acceleration and Inclusion (TRAIN) law. The tax cuts were supposed to take effect from 2023 to 2025, and the DOF said postponing the reduction would yield P97.7 billion in revenues for the government each year.

Another option for Marcos is to repeal value-added tax (VAT) exemptions while retaining such a perk for key industries such as education, agriculture, health, finance and raw food. The plan did not specify which sectors could be stripped of VAT exemptions, which senior citizens and people with disability currently enjoy.

The DOF added that the next president could also impose excise taxes on luxury goods, single-use plastics, sin products and “non-nutritious” foods.

Overall, the DOF estimates that the average annual revenue that could be collected from all proposals stands at around P349.3 billion, which the Marcos administration could use to cut debt and fund its programs. The measures could also bring down debts, as a share of the economy, to 55.4% by 2025, the DOF added.

As of first quarter, state obligations as a share of gross domestic product already stood at 63.5% -- breaching the 60% threshold deemed manageable by international debt watchers. It was also the highest debt-to-GDP level since 2005, the year when the Arroyo administration introduced the expanded VAT (EVAT) to pay off debts.

“We have the following options — borrow more to cover our existing debt, cut spending by an equivalent amount, or raise revenues and improve tax administration,” Finance Undersecretary Valery Brion told reporters.

“If we borrow more to cover the debt we have already incurred, our debt levels will grow even higher. This will risk our credit worthiness, making borrowing costs higher in the future. We cannot afford to go this route,” Brion added.

"We cannot cut productive spending, as this will risk our economic recovery and sacrifice key socioeconomic priorities. Our best option is to expand the fiscal space... and cut government’s unnecessary spending."

Political capital

Typically, collecting new taxes or raising existing ones are deeply unpopular measures for any leader. At the same time, a lot of the tax measures that DOF proposed must be legislated, which could be a very long and tedious process.

That said, the Marcos administration would need to expend political capital to make these reforms happen. So far, the president-in-waiting, who won the elections in a landslide, is cool to proposals to sell government assets to generate more revenues — which appears to be a safer move to protect his political capital than imposing new taxes.

Should Marcos follow Duterte’s advice, Jean Franco, political science professor at the University of the Philippines, believes that the impact on the new president’s popularity would depend on which segments of his support base would be affected by the tax measures.

"VAT exemptions for senior citizens and the deferment of reducing income tax are the ones that might affect his base. However, I doubt if many people will see this as his fault given that the proposals can be framed as something that has to be done because of the failures of past administrations," Franco said..

For Anthony Lawrence Borja, political science professor at De La Salle University, pushing for tax reforms would not be a big problem for Marcos if he can fulfill his campaign promises and meet his supporters’ expectations.

“As far as the pulse of (Marcos) supporters is concerned, they are expecting a favorable tax reform program,” Borja explained. “Nevertheless, if he satisfies the other expectations of his supporters, the possible deferral of reducing income taxes may be excused or pass by unnoticed.” — Infographic by Jazmin D. Tabuena

- Latest

- Trending