Red to green

After being in the red through most of the year, the Philippine stock market finally turned green. The Philippine Stock Exchange Index surged 4.4 percent for the week, bringing year-to-date returns to a positive 1.03 percent. This came after daily caseloads declined for the fourth straight week, boosting hopes for further easing pandemic lockdowns. Vaccinations have now expanded to adolescents from ages 12 to 17. In the National Capital Region (NCR), where 80 percent of the target population has been inoculated, new infections have fallen to around 2,000 per day. It reached a peak of 6,670 per day a month ago.

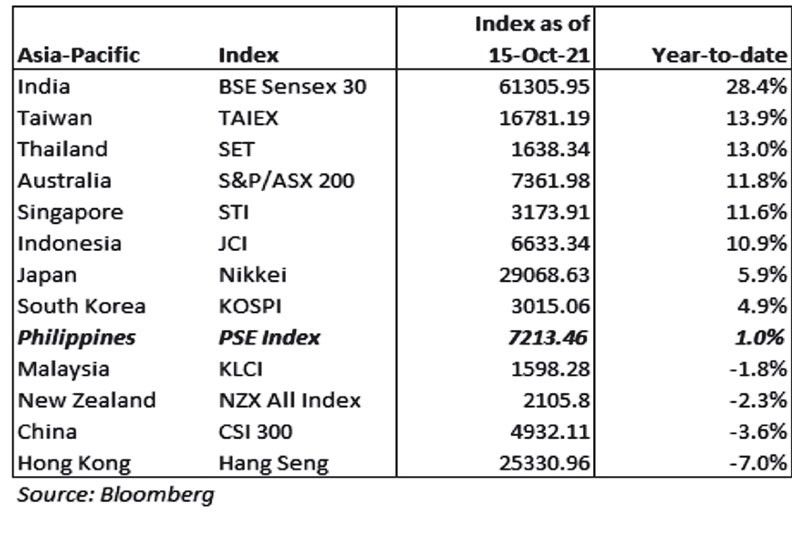

No longer the laggard

Philippine stocks remained resilient despite all the bad news such as resurging COVID cases due to the Delta variant, high energy prices, supply chain issues, and rising inflation. The improved market sentiment lifted the PSE Index to its highest in nine months. It is no longer the laggard in Asia and now shows a positive gain for the year.

India, the epicenter of the Delta variant, now shows the highest year-to-date gain in the region after its COVID-19 curve flattened. On the other hand, China and Hongkong are now laggards because of the regulatory reforms that affected many companies across all sectors (see Common Prosperity, Aug. 30 and Radical Reforms in China, Sept. 13).

Catching up with EM

Below is the chart of the MSCI Philippines ETF (symbol: EPHE) compared to MSCI Emerging Markets ETF (symbol: EEM). This shows that the Philippine stock market has started to regain lost ground vis-à-vis the broader emerging market index.

Decisive break of 7,000

With Merck’s discovery of oral antivirals, which may be a gamechanger in the treatment of COVID-19 and the global stock markets regaining ground, the PSE Index decisively broke above 7,000. This is a level it has failed to surpass several times in previous tries. The PSE Index also topped the end-2020 PSEi level of 7,139. This turned the index from red to green for the year. In stock market parlance, red means a “loss” while green means a “gain.”

Technical analysis indicates that with this breakout, the initial target for the PSEi is the year-high at 7,432. The 7,000-level would now act as a major support on any pullback.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending