Divergent views on the peso

Since reaching P54.43:$1 last September 2018, the peso is now hovering in the 52 to 53 range. Will the peso continue to strengthen or will it retest the 13-year lows of 54.43? Major global investment banks are divided into two camps. Banks such as Credit Suisse, Deutsche Bank, and ING Bank believe that the peso will trade back to the 54 levels. On the other hand, investment banks such as Goldman Sachs believe that the peso will appreciate to 50.

EM currencies rebound sharply

EM currencies have rebounded sharply following US Fed chairman Jerome Powell’s dovish remarks last November. Investors have read the comments as a signal that the Fed is nearing the end of its three-year tightening cycle. Also, there is cautious optimism that the US and China will soon find a resolution to their trade differences. The MSCI Intl EM Currency index rose to its highest level in eight months.

The Indonesian rupiah and the Thai baht led Asian EM currencies, rallying 7.1 percent and 6.7 percent, respectively, from their 2018 lows. Meanwhile, the Philippine peso bounced back 3.6 percent from its weakest level registered in September of last year. Year-to-date, the peso is up slightly by 0.3 percent against the greenback.

Performance of selected Asian EM currencies

Sources: Bloomberg, Wealth Research

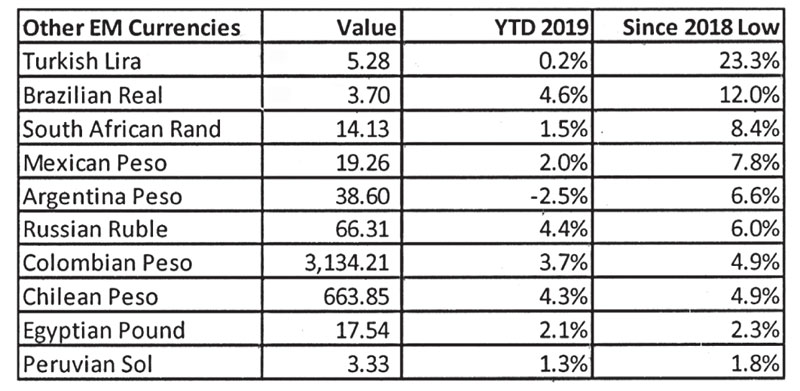

In other EM countries, the Turkish lira rebounded the most, gaining 23.3 percent from its 2018 low. Next is the Brazilian real which bounced back 12 percent from its low in September last year.

Performance of other EM currencies

Sources: Bloomberg, Wealth Research

Peso volatility has fallen

While the peso has rebounded together with most of EM currencies, its volatility has fallen. Today, the price moves in the USD/PHP rate are more stable and calm compared to the previous two years.

Last year, for example, we saw sharp moves when the peso depreciated from 49.70 to 52.50 in 1Q2018, from 51.50 to 53.75 in 2Q2018, and from 52.80 to 54.43 in 3Q2018.

We indicate these sharp moves by arrows in the chart below. Since November 2018, however, the movement has been relatively calm, ranging between 52 and 53.25.

USD/PHP rate (3-year daily chart)

Sources: Tradingview.com, Wealth Securities Research

Technical analysis points to a steadier peso

Based on the chart, the peso is firmer and even possibly stronger this year. The USD/PHP rate has breached the 200-day average in November 2018 and has stayed mostly below that level since then. The chart also shows the possible break below the two-year upward trend line. A break below 52 would confirm this reversal and possibly target 50. If the support level at 52 holds, we may expect a much longer consolidation between 52 and 53.25 range.

50 or 54?

We believe that the key factors that will move the peso to either 50 or 54 are the US Fed’s policy stance, the outcome of the US-China trade war, domestic factors such as the BSP’s monetary actions, and our country’s current account balance.

Slowing global economic growth has turned the Fed from hawkish to dovish. The Fed remaining dovish would be positive for EM currencies, including the peso. A resolution on the trade war between the US and China would be a significant boost to EM assets. Otherwise, a worsening of the trade war would bring EM assets down. Lastly, further deterioration of our country’s current account deficit may weaken the peso.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending