Wall Street slumps after Fed hikes interest rates again

NEW YORK — Wall Street stocks slumped Wednesday after the Federal Reserve lifted interest rates, sending major indices to fresh 2018 lows, even as the US central bank signaled it expects slower rate increases next year.

Many analysts had expected a "dovish" interest rate increase paired with strong verbal cues that the central bank would not tighten excessively in a period when global stocks have retreated amid concerns over slowing growth and trade wars.

But as Pantheon Macroeconomics put it, the Fed's "dovish hike" announcement "wasn't dovish enough" for US stocks on a day in which European bourses rose earlier.

The Dow, which had been up nearly 300 points prior to the decision, finished down 350 points, or 1.5 percent, at 23,323.66. That left the blue-chip index at its lowest level of 2018.

Wednesday's session "was a tale of two trading sessions," said Briefing.com

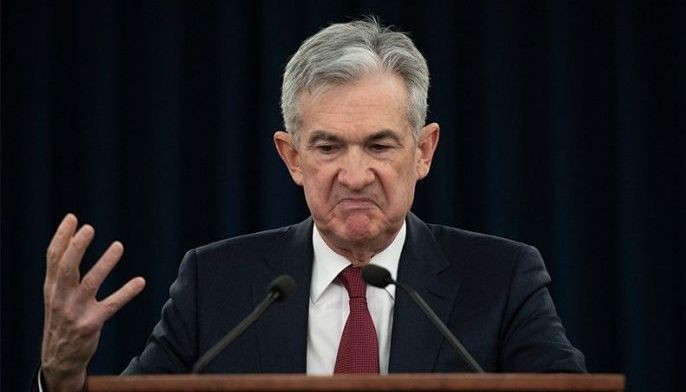

Early gains were fueled by "a sense of hope that the Federal Reserve would provide the stock market with a dovish-minded perspective on the interest rate outlook," Briefing said. But the second part of the session was "governed by a sense of disappointment that (the Fed), and Fed Chair (Jerome) Powell, didn't deliver on the market's wishes."

The Fed, as expected, raised the target range by 0.25 point, with 2.5 percent at the high end. But the Fed now projects only two interest rate increases, down from three previously, as it trimmed its forecast for US growth and inflation.

Powell said the Fed would not shift course on its path of reducing the central bank's balance sheet. Some analysts thought the Fed could signal flexibility on that measure to placate investors.

"Powell was in a lose-lose situation," said Jack Ablin, chief investment officer at Cresset Capital Management.

"If he downgrades his forecast, that creates concerns that the Fed knows something the market doesn't or it confirms fears. If he stays put, then market participants worry that the Fed is going to tighten too much."

The Fed announcement also boosted the dollar, which cut its losses for the session against the euro. Near 2200 GMT, the euro was trading at $1.1375, compared with $1.1431 shortly before the announcement.

European stocks rise

Earlier, European bourses pushed higher, led by Milan, which advanced 1.6 percent after the EU and Italy called a truce in their bitter row over Rome's disputed 2019 budget as the populist government agreed to put off signature reforms.

"There were a lot of fears that the political spat could have triggered another round of the eurozone debt crisis and those worries have since evaporated," said David Madden, a market analyst at CMC.

Meanwhile, the European Union adopted back-up plans to protect essential trade, transport and finance in the event that Britain leaves the bloc without a Brexit deal in just 100 days' time.

The pound was down against the euro with pressure on sterling coming also from news of a drop in annual UK inflation.

In a positive for London stocks, the weak pound gave the FTSE index a shot in the arm as it boosts the earnings of multinationals listed there.

On the corporate front, shares in GlaxoSmithKline surged after the UK pharmaceutical group said it and US peer Pfizer would merge their consumer healthcare units that produce over-the-counter medicines.

The tie-up of OTC brands including GSK's Sensodyne toothpaste with Pfizer's Centrum multi-vitamins paves the way for British group GSK to have two UK-listed companies, one specialized in the development of drugs and the other in consumer healthcare.

US companies with outsized falls included FedEx, which plunged 12.2 percent after slashing its profit forecast due to weakness in China and other key overseas markets.

Facebook dived 7.3 percent following new revelations over its data sharing practices with Amazon, Microsoft and other technology behemoths. The company was also sued by the attorney general of Washington, DC over alleged privacy violations.

- Latest

- Trending