Auto industry 2020 target in peril with planned tax hike

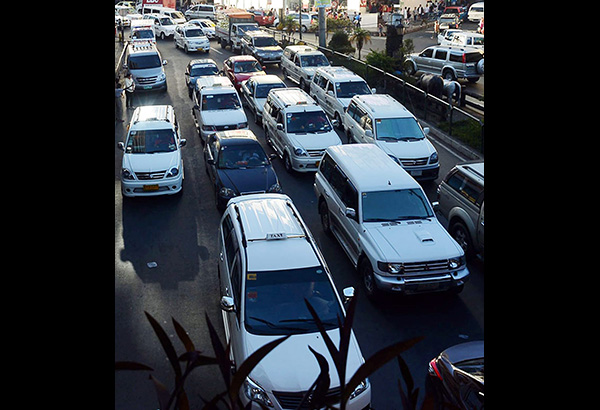

The implementation of a proposal to raise automobile taxes by 2018 would throw the Philippine automotive industry off the track from clinching its 500,000 sales target by 2020, as fears of vehicle makers continue to escalate in anticipation of the Duterte administration’s looming tax restructuring program. ANDY ZAPATA JR./File photo

MANILA, Philippines – The implementation of a proposal to raise automobile taxes by 2018 would throw the Philippine automotive industry off the track from clinching its 500,000 sales target by 2020, as fears of vehicle makers continue to escalate in anticipation of the Duterte administration’s looming tax restructuring program.

“Of course we want to maintain status quo but that may not happen because there is a pronouncement already and it’s part of the 10-point agenda. So we will seek a win-win situation. On our side, we will do simulations and we will factor in the different scenarios,” Isuzu Philippines Corp. marketing head Joseph Bautista said.

Bautista said the industry’s sales target of 500,000 units by 2020 would be in peril under the planned excise tax hike.

Should it not be imposed, however, Bautista said the industry could attain the target as early as 2018.

“If it is announced for 2018, there would be a surge in sale next year but there would also be a steep drop in 2018. That is what will likely happen. We saw this happen in Thailand and Indonesia when they changed their tax structure, there was a big drop in sales,” Bautista said.

Aside from Isuzu, other major industry players and Chamber of Automotive Manufacturers of the Philippines Inc. members such as Toyota and Mitsubishi admitted that the higher excise taxes would affect the local automotive industry’s growth track.

“There would be a temporary setback but eventually people need cars. And based on what I see, the economy can sustain its growth,” Bautista said.

The Department of Finance is pushing to lift the minimum tax to five from two percent for vehicles priced P600,000 and below.

Meanwhile, luxury cars worth over P2.1 million will have a fixed tax of 60 percent, which is currently imposed on the excess of that amount.

Finance Secretary Carlos Dominguez has said the government’s goal is to increase taxes by 2018 to lower vehicle sales.

Bautista, however, said it is unfair to blame the worsening traffic situation to the automotive sector when the real problem is the country’s lack of infrastructure.

“Why will you penalize the buyer in Metro Manila? Our vehicle density is only 40 vehicles per 1,000 persons while other countries like Malaysia and Thailand are already 200,” Bautista said.

“The problem is that our roads cannot keep up with the volume of vehicles. For every person that buys a car, he pays at least 20 to 30 percent of tax for our roads to be developed but it is not happening. So for every P1 million vehicle, a consumer paid P320,000 in taxes that would have been used to build roads. So if we sold 100 million units, then we should have a big budget that should have been allocated for infrastructure,” he said.

- Latest

- Trending