Did FQ Mom follow her own advice when she was a fresh grad?

Last week, I enumerated 10 pieces of advice on how to manage money for fresh graduates and not-so-fresh grads. If you haven’t encountered that yet, please click article link to read it, or video link to watch our episode on it.

Looking back, I started to recall if I, myself, applied those lessons. This was Mary Rose Maquera Fres when she graduated in year “kopong-kopong.” ![]()

Let’s see which ones I followed in my list when I was a fresh grad.

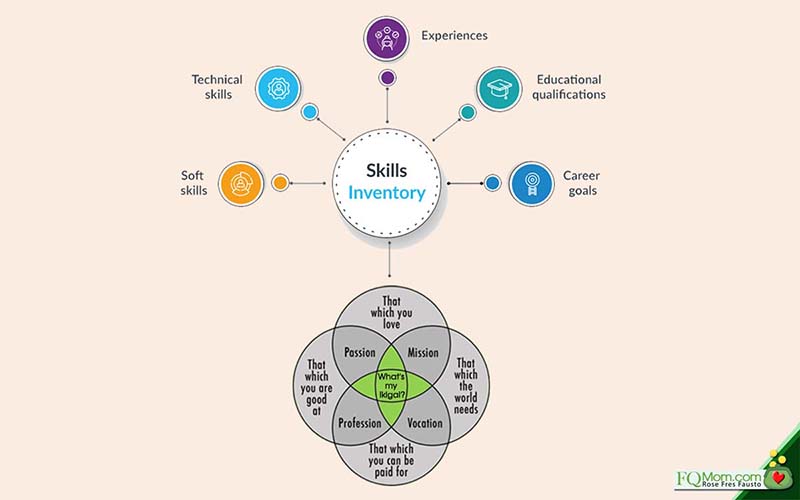

1. Prepare an inventory of your skill sets.

2. Figure out what the world needs from you.

I will be honest with you. I only had vague idea of what I was good at but I didn’t prepare an inventory of my skills. I imagined myself working in an office, but no way did I know about Ikigai and I really didn’t think about what the world needed from this neneng. I knew I didn’t want to do clerical job. Ang yabang ba? But this was not because I looked at such jobs in a condescending way, I just knew that it was not the job I was going to be happy with. I remember that there was this talk about ADB (Asian Development Bank) offering very high salaries and their canteen was really amazing, but you had to start with a clerical job. I never really confirmed the veracity of this, but I just didn’t bother applying there. I do remember that my main concern was really to find a job.

3. In looking for a job, put more weight on the training that you will get.

First, let me tell you how job-hunting was during our time, at least how I did it. I prepared several copies of my resumé together with my transcript of records. I mailed them to some companies and also hand-carried a few to offices along Ayala Avenue together with my friends. Here’s the thing, there was no internet and sure, telephone already existed but our village was relatively new and had no PLDT lines yet. So, I wrote down the telephone number of my mom’s office. Our school’s placement office also had some companies visit our campus for direct hiring.

I got a few calls for interview and one of the first to give me an offer was Far East Bank & Trust Company, then a fast-growing bank founded by Jobo Fernandez who at that time was already the governor of the Central Bank of the Philippines (the precursor of Bangko Sentral ng Pilipinas). It was for the position of a credit analyst. Maybe I felt good when the HR person interviewing me said something like this, “I want to place you in the credit department at the head office because you are better suited there compared to any entry level position in a branch.” It sort of addressed by avoidance of the clerical job. The offer included a little bit of premium because I was an honor graduate. The young girl’s ego was stroked and she accepted, never mind if head office was all the way in Intramuros!

The atmosphere at Far East Bank was young and fun with my co-workers mostly coming from Ateneo, UP and La Salle, and our lady big boss was from Assumption College. She was not your typical corporate boss but she knew how to make all her credit analysts shine in the entire bank!

Here’s the thing, I loved the company of the people I worked with, but there was a time I almost gave up because right at the start I was already expected to prepare financial projections and I could barely balance a cashflow statement! The job of a credit analyst was to prepare company studies and give recommendations whether the bank should lend or not. “Is this job really for me? Am I cut out to be a finance person? How about marketing?” One of the senior analysts I talked to about this dilemma told me this, “Don’t worry, you’ll get the hang of it. In finance, the longer you stay in the field, the more valuable you become. That’s not the case in some fields.” That statement made a mark on me, and I stayed and got the hang of it. And enjoyed it. Do you know who that guy was? He became my favorite person in the world! ?

So that’s the long answer to the question if I observed advice number 3. I was trained well at my first job. It was not easy. I’d sometimes work overtime or bring home my work to finish it at home. But I appreciated the privilege of having interviewed CFOs, CEOs, founders of companies, and having presented to the credit committee and sometimes all the way to the bank’s executive committee, right on my first job.

4. Create your balance sheet.

I had a listing of my “kapiranggot” assets which were mostly my savings account. The balance sheet came in when I learned how to do it at my first job.

5. Note to parents: Cut your children’s financial umbilical cord.

Yup my mom also stopped giving me allowance once I graduated from college. But we had one shopping trip where she bought me a few pieces of office clothes. Just a few was fine because there are four sisters in our family, so my wardrobe was multiplied by four because of “hiraman.”

6. Even before you get your first salary, set in place your automatic saving and investing.

There were no automatic saving/investing vehicles yet, but I did one manually. In my first book “Raising Pinoy Boys”, I shared my childhood money memory (CMM) that back in kindergarten, I received an “alkansya” shaped like a transistor radio from my pretty Auntie Vicky and that started my habit of saving from my allowance every month. I continued that habit using my Banco Filipino savings account that had Lala & Kiki of Sanrio as the cover of my passbook. Later on, I moved my savings to Far East Bank. When the bank announced that our salaries were to be directly deposited to our savings accounts instead of the former set up of pay envelops that contained bills and coins distributed by a bank teller who came to our floor together with a security guard carrying a gun, a lot of employees didn’t like it because they will now have to withdraw to get their money. But I was secretly delighted because it became easier for me to “pay myself first.” Yup, I felt weird feeling good about it while others were complaining at that time.

The automatic saving and investing came about as soon as these were introduced later on in my life as a wife and mom.

7. Track your expenses.

Oh yes! I had been doing this while still in school, a copy of my diary expense tracker is even shared in "Raising Pinoy Boys".

8. Use loans prudently.

Oh yes again! No loans for this Ilocana until we built our house, and it was a company benefit of my husband in his office. Later on, I also availed of the SILP (Salary Investment Loan Program) because the interest rate was low. I bought a few PLDT shares. I later on fully paid when I was getting conscious if the cost-benefit was still worth it. Let’s put it this way, we make use of credit for long-term assets, and only if the interest rates make sense. Here’s my pet peeve. During times when I inadvertently miss to pay our credit cards, I am really pissed off. Why? Because the rates are just way too high and it’s crazy when you know that your savings account balance can pay off the amount while it sits there earning nothing. I have yet to check with my bank if there’s a good arrangement that can automatically pay our credit cards in order to totally avoid these mishaps.

Note to graduates whose parents took care of their college education expenses: Please thank your parents, big time. I recently saw this episode on Netflix about student loans and my oh my! It is indeed very difficult to start your life after college when you are already buried in student loans. It is like going to a marathon carrying a ton of luggage.

9. Are your parents/other relatives expecting you to help?

Fortunately, my parents didn’t expect us to help out in our home expenses. I remember my mom saying, “No need to give, just save as much as you can from your salary, but don’t forget to enjoy the fruits of your labor.” My oldest sister also said something like this, “When you get a salary increase, make sure you use that amount in something that will earn instead of just spending it.” I took these pieces of advice to heart. But I also delighted in the thrill my parents had whenever I gave them unexpected gifts. Again, as mentioned last week, help if you have to, or even if you just want to. Just don’t jeopardize your own saving and investing.

10. If you’re a freelancer, you have a bigger challenge of managing your money.

This lesson was applied when I decided to say goodbye to my investment banking career, together with half of family income. I became oh so OC about keeping track of our expenses. That’s when I watched our expenses like a hawk and prepared balance sheets not only for me and husband, but also for our children. Later on, when I had a consultancy job with USAID on renewable energy long before it became a buzz term, that also allowed me to work from home long before WFH became the norm, we also managed to save a big chunk of my fee, because we knew that the engagement was not going to last forever. All of these later on became the seeds of FQ Mom! ![]()

So there, I think going down my fresh grad memory lane made me realize that I applied almost all the lessons when I graduated. These lessons have significantly helped me reach my desired financial condition. I hope they help you and your children too.

Cheers to high FQ!

ANNOUNCEMENTS

1. Please join me tomorrow live on Kumu or FB Page. I will be with my birthday boy FQ Son Martin to discuss "Creative Ways to Give Cash Gifts to Kids"

2. Sorry to burst your bubble, but there are huge limitations to financial education in bringing about the correct financial behavior. I will be talking about my favorite topic these days because I want us all to really zero in on what really drives our money behavior. This is free but you have to register here: bit.ly/SLAMCI-BrightTalks-May2021. We hope to see you there!

3. To learn more about your money behavior, get your copy of FQ Book 2. Get copies for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video.

4. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire