The language you use affects your saving behavior

August is Buwan ng Wika and today’s article talks about an important language effect in our FQ. What language do you use at home? Is it English, Tagalog, Ilocano, Visaya, Chavacano, Chinese, German, etc.?

Do you know that the language a country (or a family) speaks affects savings behavior?

Behavioral economist Keith Chen, together with his colleagues at the Yale University, did a very interesting study on this.

Futured and futureless language

Remember your grammar lessons on the tenses of the verb? Let’s take the verb “eat” as an example. We have different forms of the verb depending on when the action happens.

I ate yesterday.

I eat today.

I will eat tomorrow.

We cannot say “I eat yesterday.” or “I eat tomorrow.” It’s grammatically wrong to do so.

Let’s check our Tagalog language.

“Kumain ako kahapon.”

“Kumakain ako ngayon.”

“Kakain ako bukas.”

We cannot say “Kain ako kahapon.” or “Kain ako bukas.” Those who would hear would say, “Para ka namang ‘Intsik’ magsalita!” (Note that “Intsik” is now considered a derogatory term for Chinese.)

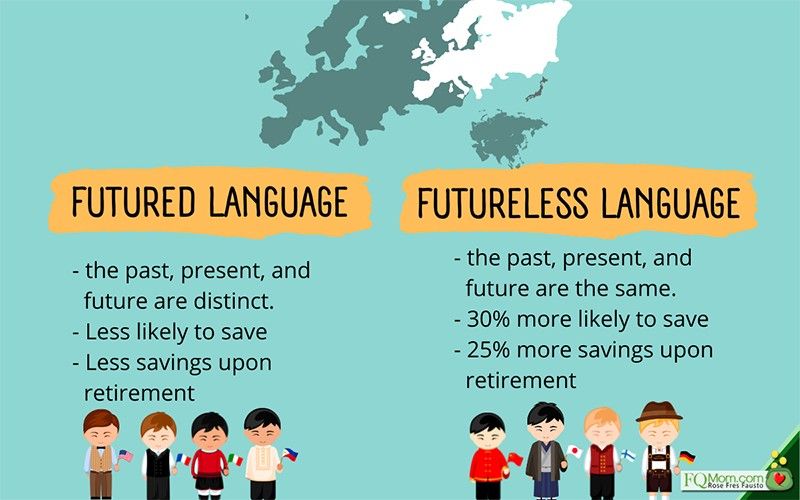

In the way English and Tagalog are spoken and written, the past, present, and future are very distinct from each other. The past is separate from the present, the present is separate from the future. The future is separate from the past. These two languages are what Keith Chen calls futured language.

Now let’s check out the Chinese language, using the same verb “eat.”

The Chinese verb for eat takes the same form in all three sentences. The literal translations of these are:

I eat yesterday.

I eat today.

I eat tomorrow.

There is no distinction in the verb form when expressing past, present, and future. By the way, I got these sentences from my Xavier School-educated son, Martin.

The findings

Interestingly, the findings of Chen show that the countries with futureless language like China, Germany, Finland, Japan, etc. have higher savings rate than those with futured language like USA, UK, France, Italy, Spain, etc. (We’re not in his study but note that our national language, Tagalog, is a futured language.) The study is not just a haphazard comparison of savings rate, but a careful analysis of big data where they isolated other factors that might affect money behavior such as income level and cultural factors. The futureless language speaking people were 30% more likely to report having saved in a given year. By the time they retire, the futureless language speakers, assuming that their income remains constant, are going to retire with 25% more in savings.

This phenomenon was also observed in a single country, Switzerland, when they compared the regions speaking their three different languages. The savings rate of the German speaking regions (futureless language) was higher than that of the French and Italian speaking regions (futured languages).

Why?

If you think about the way our languages are structured, making our present actions distinct from our future actions makes us dissociate our present self from our future self. This can unconsciously go as far as making us think of our future self as a different person. So, our pleasure of today becomes more compelling and we oftentimes do it at the expense of that “stranger,” our future self.

This is very closely related to Hyperbolic Discounting, a behavioral bias I discuss in FQ Book 2, “Why Financial Education Alone Does Note Work (a crash course in Behavioral Economics back-to-back with The Psychology of Money”. This is our tendency to choose a smaller but now reward over a larger but later reward. Our futured language that dissociates our present self from our future self further exacerbates our present bias.

The Pinoy mañana habit may have been caused by this futured language as well. We got this bad habit of procrastination from the Spaniards whose language is also futured.

But wait, there’s more! Do you know that our saving behavior is not the only one that is affected by our language? Even our health behaviors are similarly affected.

Futureless language speakers are 20% to 24% less likely to smoke at any given time compared to identical futured language speakers. The former group is also 13% to 17% less likely to be obese. You see, healthy habits today are very much like saving and investing done today. They are all doing the right thing for our future self. Isn’t it so ironic that the so-called futureless language speakers are set to have better futures?

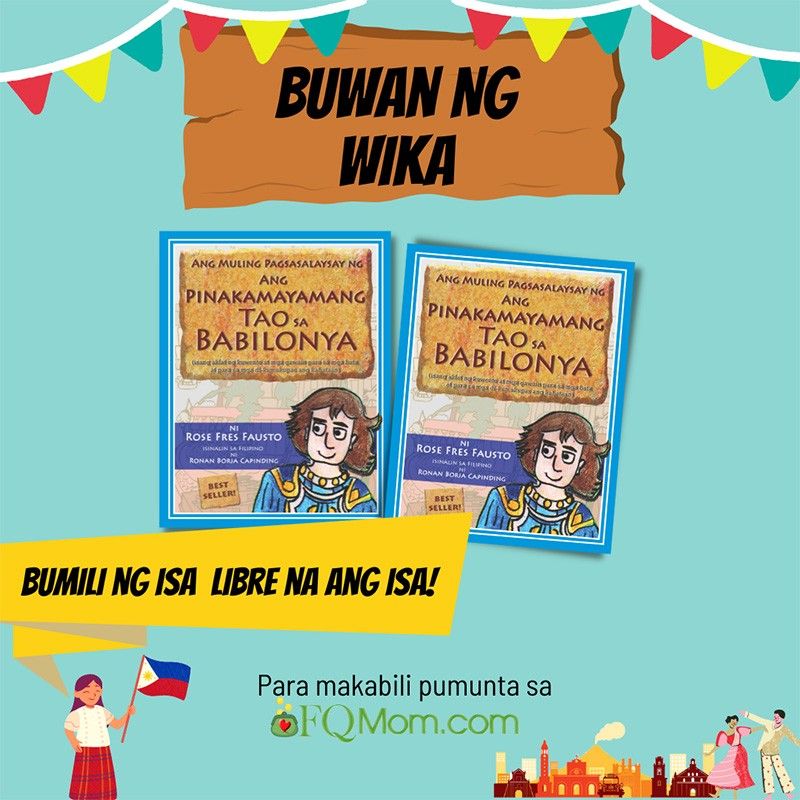

As we celebrate Buwan Ng Wika this August, we cannot just blame its futured structure to our inability to save for our future. Moreover, we also cannot do an overhaul of our language in order to improve our saving behavior. So, what can we do? We can start bringing money conversations in our family dinners and other casual encounters to develop a healthier relationship with money. Start our kids young, even if we use our futured language. The good news is this: We are having a buy 1 – take 1 free promo for our Tagalog book, “Ang Muling Pagsasalaysay ng Ang Pinakamayamang Tao sa Babilonya”, for the entire month of August 2022.

I hope this helps you raise your children to have a high FQ. And hey, the next time you hear someone speak in “broken” Tagalog like this. “Ako ipon kahapon. Ako ipon ngayon. Ako ipon bukas!” don’t criticize or laugh at him. Instead, say something like, “Ako gaya sa ‘yo! Ipon kahapon, ipon, ngayon, ipon bukas, para lahat tayo High FQ!”

ANNOUNCEMENTS:

1. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click FQ test.

2. After the test, make them understand the basic laws of money, understand their relationship with money, including their own money biases, so they can improve their FQ, their money knowledge and behavior. Give them the gift of any or all of the FQ Books. Click here.

3. Watch this Ted Talk https://www.youtube.com/watch?v=CiobJhogNnA

This article is also published in FQMom.com.