My Kind of LODI

Lodi is a relatively new Pinoy term for the English word that it spells backwards - “Idol.” We hear a lot of Pinoys say, “Lodi ka talaga, ang galing mo!” (“You’re really an idol, you’re so good!”) The recipient of that remark usually feels good about the admiration.

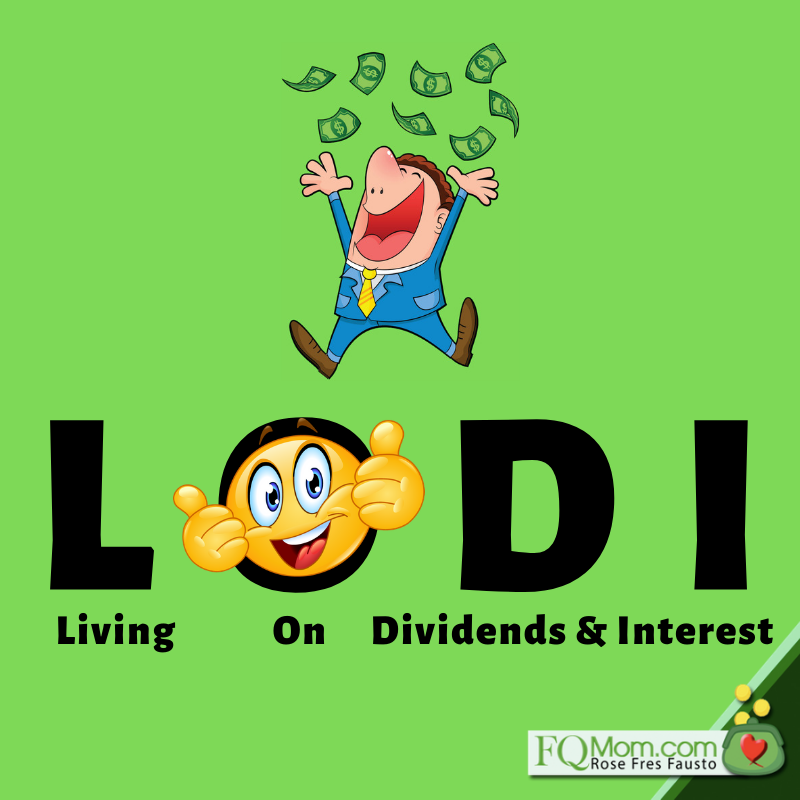

Today, I’d like to discuss the kind of LODI that we should all aspire for. It’s an acronym that stands for a happy financial state:

Yup, that’s my kind of LODI! Let’s all aspire to be LODIs in this sense.

What is the LODI level?

This is the level when you’ve accumulated enough such that your regular living expenses can be covered by the passive income you derive from your earning assets such as bonds, stocks, properties, etc. This is the level when you don’t have to actively work for money in order to live. Take note the operative term is “don’t have to,” but please, by all means continue working if it’s what keeps you alive and relevant in this world. Incidentally, one of my “Lodis” (i.e. idol or life peg) was the late Washington Sycip because he continued to do his work until his last breath. ![]()

Some may be lucky enough to inherit a lot to afford being a LODI right away, but that’s a miniscule percentage of our population. And come on, what fun (and pride) is that when you’re not really responsible for reaching that level?

So how do we get to LODI level?

1. Start as early as possible. Parents, please open your children’s bank accounts as soon as they are born. This starts their awareness early on. Then teach age-appropriate FQ lessons as necessary skills together with reading, writing, math, kindness, integrity, and other values that you care for.

2. Follow the three basic laws of money:

a. Pay yourself first.

b. Get only into a business that you understand and seek advice only from competent people.

c. Make your gold work for you. Make and army of golden slaves before you buy luxury.

3. Mind your asset allocation. This could be your most important investment strategy, as you’re able to manage your risk when you mindfully divide your portfolio into different asset classes to best suit your goals, risk appetite, expertise, and life stage. In preparing your Balance Sheet, be mindful also of what your Earning Assets are. Early on in the preparation of our Conjugal Balance Sheet, we already marked which among our assets were what we consider earning. Strictly speaking, most of them could be considered earning assets because even if they don’t give out interest and dividends, they could earn in terms of value appreciation. But we put a filter to it. For example, our house where we live in, which takes a significant chunk of our total assets is not considered an earning asset. Why? Because we intend to live there for an indefinite period of time, and it’s not something that we could easily decide to sell when we need liquidity. Other real estate investments are considered as earning assets, as we can sell them if needed, without sacrificing the roof over our heads.

4. Mind your spending habits. This is already assumed in the third basic law of money, to delay gratification by following the FQ rule of thumb in luxury: Buy luxury only if you can afford to buy 10 pieces of it. Still, I’d like to emphasize that your ability to be FQ-LODI also depends on your spending habits. The bigger your expenses, the longer it would take you to be LODI.

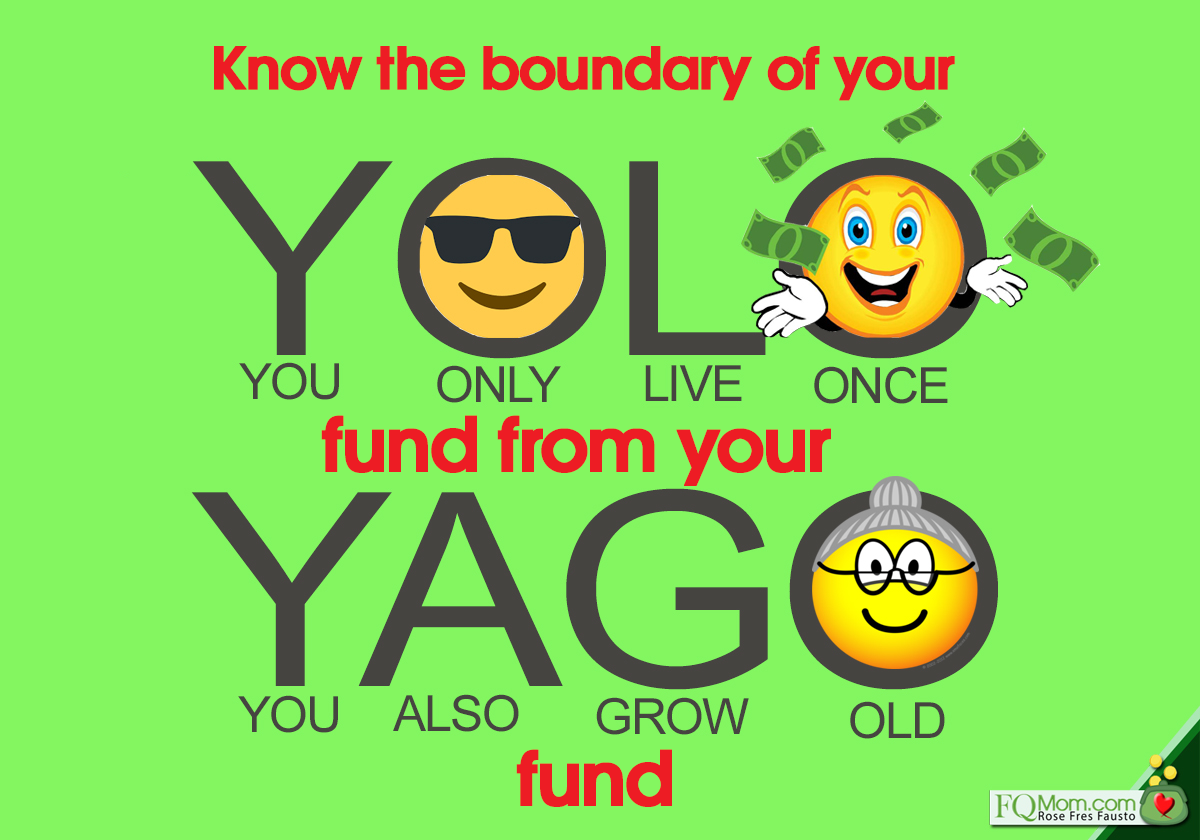

5. Design your saving and investing, and separate your YOLO from your YAGO funds. Automate, automate, automate! Invest as much as you can now while you’re young (of course without being miserable). Know the limit of your YOLO (You Only Live Once) funds are – the money you can spend to make your present-self happy enough, but don’t you dare forget your YAGO (You Also Grow Old) fund so your future-self will be happy and taken care of too!

So are you ready to be FQ-LODI? ![]()

*********************************

ANNOUNCEMENTS

1. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of FQ: The nth Intelligence

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com

2. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link. http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a Behavioral Economist, Certified Gallup Strengths Coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook&YouTube as FQ Mom, and Twitter&Instagram as theFQMom. Her latest book is FQ: The nth Intelligence.

IMAGE ATTRIBUTIONS: Photos from hiclipart.com, seekpng.com, vectorstock.com, and freepik.com, modified and used to help deliver the message of the article.