Fitch unit wary of SMC Global Power's liquidity issues

MANILA, Philippines — A unit of Fitch Group is concerned about whether San Miguel Corp. Global Power could tap into debt markets for financing, as issues cropped up surrounding its ability to pay back bond creditors.

In an emailed commentary on Tuesday, CreditSights spotlighted this concern as SMC’s power unit’s leverage showed signs of worsening. The Fitch unit kept its “Underperform” recommendation on SMC GP.

“While there is some headroom for SMC GP to assume more debt without breaching its debt covenants (net debt excluding perps/equity to not exceed 3.25x, ratio at 1.31x as per our calculations for FY22), we question if SMC GP can adequately access the debt markets at acceptable costs, amid its weak fundamental profile, tighter funding market conditions post the recent banking crisis,” the commentary read.

As it is, the Fitch unit questioned how SMC GP will pay back its $3.3 billion perpetual call profile. Of that amount, $783 million is due in 2024, $1.2 billion is due in 2025 and $1.3 billion is up for payment in 2026.

CreditSights noted that they expected the company’s 2022 financial to prove weak, despite a strong revenue performance. The commentary indicated that SMC GP’s earnings before interest, taxes, depreciation, and amortization plunged, as it was unable to cushion increasing thermal coal input costs.

SMC GP’s liquidity proved too compressed as well. The Fitch unit said they can set aside its band debt for the meantime owing to its parent company’s reputation.

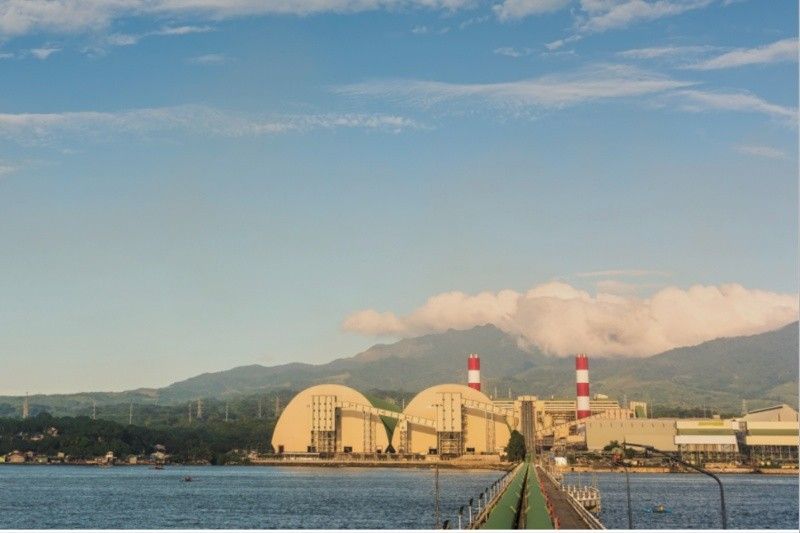

The company’s capital expenditures hit P49 billion in 2022, as SMC GP invested further into liquefied natural gas, hydro, and battery storage assets.

That said, CreditSights noted that the Ang-led SMC will still back the company amid the unit’s poor leverage.

“Given parent SMC is a holdco with limited assets on a standalone basis to avail of debt, it could leverage on its good reputation and sound banking relationships to raise loans or local bonds to funnel down to SMC GP,” the commentary added. — Ramon Royandoyan

- Latest

- Trending