Pandemic to hurt BPOs with first revenue decline in 11 years

MANILA, Philippines — The coronavirus pandemic is leaving nothing unscathed, not even the digitally-inclined business process outsourcing (BPO) companies, a critical dollar earner and job-generating sector now poised for its first revenue decline in 11 years and slower future growth.

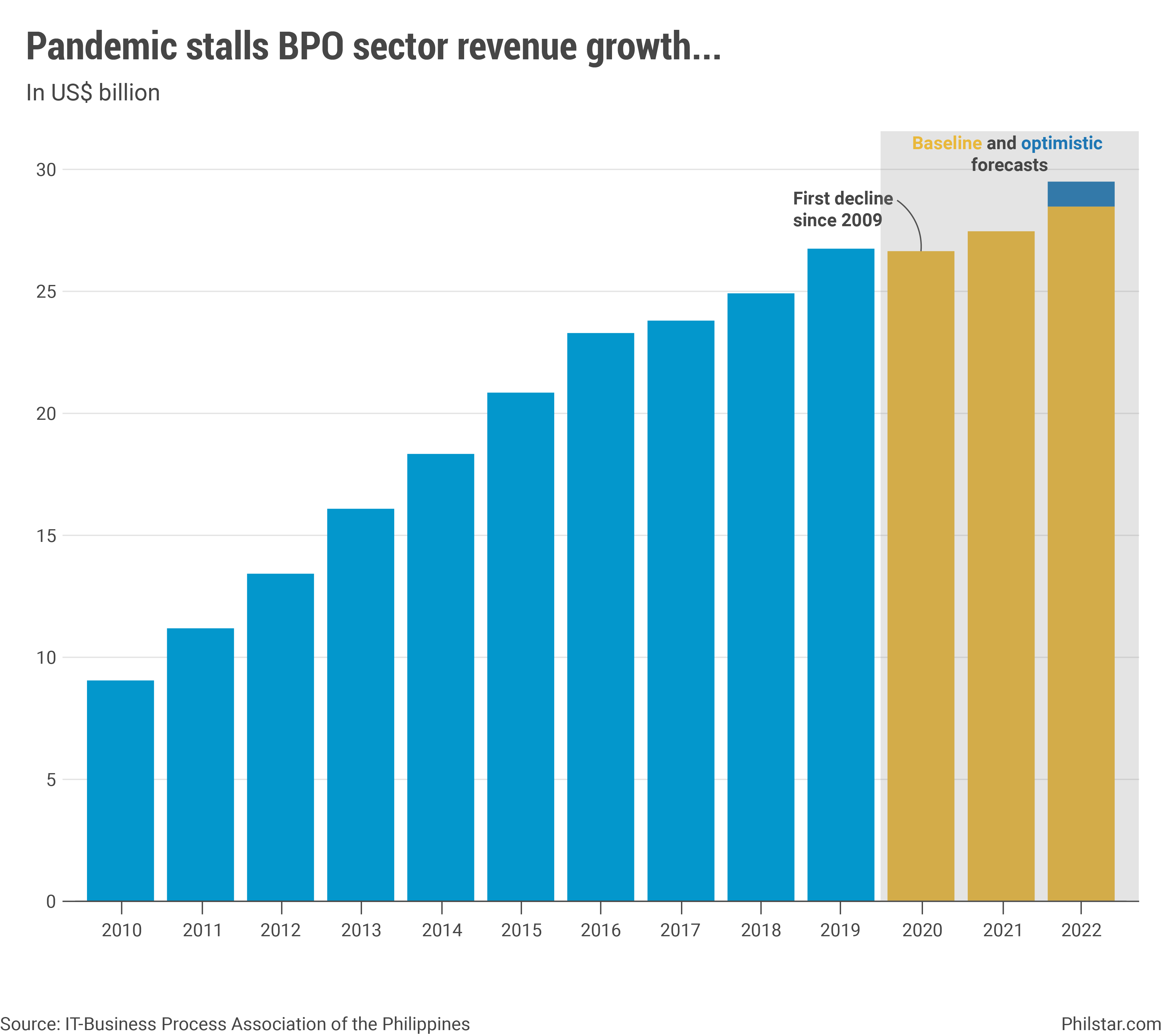

Members of the IT-Business Process Association of the Philippines (IBPAP), the sector’s umbrella group, are seen generating $26.2 billion this year, 0.5% down from last year $26.3 billion. The forecast was down from $27-$28 billion seen last year.

If realized, it would mark the first year-on-year decrease in revenues since 2009, a year after the global financial crisis.

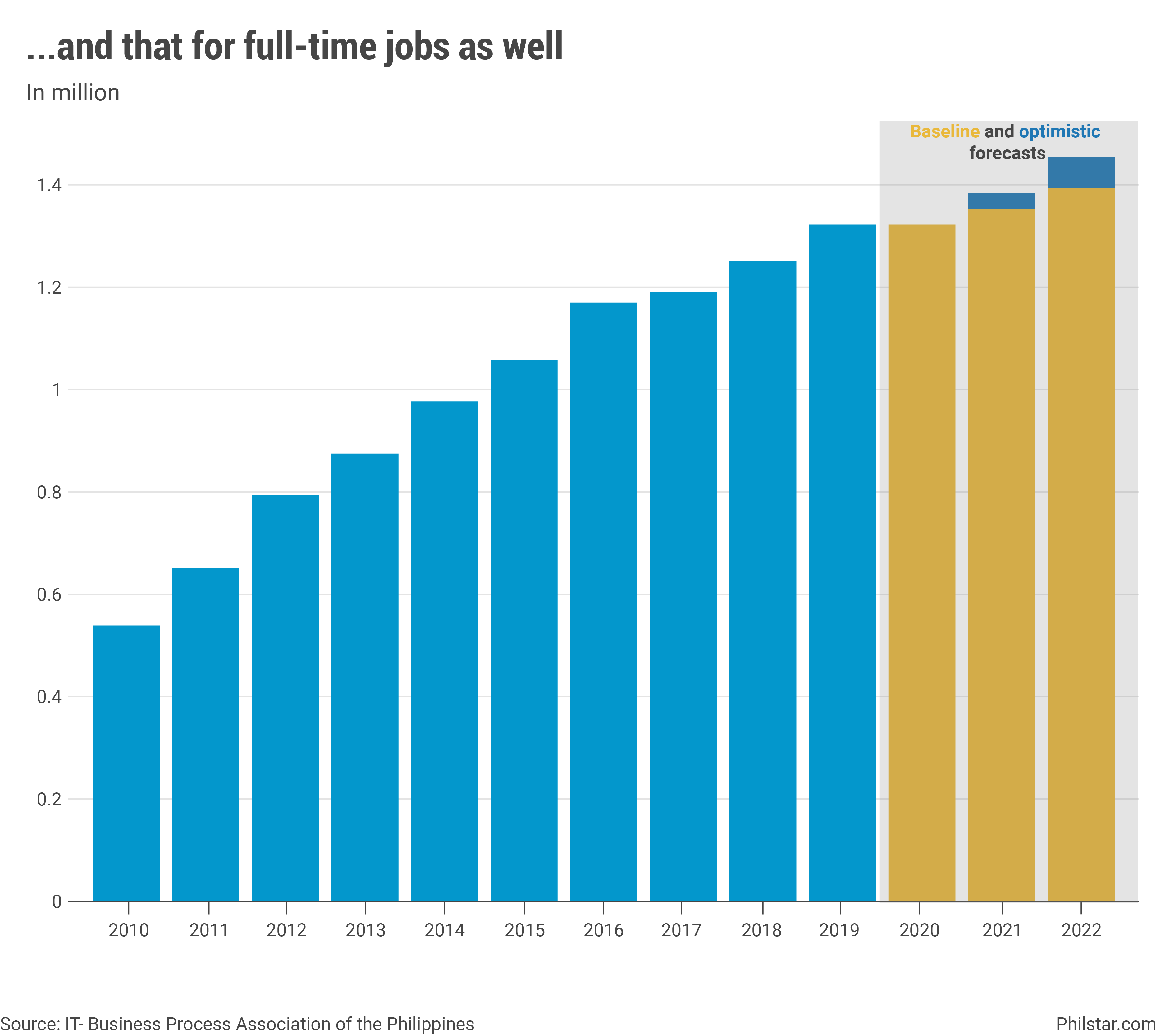

With revenues slightly going down, jobs creation would likewise get stalled at 1.3 million full-time employees, also below the 1.33 to 1.37 million projected a year ago. IBPAP President Rey Untal was not worried.

“I consider that good news in consideration of the fact that if we look at GDP (gross domestic product) in the Philippines, we will likely end the year down 7-8%. For this industry to be reporting flat growth, is again great,” Untal told reporters in an online briefing.

The impact would linger beyond this year. BPO revenues next year are seen to grow to $27 billion before hitting between $28-29 billion in 2022, albeit down from as much as $32 billion originally. Full-time jobs are likely to reach up to 1.36 and 1.43 million in 2021 and 2022, respectively, also down from as much as 1.57 million.

To be fair, the local BPO sector’s performance is tracking global counterparts whose work were also hampered by broad lockdowns to control the spread of the deadly virus. As expected, Untal said BPOs did not encounter difficulty shifting to work-from-home arrangements, benefiting from years of digital investment in the workplace that only “accelerated” with the health crisis.

That said, current dismal revenue and jobs projections were once seen unthinkable for a sector that years back, were thought to take over remittances as the country’s top dollar source. That did not happen, although this year, remittances are forecast to drop a bigger 2% by the central bank although actual inflows would remain way above BPO earnings.

But apart from pandemic, challenges unique to the Philippines are also darkening the outlook for BPOs. One of the most immediate and immediately present is the Duterte government removing tax perks on key industries like BPOs through the Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill. This is not new, as in 2017 a similar but unsuccessful push drove away investments from the sector.

Yet with dramatic policy shifts ushered in by coronavirus elsewhere, Untal is optimistic CREATE, now pending at the Senate, would prove to be “investment friendly” to BPOs over the long haul.

Without going into specifics by subsector, Untal said growth was tapering off in the IT segment whose work has been hampered by movement restrictions. Animation and creatives segments are also encountering “unique” challenges, which he did not specify.

There was also be weakening in growth for top earning call centers to a “minimal extent,” a scenario already seen last March when movement restrictions prevented workers from taking calls at the office. Government asked BPO firms to subsidize free shuttles and accommodation for their workers.

On the flip side, “a surge in demand” for healthcare is precipitating growth in medical BPO services including telemedicine. Expansion is also picking up for global-in-house centers.

Overall, Untal is banking on typical sources of growth of finding new locations away from traditional central business districts to the provinces, skills training and large investments in the telco sector ahead of a new player and driven by demand for better network services. “I think there are tremendous opportunities across the board,” Untal said.

- Latest

- Trending