Mahal kong anak (The high cost of having a child)

Dear children. Yes, the cost of having children has become so dear! Mahal kong anak talaga (pun intended).

Young couples have been delaying having children. In fact, not having children among married couples has a become a not so uncommon active choice already. The reasons cited are “We can’t afford to have one.” “We may not be fit to be parents.” “We’re not sure if it’s fair to bring someone to this world.” “We want to help solve global warming.” “We just don’t want.”

Ganito kami noon

Before getting married, my husband and I thought we would like to have kids after two years. But after talking to the priest who celebrated our wedding mass, we were convinced that for the first child, we were better off just doing a que-sera-sera. Of course, he called it God’s will. We had our first child nine months after our wedding, truly a honeymoon baby. Honestly, we didn’t go through a lot of cost computation of having a child. We probably were just confident or clueless. We felt everything would be okay because both of us were gainfully employed in the finance industry, had a roof over our head, and my husband had a good health benefit care of the company. And I guess, we were quite lucky then. We still remember it fondly that our hospitalization bills for our first two sons were adequately covered by my husband’s health benefit. (It was not the same for our third, as he had gone to another employer then.)

I also remember that after I gave birth to our first-born, my mother-in-law visited us and handed my husband an envelope with five thousand pesos, saying, “O, ito ang tulong ko sa inyo, baka malaki ang nagastos nyo sa ospital.” At that time, that amount could almost shoulder the doctor’s professional fee for a normal delivery. I actually told Marvin, “Maybe we should return it because we didn’t spend for the hospital.” But he said it was a really a gift freely given and might not be accepted well if returned. He further said, “Let it be an addition to our baptismal fund.”

Our other baby needs were given as brand-new gifts or hand-me-downs from family and friends. I remember a sweet gesture from my boss who visited me at the hospital not with food or flowers but a baby stroller! I also remember that even while pregnant, we already bought a college education plan for our first born.

You can say that Marvin and I were lucky not to have worried a lot about the cost of having a child when we had our first, second and third. But of course, as I’ve written a number of times, we had already started setting aside regularly from our salaries from the very beginning. Looking back, that’s one important FQ lesson worth sharing. Although it’s important to know what we’re saving and investing for (start with your why), it’s also good to just save and invest even with no specific usage in mind. Just make it a habit. Thinking of how to use it later on is a much sweeter problem than thinking where to get it when you need it.

Paano na ba ngayon?

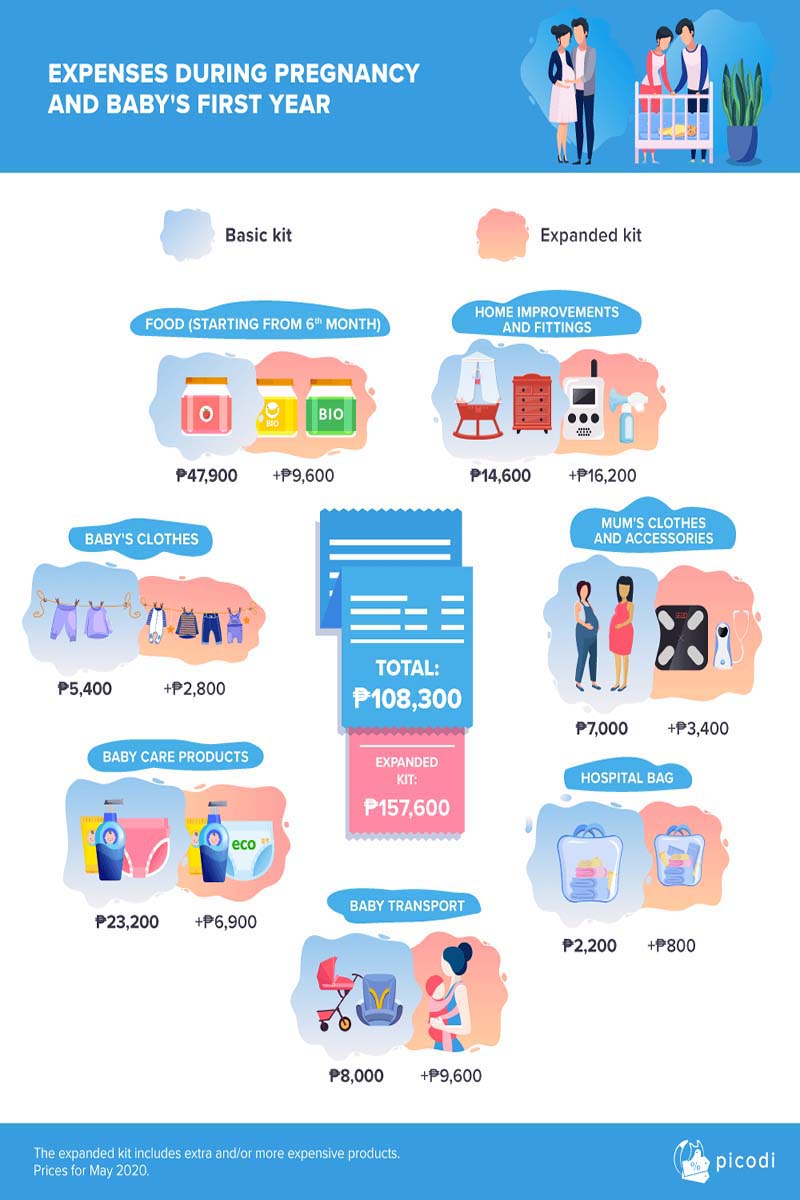

I came across an analysis on the expenses connected to the birth of a child – from pregnancy clothes for mother, hospital kit, household equipment and the cost of bringing up the child in the first year of life by picodi.com. They divided the shopping list into seven thematic categories as seen below. Note that the ones in blue are the basic products and the pink are the non-essential add-ons or expanded kit.

The basic kit is already P108,300 and the expanded is P157,600. And please note that these numbers do not include the hospitalization during delivery which could easily be P100,000, prenatal and post-natal visits, the long list of vaccinations and many many more.

Who can afford to have mahal na anak?

Here’s an interesting graph that shows the affordability of the basic kit across 12 countries studied. They compare the expenses for a baby (the basic kit discussed above) alongside the average salaries of the 12 countries. Assuming an average net monthly salary in the Philippines of P15,380, it would take seven months of saving 100% just to afford the basic kit! Again, this excludes the hospitalization costs, pre and post-natal visits, vaccinations and many many more.

It’s very disheartening to think that only the rich can comfortably afford to have “dear children.” But ironically, the higher population growth rate does not come from that social class.

Let’s talk more about this

Join us on Thursday as we discuss more about mahal na anak, if it’s true that millennials would rather have pets than children, and more. Our special guest is sports anchor and commentator, and new daddy, Migs Bustos. My co-host is VJ Anton, a dog owner.

Whether you’re a parent with dear children or thinking of whether you want to have “mahal na anak” or not, I hope that you can find the courage and foresight to assess things properly. Parenting may be costly and difficult, but it probably has the most extraordinary impact we can ever experience in our life. But then again, I also believe that not everyone should be forced into this traditional way of living life and leaving a legacy. The reality is, there are so many other ways.

*******

ANNOUNCEMENTS

1. Thank you to those who joined the Jewels Conference 2021, especially those who reached out to me after the event.

2. Please subscribe to my new FQ Mom Podcast. If you’d rather consume this article in audio and listen to additional comments and insights, please listen to my podcast on the platform of your choice.

3. To learn more about your money behavior, get your copy of FQ Book 2. Get copies for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video.

4. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire