Food prices peaked

Our previous article (Peak inflation, Aug. 8) discussed that inflation may have already peaked. True enough, the US Consumer Price Index (CPI) report released last Wednesday supports the view that inflation has finally turned after headline CPI fell to 8.5 percent in July from 9.1 percent in June. Moreover, the CPI was flat on a month-on-month basis - the first time since May 2020 that the CPI did not show any increase. In addition, last Thursday, the US Producer Price Index (PPI) report showed that the prices businesses pay for their supplies fell by 0.5 percent in July, another sign that inflation is slowing down.

Of course, despite the July monthly decline, both the CPI and PPI are still unacceptably high on a year-over-year, but what’s encouraging is the direction change. Barring a military conflict in the Taiwan Strait or an escalation of the war in Ukraine, it now seems that peak inflation is behind us.

Energy costs down, but food prices up

July’s US CPI decline is primarily due to falling energy costs. Gasoline prices fell 7.7 percent month-on-month in July, following an 11.2 percent increase in June. In addition, natural gas prices fell 3.6 percent in July after sharp increases in recent months. Food costs, however, climbed 1.1 percent in July to record the seventh consecutive monthly increase of 0.9 percent or more. All six grocery store food groups increased, led by coffee and non-alcoholic beverages, which rose 3.5 and 2.3 percent.

Agri commodities signal lower food prices

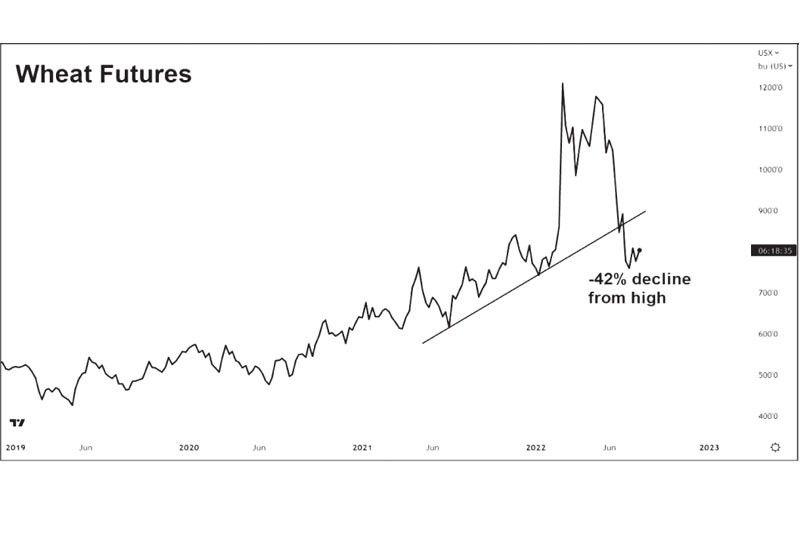

Rising food costs are a significant burden among lower-income households. However, the sharp decline in agricultural commodity prices over the past five months should eventually lead to lower food prices. Leading the decline is wheat, which has plummeted 41.6 percent from its high last March. It was down 8.6 percent in July, partly in reaction to the agreement by Russia and Ukraine to unblock the Black Sea ports, indicating imminent resumption of grain exports from Ukraine.

The chart below shows that wheat prices have broken the uptrend line that started in July 2021. Wheat prices are back at pre-Ukraine war prices and are up by only 6.6 percent year-on-year.

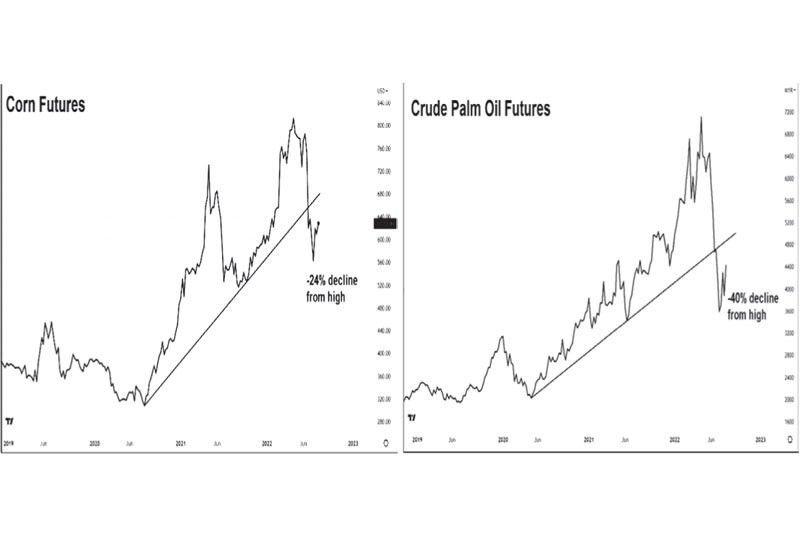

Corn has fallen 24 percent from its April high. Like wheat, corn prices have reversed and have broken below the uptrend line that started in April 2020. Corn prices are also back at pre-Ukraine war levels.

Palm oil, which comprises roughly 40 percent of the total vegetable oil market, has fallen 40 percent from its March high. Palm oil has also broken below the uptrend line that started in May 2020. In addition, prices are significantly below the pre-Ukraine war levels.

Fertilizer and feeds prices decline

Fertilizer prices have also gone down significantly after soaring to record prices in March. This lowers the costs of producing grains used for animal feeds, which in turn reduces the prices of meat and poultry products.

A breath of fresh air

The CPI report has been a breath of fresh air for the Fed and the markets. The potential of a sustained deceleration of inflation means that the Fed may no longer need to hike rates at a steep pace for an extended period. Accordingly, traders responded by pricing smaller interest rate increases from the Fed in the coming months.

Stocks markets worldwide jumped higher on the prospects of a less aggressive Fed. The benchmark S&P 500 index increased 2.1 percent, and the more interest-rate sensitive Nasdaq Composite leaped by 2.9 percent on the day of the report. Both indices ended the week higher for the fourth straight week, with the S&P 500 rising 3.3 percent and the Nasdaq rallying 3.1 percent.

PSEi rallies 4.6% for the week

Last week, the US dollar index (DXY) fell 0.85 percent on the lower-than-expected inflation numbers. The lower dollar and easing inflation bode well for emerging markets, which rallied 2.5 percent last week. Following the US inflation report, Philippine stocks recorded the biggest daily increase since June 2, 2021, after the Philippine Stock Exchange Index (PSEi) surged 3.23 percent on Wednesday. The PSEi ended the week up 4.6 percent to close at 6,699.66.

Stock markets, a leading indicator

The stock market is forward-looking and typically bottoms out six to nine months ahead of the economy. With inflationary pressures peaking, the movement of stock markets and long-term US Treasuries suggest that the bear market low of S&P 3,666 was reached last June 16.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit http://www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending