Transition from Kuripot to FQripot

“Kuripot ka ba?”

If asked that question, how would you answer? Some would probably say yes with pride, especially the regular readers of FQ Mom articles. ![]()

But let’s examine the word kuripot. It actually means a person reluctant to spend, sometimes to the point of foregoing even basic comforts and necessities he can easily afford, just to hoard money. In English, we say stingy, miser, or ungenerous. Since it’s almost Christmas, a good example is Ebenezer Scrooge of Charles Dickens’ 1843 story entitled "A Christmas Carol".

From the above, we actually don’t want to be labelled kuripot. We’d rather be called FQripot! So, what’s the difference? Oh, there’s a world of a difference between Kuripot and FQripot!

Kuripot

In the story of Dickens, Scrooge, the quintessential kuripot, was wealthy but he was underpaying his clerk Bob who needed financial help for his sick child. He also hounded his debtors, while he lived cheaply and joylessly in the quarters of his deceased business partner Jacob. He hated Christmas because he related it with reckless spending.

I tried to look for a Pinoy counterpart of Scrooge, but there’s no one particular character. We do have Asiong Aksaya, who’s the exact opposite. If there’s any Pinoy version of Scrooge, it is not one person but a group of people - and that’s me and my ka-ilians, the Ilocanos. Google kuripot and you’re bound to find Ilocanos in the suggested contents. This reminds me, why is it that the most famous Ilocano family is not kuripot at all? But that belongs to a whole new article.

Why are Ilocanos known to be kuripot? In some of the books that I’ve read, this characteristic of being frugal is attributed to the harsh weather conditions in the region. In Ilocos, when it’s hot, it’s really hot, and when it’s typhoon season, it’s really typhoon season, making it difficult to have good harvests all year round. This made the agricultural Ilocanos in the early years learn how to budget well, to save up not just for the rainy days but also for the really hot days.

FQripot

FQ (financial quotient) is the ability to make sound decisions and actions with regard to personal finances. It is the IQ and EQ of handling money.

FQ is big on understanding the role of money in one’s life. A high FQ is having a healthy relationship with money, something that Scrooge didn’t have at first, even if was wealthy. A healthy relationship with money is neither being a reckless spender nor a miser. Both of these are signs of a toxic relationship with money. To make sure you don’t have a toxic relationship with money, go over the checklist - 13 signs of a toxic relationship with money.

The key to having a healthy relationship with money is to know your core values and make sure that these are being fulfilled and aligned with what you do with and for money. In chapter 5 of "FQ Book 1 – FQ: The nth Intelligence", there is an exercise on how to make sure you have an alignment of these two.

So, FQripot is knowing how to spend your money well. FQripot is not being cheap (Read Frugal is not cheap). It is being frugal in general in order to have money to spend on the things that really matter to you. It is spending based on your value-centric goals.

Therefore, you’re not being FQripot if, despite having more than enough money, you still refuse to spend it to fulfill something that is very important to you, just so you can hoard money. That is being Scrooge-kuripot and if you keep on doing that, you are bound to live a miserable life. Don’t wait to be visited by the ghosts of Christmas past, Christmas present, and Christmas future, just like what happened to Scrooge, in order to change your miserly habits. Understand the true purpose of money in your life now. It is to fulfill your core values.

Shift from Kuripot to FQripot

In our Financial Architecture service, we help our clients understand their value-centric goals and eventually, help them direct their saving, investing, and spending accordingly.

It is always better to start off as being generally frugal. Then there comes a time in our life when we have to assess where we are and what else we want to do. Let’s take for instance a senior couple who are now done with their obligations with their children. Because of their frugal way of life, they have accumulated a healthy level of retirement nest egg. They both love to travel. It has made them enjoy each other’s company all these years, deepened their relationship, and allowed them to continue learning. And because a business class ticket is typically three to four times more expensive than an economy one, they have always travelled on the latter. (Okay, this reminds me of an Ilocano politician who professed that he was too embarrassed to ride “coach” or economy, because he always travelled first class, now that’s even more expensive than business class! Hello, Ilocano ka ba talaga?)

Back to our frugal couple who always travelled on economy. Now with their senior bodies, the toll of long-haul flights has become more apparent. When it was pointed out to them that they can comfortably afford to treat themselves to business class flights and arrive at their destination more refreshed with no aching bones to recover from before they start their adventure, they started to transition to being FQripot!

This may not be a common concern but it is something that is worth sharing. It’s all part of our journey to have a high FQ! We all need to fully understand what we are working hard for, saving up for, investing for, and how we can have a healthy relationship with money.

So, are you like this senior couple who needs to be reminded to transition from being kuripot to being FQripot? If you’re still in the accumulating stage, it is also good for you to know that if you keep at it (mindful spending, religious saving and investing with a system, hopefully automatically done), you have this sweet problem to look forward to.

Cheers to being FQripot!

P.S. If you want to watch the different FQripot Tips from finance people and other celebrities, please go to the FQripot Tips Playlist on FQ Mom You Tube Channel. https://www.youtube.com/playlist?list=PLZ_fgnSCHbDjU2VyUYUM0NHukdRCiwHtY

Announcements

1. If you want to have a free exploratory consultation on our Financial Architecture service, please click this link https://tinyurl.com/IFEFinancialArchitecture.

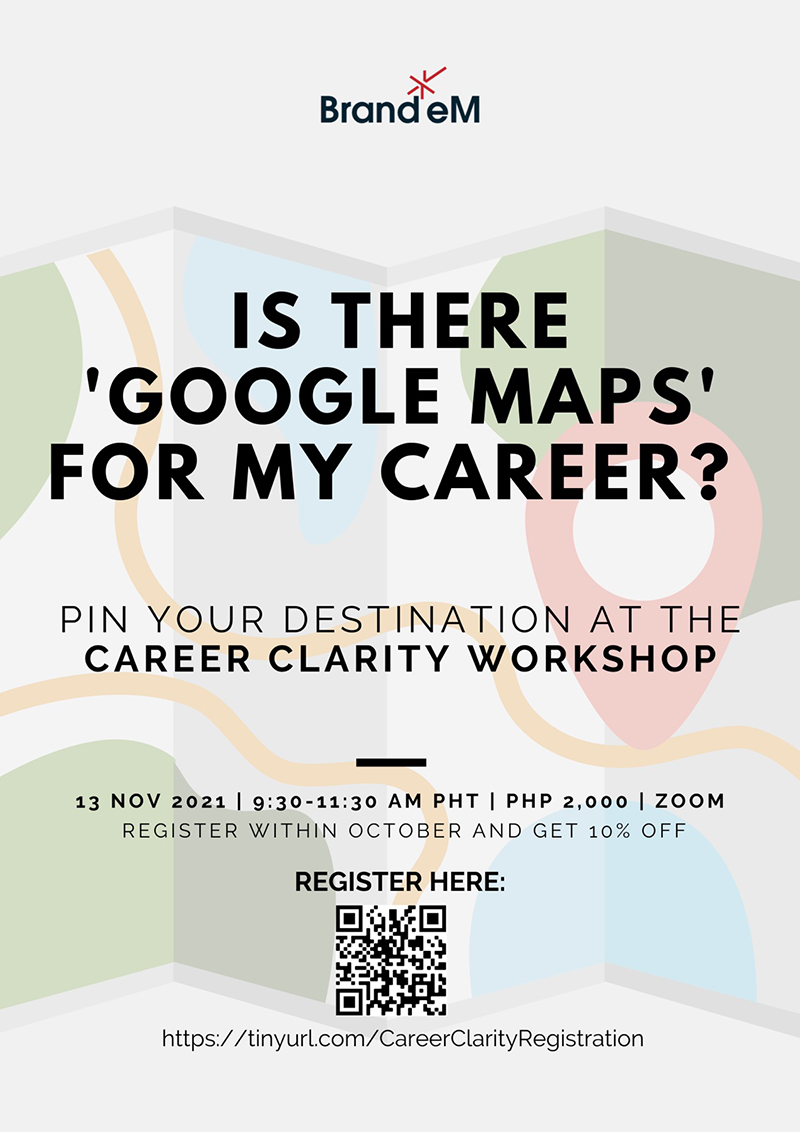

2. Most of the time, what we lack is not motivation but career clarity. Join this workshop on Nov. 13, 2021 Click https://tinyurl.com/CareerClarityRegistration to register and reserve your slot.

3. I’ll be giving a talk on the Psychology of Money on Nov. 12, 2021.

4. I’ll be part of the 2021 BSP Stakeholders Summit on Nov. 25, 2021.

5. Share your business ideas. I will be one of the judges of Condura Negosyo Plus on Nov. 20, 2021 to join register to this link. https://bit.ly/NegosyoPlus

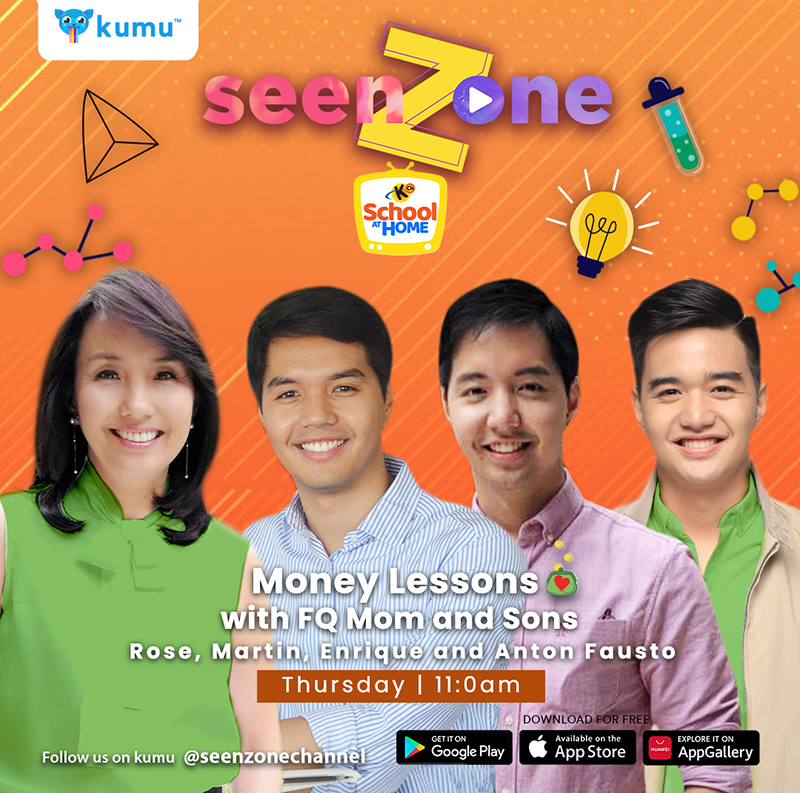

6. Join us on Kumu on Thursday, Nov. 4, 2021 at 11 a.m.

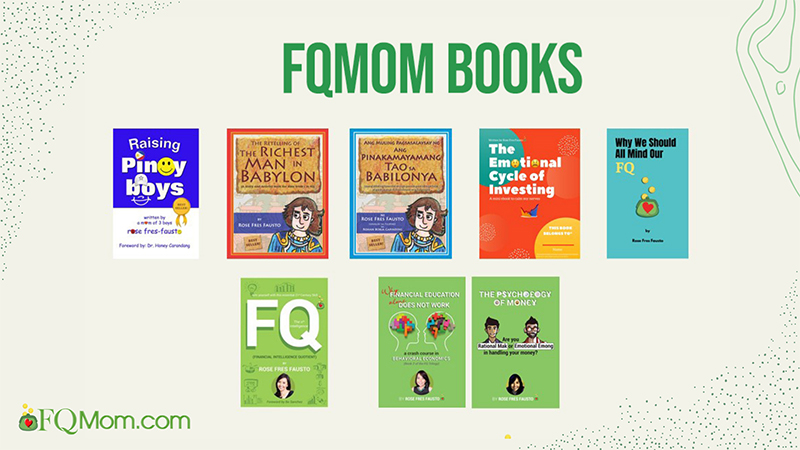

7. To learn more about your money behavior, get your copy of FQ books and for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video.

8. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire

This article is also published in FQMom.com.