Peso: Worst to best

In a surprising turn of events, the Philippine peso transformed from being one of the worst to becoming the best-performing currency in the region on a one-month basis. The peso closed the month of September on a strong note, even as the US dollar index (DXY) reached its highest point of the year last Wednesday. The peso’s resilience was further highlighted when compared to most other currencies’ performance.

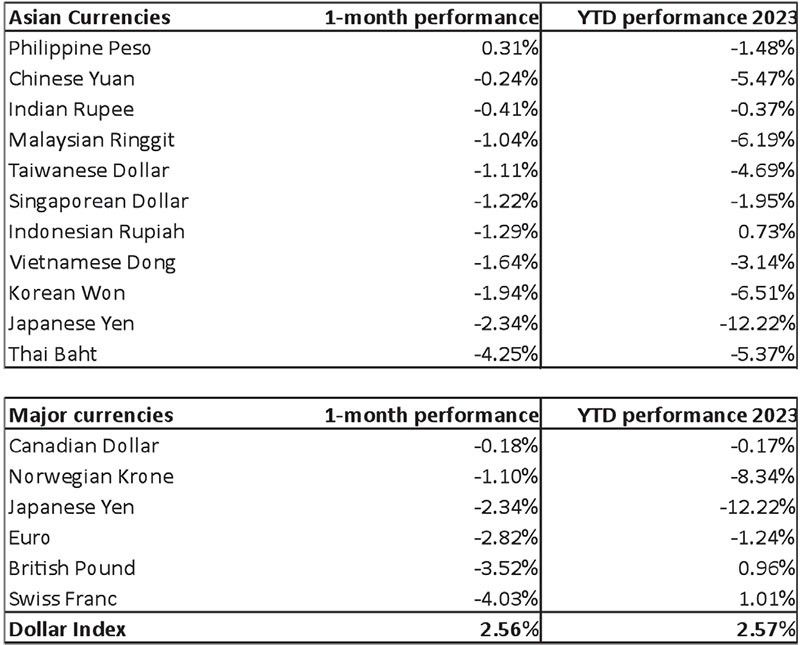

Source: Bloomberg

The Philippine peso rallied from an intraday low of 56.98 last Wednesday to close at 56.58 last Friday. It gained 0.31 percent vs. the US dollar in September, even as the DXY rallied 2.56 percent. Year-to-date, the peso has now emerged as the third best-performing currency in Asia, closely following the Indonesian rupiah and the Indian rupee.

Resolute BSP policies drive peso resilience

The key driver behind the peso’s steady performance was the clear and decisive stance of the Bangko Sentral ng Pilipinas (BSP) and its resolute defense of the peso. BSP Governor Eli Remolona revealed that BSP officials are actively involved in interventions to safeguard the peso at the 57 level, preventing further depreciation. He stated, “There are resistance levels, and when those are crossed, you’ll suddenly see trades in the same direction. There’s herding.”

The BSP’s proactive defense of the peso at the crucial 57-level underscores Gov. Remolona’s profound understanding of market dynamics and technical analysis, reflecting his keen insights into currency market movements. Furthermore, with rising prices of crude oil, sugar, and rice, the defense of the peso has proven to be both timely and critical in maintaining price stability.

BSP’s hawkish stance

The BSP has adopted a hawkish monetary policy, signaling a more aggressive approach to manage inflation and support the peso’s value. In an interview with Bloomberg last week, Governor Remolona expressed his readiness for an off-cycle interest rate increase. Such a move will enable the BSP to synchronize its policy actions with those of the Federal Reserve, particularly if the latter decides to hike rates during the November 2 review.

Gov. Remolona emphasized, “It would be too soon to pivot to cutting the policy rate in the first six months of 2024.” He explained that for a rate cut to be considered, it would require a significant economic slowdown and inflation falling below the target range.

Additionally, Gov. Remolona highlighted that should potential upside risks stemming from energy and transport prices materialize, the BSP is prepared to raise borrowing costs by 25 basis points at the Nov. 16 meeting or even sooner.

Commitment to inflation control

Gov. Remolona emphasized his commitment to prioritize inflation control and pledged to take the necessary steps to return inflation to the central bank’s target range of two to four percent by 2024. He affirmed, “If inflation is very high, we’re willing to slow down the economy a little bit to get the inflation rate down,” emphasizing BSP’s steadfast stance to combating inflation and anchoring market expectations.

Remolona’s decisive leadership

The peso’s strong performance reflects the BSP’s decisive and proactive actions. It also highlights Gov. Remolona’s resolute leadership, profound understanding of macroeconomics, and extensive experience. His clear comprehension of the potential consequences of further peso depreciation on inflation is evident.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending