Asean currencies, blow-off tops

Last week, we noted the dramatic reversal of emerging market currencies, especially among Asean currencies such as the Indonesian rupiah, Malaysian ringgit, Singapore dollar and the Philippine peso (see Reversal, Oct. 12). The increased likelihood of a further delay in the long-awaited Fed rate hike following a disappointing US jobs report has spurred sharp rallies in EM currencies.

Asean currencies have climaxed in what technicians call a classic “blow-off top.” This move is characterized by parabolic rises or sharp exhaustion moves followed by steep and rapid drops. We have seen these moves in the Indonesian rupiah, Malaysian ringgit, Singapore dollar and the Philippine peso in recent weeks.

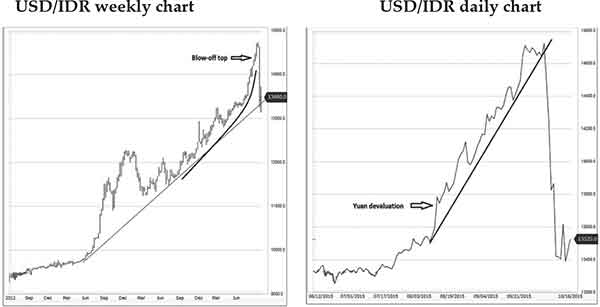

Indonesian rupiah

USD/IDR shot up to 1997 Asian Crisis levels, after a parabolic move last month rocketed it towards 14,753.2. It has since declined 9.2 percent near its weekly trend line support at around 13,500.

A look at the weekly chart would show a decisive break below this trend line would validate the topping pattern in USD/IDR. On the daily chart, one can see the rupiah has recovered all of what it lost since the devaluation of the Chinese yuan last Aug. 11.

Source: Wealth Securities Research

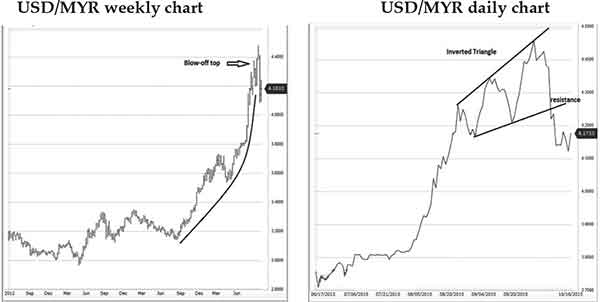

Malaysian ringgit

A similar parabolic rise is seen on the USD/MYR weekly chart. It reached 4.45 last month, way past its 1997 peg. But it has since collapsed 7.7 percent towards 4.13. On the daily chart, one can see a rare “inverted triangle top.” In this case, the rising hypotenuse should act as resistance at around 4.25 – 4.30 on subsequent rallies.

Source: Wealth Securities Research

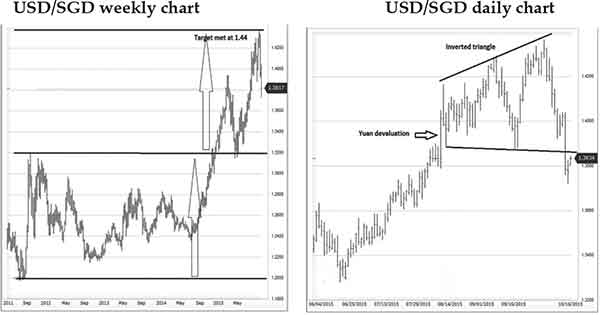

Singapore dollar

USD/SGD met its “measured move” target of 1.44 as shown in the weekly chart. It has since declined four percent to 1.3817. Similar to the ringgit, the daily chart of the Singapore dollar shows an “inverted triangle top” or “broadening top” as some technicians call it.

Source: Wealth Securities Research

Philippine peso

USD/PHP meanwhile has made a double top at 47 as seen on the daily chart. We expect it to retest support at the 45 – 45.50 range. Similar to the rupiah and the Singapore dollar, the peso has completely unwound the effects of the Chinese yuan devaluation.

Looking at the weekly chart, a break below the 45 level which is both a trend line support and a previous resistance level (now turned support) would be bullish for the peso. If this happens, we see USD/PHP further stabilizing and going back to its previous trading range of 43 to 45.

Source: Wealth Securities Research

Crowded trades

The “short EM currencies” and “long US dollar” were the most crowded trades in September and October, according to the recent Bank of America Merrill Lynch Survey of Global Fund Manager Survey. Hence, it is not surprising to see sharp turnarounds in EM currencies as global fund managers unwound these crowded trades.

Philippine peso and stocks bottom out

The rally in EM and Asean currencies, including the peso, have been accelerating, increasing the likelihood of additional gains in stocks. As we have noted in previous articles, there is a correlation between currency movement and stocks. The break of September lows (as shown above) indicates a top in place for the dollar and a low in these four Asean currencies. This reinforces our call that we may have seen the low for Philippine stocks in this correction period.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending