Risk appetite, risk tolerance, risk capacity and Anton’s story

Years ago, I received an angry feedback from a reader who reacted to my articles on why our young children should be investing in the stock market. She said, “How irresponsible of you to advise parents to put their children’s money at risk!”

She was angry because she failed to understand completely the concept of risk appetite, risk tolerance, risk capacity, and investment in general.

Risk is an exposure to uncertainty, possibly danger, harm, or loss. Since nothing in this world is certain except death and taxes, we all need to embrace uncertainty and the importance of taking calculated risks. Remember, no growth happens without risk.

Risk appetite vs risk tolerance vs risk capacity

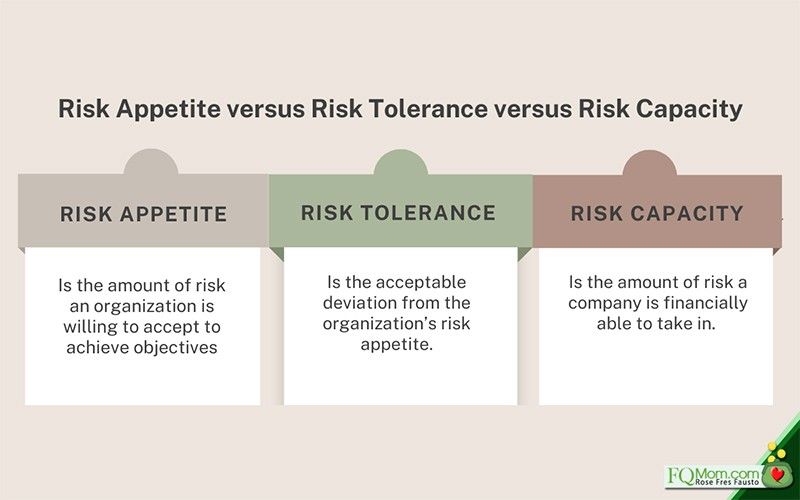

Risk appetite is the amount of risk an organization is willing to accept to achieve objectives.

Risk tolerance is the acceptable deviation from the organization’s risk appetite.

Risk capacity is the amount of risk a company is financially able to take in.

Anton’s story

The above are the definitions of the three risk terms when it comes to a corporation’s risk-taking. But for purposes of our personal investment risks, and that of our children’s in particular, let me narrate a conversation I had with my youngest son, Anton, when he was still in his early grades one weekend morning. Like a kid who discovered something great, he excitedly shared with me his “action plan” on his “investment strategy!”

Anton: Ma, I want to put almost all my money in the stock market!

Mama: Why?

Anton: Well, you and Papa always say that the stock market gives the highest earnings in the long run, right? That means if I put more money there, I will earn more money!

Mama: Well, yes. But don’t you think it will be too risky for you. Remember Mama showed you how the prices of stocks go up and down, up and down? What if the stock market goes down? You might get sad if the next time you update your Balance Sheet, you will find your total assets go down.

Anton: Well, if the value of my stocks go down, my lifestyle will not change. It is when the value of your and Papa’s stocks go down, that my lifestyle will change, right?

After hearing his argument, I thought I just heard the best articulation of why parents should invest their children’s angpaos, other cash gifts, and earnings in the stock market while they’re still very young.

He was right! It was our responsibility to provide for him. It was our lookout to cushion ourselves well against stock market swings. His risk appetite, tolerance, and capacity were definitely bigger than ours because of age and other circumstances - i.e. he was still our dependent while we were middle-aged parents taking care of three dependents.

That happened many years ago. Anton is now 25 years old and his risk appetite, tolerance, and capacity have changed.

Understanding the relationships of risk appetite, tolerance and capacity

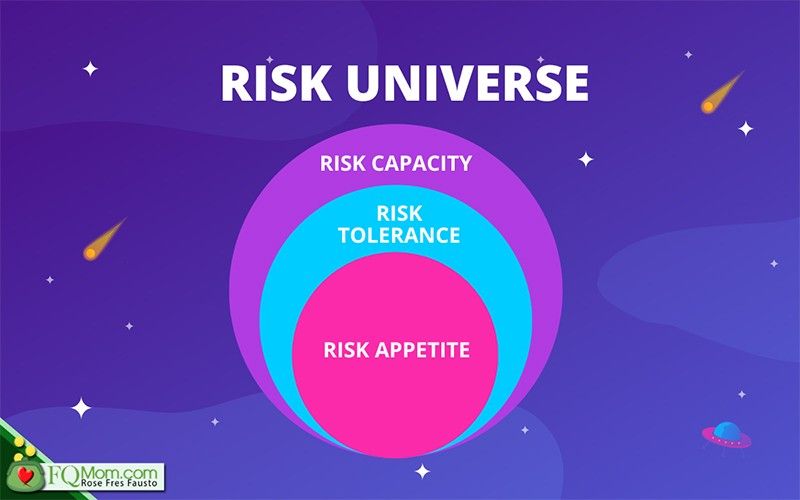

Imagine a risk universe that contains all the risks that one can get into, in pursuit of one’s objectives - in this case, our investment objective to grow our money.

A person, even the richest in the world, has a finite risk capacity. His financial condition and stage in life will greatly determine his capacity – the amount of risk he can accommodate without losing his shirt.

But an intelligent investor knows that he should not just look at his risk capacity. Within that capacity lies, at the innermost circle which is his risk appetite – the amount of risk he is willing to accept to achieve his investment goals.

However, from time to time, that limit may be poked and this is his risk tolerance – the deviations from his appetite that he is still willing to take from time to time. A common example to illustrate the difference between risk appetite and risk tolerance is the traffic police. Let’s assume the speed limit is at 100 kilometers per hour. That is the “risk appetite” stated by law that the traffic police must implement. However, we know that several motorists go over that and not all are apprehended. If the policeman only pulls over those who go beyond 110 kilometers per hour – that is the equivalent of risk tolerance, the deviation that he allows from the speed limit.

Applying risk concepts on your and your children’s investing

Now that you know the differences and relationships of risk appetite, risk tolerance, and risk capacity, I hope you can properly implement the proper asset allocation to your portfolio(s) to manage your risks and achieve your investment goals.

ANNOUNCEMENTS

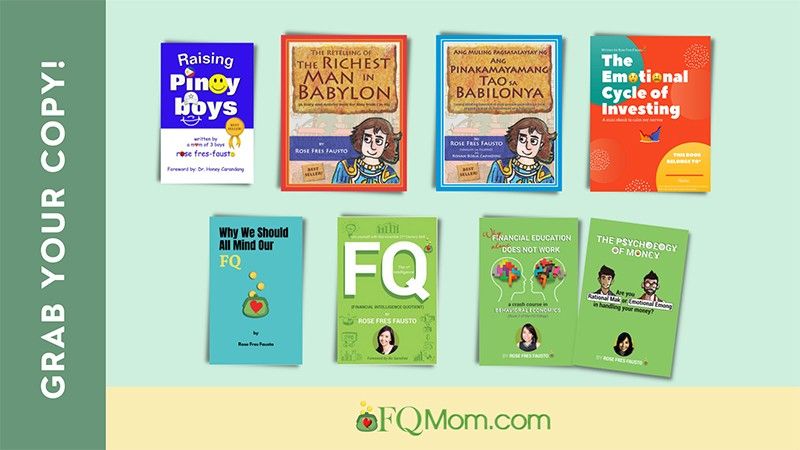

1. Last day of our buy 1 – take 1 free promo for our Tagalog book, "Ang Muling Pagsasalaysay ng Ang Pinakamayamang Tao sa Babilonya". Click here to get your copy.

2. How good are you with money? Do you want to know your FQ Score? Take the FQ Test and get hold of your finances now. Scan the QR code or click FQ test.

3. After the test, make them understand the basic laws of money, understand their relationship with money, including their own money biases, so they can improve their FQ, their money knowledge and behavior. Give them the gift of any or all of the FQ Books. Click here.

This article is also published in FQMom.com.