The importance of Behavioral Economics in your financial life Part 2 (Meet John Beshears)

I had two important highlights in 2019, the year before our lives changed drastically. And I am so happy that COVID-19 didn’t come a few months earlier; otherwise, these highlights wouldn’t have happened.

One highlight happened in August 2019, our Pearl Wedding Anniversary. As you may already know, I’m a serial bride. ![]() My husband and I have exchanged “I do’s!” for quite a number of times, and that was our fifth! If you’re like me who just loves watching wedding videos, photos and other wedding matters, let me share with you short videos of our milestone celebration.

My husband and I have exchanged “I do’s!” for quite a number of times, and that was our fifth! If you’re like me who just loves watching wedding videos, photos and other wedding matters, let me share with you short videos of our milestone celebration.

Pearl Wedding Same Day Edit Video by Dennish Studio

Pearl Couple 1930s Dance

Dance by the Boys w 1930s vibe

Fun Wedding Homily by Fr. Johnny Go, SJ

VJ Anton's Podcast - Heartfelt Interview on the night before the Pearl Wedding

Pearl Wedding Photo Video by Pat Dy

My other highlight during that year was taking up an executive course in Behavioral Economics at the Harvard Business School (HBS) in October 2019. This was a follow up to my collaborative meetings with the father of Behavioral Economics and Nobel Laureate Richard Thaler at the University of Chicago, and with Dan Ariely at the Duke University.

This highlight was a dream come true for me – not only because it fulfilled every nerdy Pinoy‘s dream of studying at “Hahvahd” :) but also because it allowed my husband Marvin and me to experience being “campus sweethearts!” Yup, even if we were just a couple of years apart at the Ateneo, we never saw each other. There’s a family joke that maybe we were not yet ready for each other back then.

The Harvard experience was pretty awesome. And when I say awesome, I mean it in the original sense of the word “awe.” Marvin and I did not only interact and exchange ideas with 90 other executive students from all over the world in different accents (I loved that part too), but we were listening to the lectures and discussing with professors whose work I’ve read and admired. If I were an aspiring singer/dancer, it would be similar to interacting with Michael Jackson, Madonna and Cyndi Lauper. (Okay, that reveals my age!)

Meet John Beshears

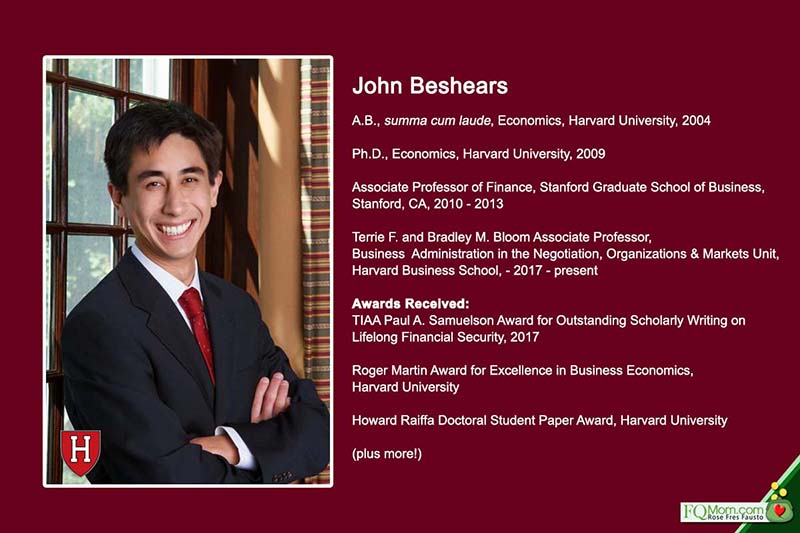

Among the Behavioral Economics rock stars mentioned above is John Beshears. He is an associate professor at the Harvard Business School’s Negotiation, Organizations & Markets Unit. He is also a fellow at the National Bureau of Economic Research (NBER). When I started my interest in the field of Behavioral Economics, NBER was a main source of my readings. Prior to Harvard, Beshears was an assistant professor of finance at the Stanford Graduate School of Business.

He has extensive studies in the field of Behavioral Economics focused on understanding how the financial decisions of households and firms are influenced by the institutional environment in which choices are made. He has collaborative studies on the participation in the retirement savings plans, household investment decisions and health care choices. Among them are the following:

- "Building Emergency Savings Through Employer-Sponsored Rainy-Day Savings Accounts."

- "The Impact of Employer Matching on Savings Plan Participation under Automatic Enrollment."

- "The Importance of Default Options for Retirement Saving Outcomes: Evidence from the United States."

- "Retirement Saving: Helping Employees Help Themselves."

- "Vaccination Rates Are Associated with Functional Proximity but Not Base Proximity of Vaccination Clinics."

- "Planning Prompts as a Means of Increasing Rates of Immunization and Preventive Screening."

Let me bring to life John Beshears by sharing my FQwentuhan recorded at the Harvard Business School.

I hope you enjoy the above FQwentuhan. If you want to learn more about how you can use the principles in Behavioral Economics to improve the way you handle money in an easy-to-understand language with Pinoy flavor, I invite you to read my latest book by clicking this link. Then do share with me your ME (MakEmong) score!

*****************

ANNOUNCEMENTS

1. Use the principles in Behavioral Economics to your advantage! Apply them not just in money matters but also in matters of the heart, career and other important aspects of life. My latest book is a product of my years of studying, writing, rewriting, some more writing and rewriting. To get your copy click: https://fqmom.com/bookstore/ Insert FQ Book 2 Poster.

To know more about FQ Book 2, watch this short video.

2. On Friday, my sons Martin, Enrique and I will be holding the second of a series of FQ workshops for a major corporation who wants to enhance their manpower well-being through financial coaching. If you’re interested to have FQ workshop with your company, family, civic or other kind of group, please contact us at FQTeam@FQMom.com.

3. How good are you with money? Do you want to know your FQ score? Take the FQ test and map out your 2021 FQ plan. Scan the QR code or click the link: http://fqmom.com/dev-fqtest/app/#/questionnaire.