On to a good thing

The Government Service Insurance System (GSIS) has latched on to what can arguably be one of the best investment decisions for the government controlled pension fund – increasing its stake in the soon to delist Metro Pacific Investment Corp. or MPIC.

In fact, industry sources told this writer the GSIS is aiming to get at least two board seats in MPIC as it continues to quietly buy shares on top of what it has already acquired – equivalent to 11.9 percent of total shares – that would entitle the government-controlled pension fund to at least one board seat.

GSIS, likewise, holds in trust MPIC shares of the Social Security System.

The GSIS is, thus, investing in MPIC for the long term.

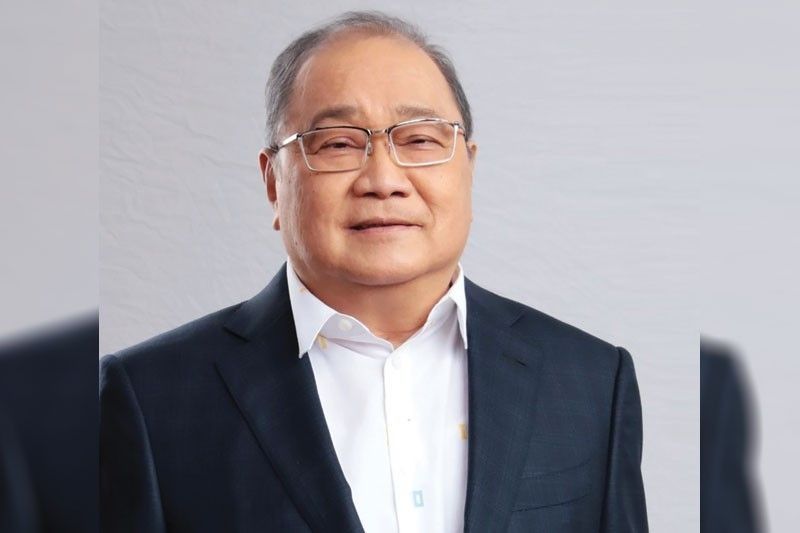

MPIC, headed by Manuel V. Pangilinan, is the Philippine-based unit investment holding company of the Indonesian Salim Group’s Hong Kong-listed First Pacific Co. Ltd. through Metro Pacific Holdings Inc.

The Salim Group is Indonesia’s largest conglomerate and thus offers MPIC and its subsidiaries potential investment opportunities to tap Indonesia’s 275 million population.

MPIC, through its subsidiaries, provides power; water, sanitation and sewerage services; transport and logistics; healthcare and education; food and beverage, and also operates real estate and infrastructure projects.

According to well-placed sources in the GSIS, the leadership of the pension fund sees an opportunity to “contribute in nation building” and tap into the synergies that the MPIC Group offers, which has further been enhanced by the recent partnership between MVP and tycoon Ramon S. Ang, or RSA, of San Miguel Corp.

The GSIS leadership, sources pointed out, did not see the logic of selling its shares in MPIC at the low valuation of P5.20 per share and instead saw a good opportunity that the MPIC Group offers as it continues to invest in important projects in power through Meralco and Global Business Power; water, sanitation and sewerage through Maynilad; vital transport and infrastructure projects through the Light Railway Manila Corp. and Metro Pacific Tollways Corp., as well as plans to expand further into food and beverage, all of which contributes to the economy.

Likewise, because of its global linkage, MPIC also offers further investment opportunities in other ASEAN countries in terms of all its core businesses. The Pangilinan-led holding company, through it subsidiary MPTC already has an investment in Vietnam through the Ho Chi Minh City Infrastructure Investment Joint Stock Co., and in Thailand, through the Don Muang Tollway Public Co. Ltd.

The GSIS leadership, sources said, also foresees multiple synergies and opportunities offered by MPIC’s current shareholders that include the Ty family’s GT Capital Holdings and Japan’s Mitsui Group.

MVP-RSA synergy

The recent warming of business ties between MVP and RSA, sources added, only enhances MPIC’s value, which could include cooperation and tie-ups in each group’s various businesses, particularly in the food and agriculture sector as MPIC, through the Salim Group’s IndoFood, and RSA’s SMC food and beverage unit, could offer opportunities with the growing global need to ensure food security following the disruption caused by the Russia-Ukraine conflict.

Both MVP and RSA have separately expressed their desire to help the government improve agriculture productivity and invest in corporate farming.

Likewise, the power sector also offers attractive opportunities for MPIC’s power units, as well as RSA’s SMC Global Power Holdings Corp.

MPIC is already exploring alternative energy sources, particularly modular power reactors, while SMC Global Power contemplates its future plans for its Ilijan power facility.

Other business tycoons like Enrique Razon have also held exploratory talks on small modular reactors. The Aboitiz Group has been a powerhouse in the Visayas and Mindanao, while the Ayala Group has been investing in renewable energy here and abroad.

After years of competitive arms-length relations, MVP and RSA in July this year finally decided to join forces to build a 96-kilometer tollway that would effectively link Cavite and Batangas and connect MVP’s CALAX and RSA’s STAR tollways.

In the past, MPTC and SMC Tollways have had problems in synching their toll collection system to offer users a seamless connection. With the new tollway collaboration, users of SLEX, NLEX and TPLEX may finally enjoy a more pleasant tollway collection system that could drastically improve and shorten travel time.

- Latest

- Trending