Marcos sees slower price growth by Q2 as inflation spreads beyond food, fuel

MANILA, Philippines — President Ferdinand “Bongbong” Marcos Jr. said Tuesday Filipino consumers would likely see lower prices in the second quarter, as his government struggles to control red-hot inflation that has already spread to majority of commodity groups.

Speaking to reporters, Marcos admitted that the measures meant to tame stubbornly high prices, including importing certain food items to augment limited supply at home, are taking some time to be felt.

"My continuing estimate or forecast is that by — we can see the lowering of inflation by the second quarter of this year," he said.

Inflation, as measured by the consumer price index, unexpectedly accelerated 8.7% year-on-year in January, faster than 8.1% clip recorded in December, the Philippine Statistics Authority reported.

The surprising January figure bucked market expectations of a cooler inflation, which was widely projected to have peaked in December as robust demand during the holiday season was highly expected to have waned.

The government had similar hopes as it scrambles to tame stubbornly high prices that have been hurting many Filipino families for over a year now. But the much-anticipated inflation peak did not happen and the upsetting figure even exceeded the Bangko Sentral ng Pilipinas’ 7.5-8.3% forecast range for January.

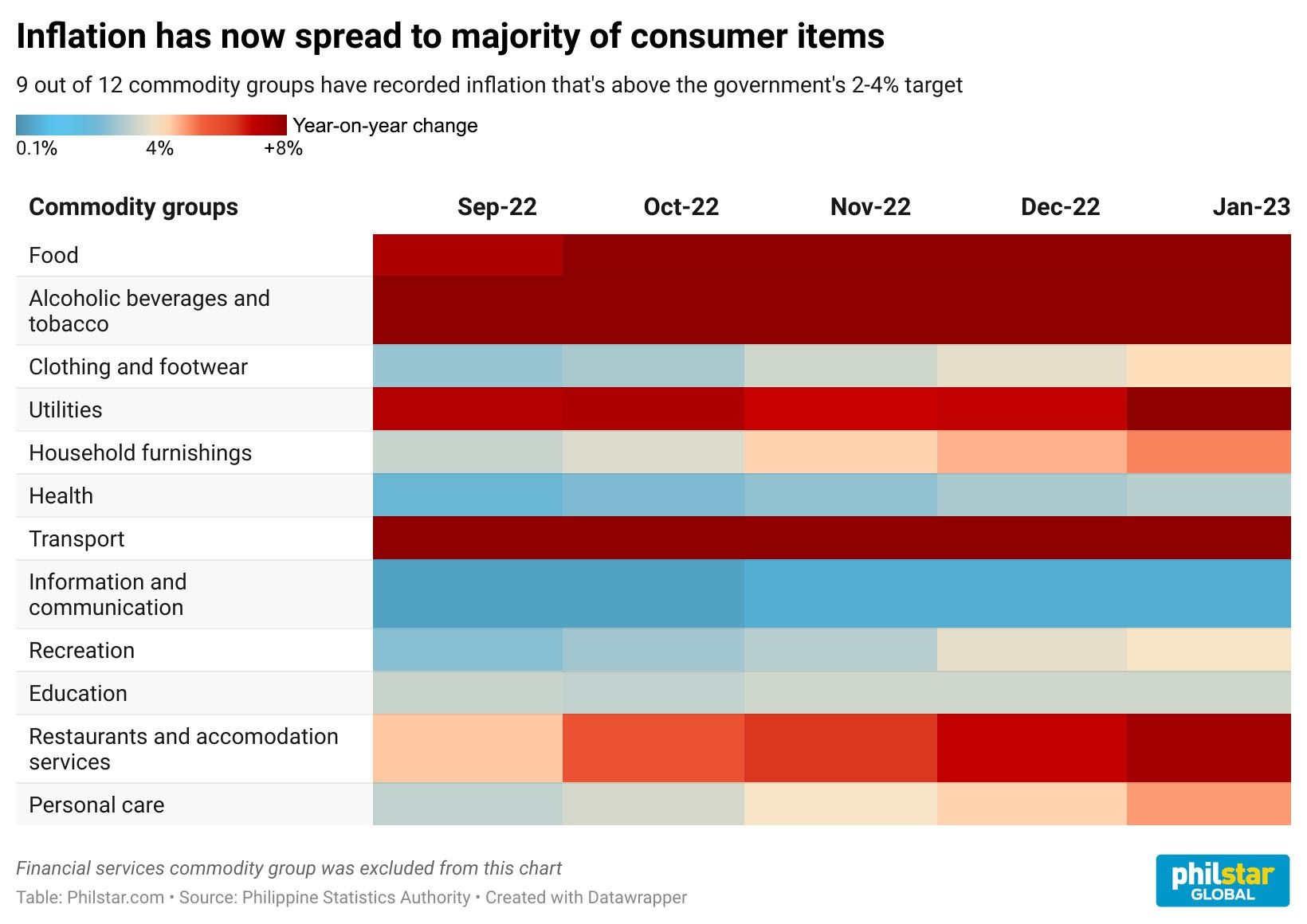

The inflation contagion

As it is, inflation has now spread beyond expensive food items and fuel, with analysts warning that reining in high prices would get harder by the day if the government fails to immediately solve the worsening supply-demand imbalance.

No less than National Statistician Claire Dennis Mapa said that reaching peak inflation would have “challenges”.

“Inflation has infected the rest of the CPI basket,” said Nicholas Antonio Mapa, senior economist at ING Bank in Manila.

“Unless we see some relief on the supply side we could see inflation continue to feed off on itself,” he added.

“Rate hikes are designed to dissipate demand side pressures by hitting growth. If we follow this tact we could end up in a situation of even slower growth over the medium term while still dealing with inflation,” he continued.

RELATED VIDEO:

- Latest

- Trending