Banks shun lending with loan growth slowest in over 10 years

MANILA, Philippines (UPDATE 4:56 p.m., Sept. 4) — Borrowers are unconvinced it is a good time to borrow from banks despite interest rates at their record-lows, a big hurdle to the government’s tack on relying on lenders to salvage shuttered businesses and induce consumers to spend.

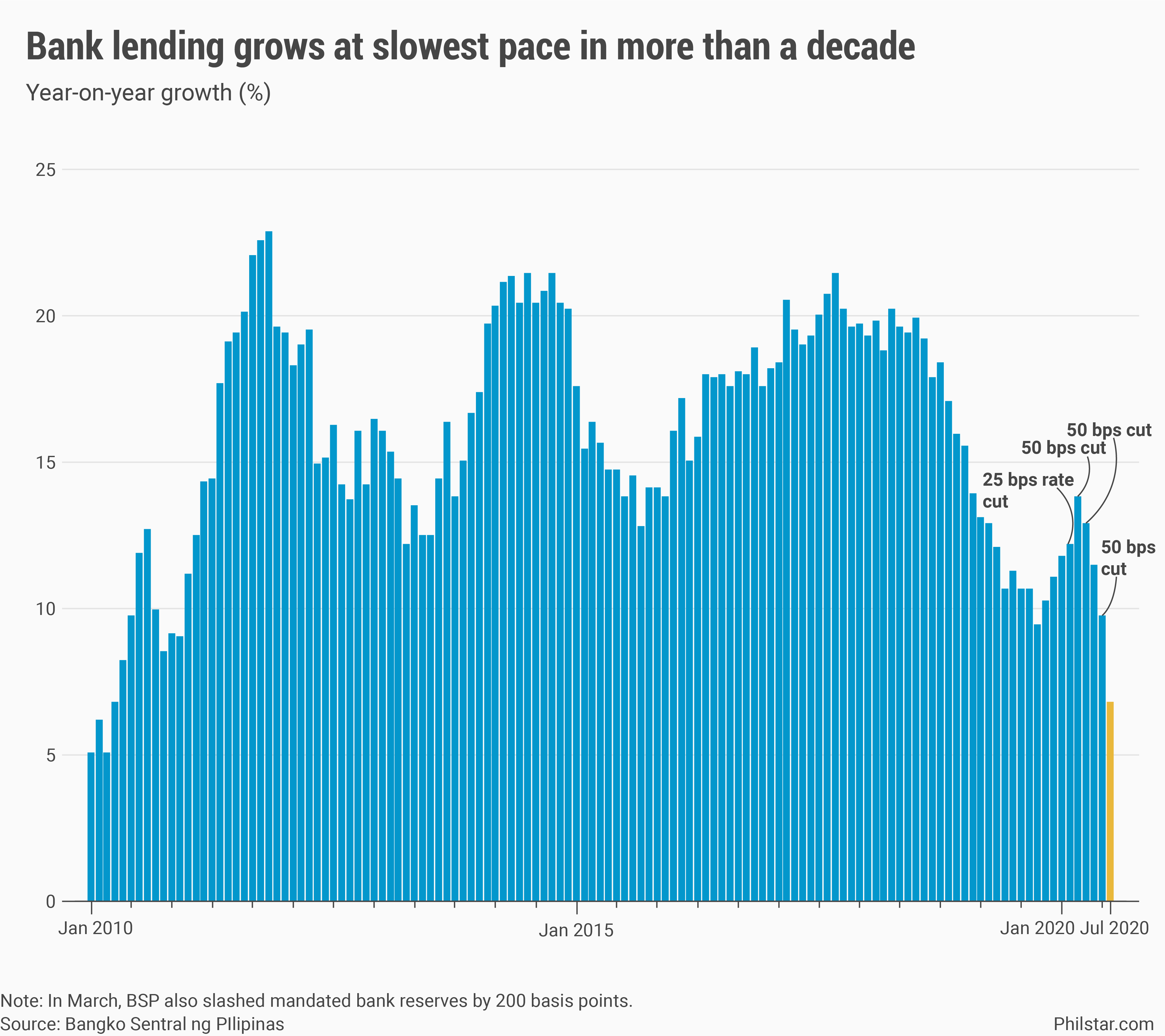

Outstanding loans by big banks, excluding funds lent among themselves, rose 6.7% year-on-year in July, slower than the 9.4% annual growth the previous month, the Bangko Sentral ng Pilipinas (BSP) reported on Friday.

The growth rate was the slowest pace recorded since the 5% uptick recorded in March 2010 and came even after the central bank slashed benchmark lending rates by 175 basis points since February and pushed them down to historic lows.

The lending situation looks worse on a monthly basis. Loans extended declined 1.1% to P9.18 trillion in July from P9.2 trillion in June.

A day before the report was released, BSP Deputy Governor Francisco Dakila Jr. pinned the blame on banks tightening loan requirements during a pandemic that has killed jobs and with it, the capacity to pay of borrowers. In July, a tenth of the labor force still reported out of work, easing from a record 17.7% in April.

“This latest number from the Labor Force Survey which shows a significant reduction in unemployment rate, although this is still elevated, still this is a positive signal that should reduce the uncertainty facing the business sector,” Dakila said.

Sought for comment, BSP Deputy Governor Chuchi Fonacier said "borrowers themselves are also still assessing the situation" before they borrow. "But I think the hesitance to borrow is only a temporary thing since restrictions have been slowly eased," she said in a text message.

But analysts are not so optimistic. Patrick Ella, economist at Sun Life of Canada (Philippines) Inc., said any rebound to double-digit growth rates in lending would have to wait next year. “But this is hinged on a mitigation of that negative sentiment and downside risk in the economic condition…,” Ella said in an e-mail.

Nicholas Antonio Mapa, senior economist at ING Bank in Manila, meanwhile said the dismal loan performance of universal and commercial banks showed that the P1.5 trillion in liquidity released by BSP’s rate cuts only “cycles back and forth” between BSP and the banks and never used for productive activities.

Broken down, loan to big production activities, which cornered the bulk of bank credit with 86.9% share, increased by a slower 5.9% annually to P7.98 trillion. By sector, growth was propelled by lending to information and communication segments, which grew 18.4% on-year, and the booming property industry that went up 11.5%.

However, compared with their end-June levels, lending to these industries weakened from 23.6% and 16.8% growth, respectively.

“Throwing money at the problem will not solve the woes of the public if end-user demand remains largely absent amid decrepit labor market while uncertainty over the virus remains in the air,” Mapa said.

Households themselves were not too excited to borrow despite low rates. Data showed that while consumer loan growth remained on double-digit at 17.3% on-year, this was markedly slower than the 27% in June. Broken down, car loans went up 9.6%, credit card spending by 27.4% and personal salary loans by 11.3%, all weaker from previous month.

Mapa believes an economic recovery, bankrolled by bigger government intervention, will help lending appetite recover, and not the other way around.

“The pace of bank lending will take its cue from the pace of the economic recovery. Given that, I am not confident of a quick rebound (negative GDP likely until first quarter of 2021). I do not expect a sharp surge in bank lending, reflecting a less than robust recovery,” he said.

Editor's Note: Updated chart, included Deputy Governor Fonacier's comments

- Latest

- Trending