PHL vs. ASEAN: The vaccine race and the markets

MANILA, Philippines — In 2020, the race was about getting a vaccine for COVID-19. Nine months after a global pandemic was declared by the World Health Organization in February 2020, news of the first vaccine discovery sent stocks and bond yields soaring on hopes an economic recovery will happen sooner rather than later.

In 2021, the race turned to vaccine rollouts. On the first trading day of the year, major stock markets welcomed the news that some COVID vaccines were ready for distribution.

While questions still linger over the vaccines, financial markets get a shot in the arm every time a vaccine-related positive development hogs the headlines. After entering a global economic recession, any sign that leads to a recovery is being taken by investors as a cue to buy stocks.

“The recovery of the markets rests heavily on the success of the country’s vaccination program. Should the vaccination program proceed in earnest and a larger part of the population will be inoculated, the government can further open up the economy. This should significantly improve investor confidence in the country,” said Edser Trinidad, head of Investments and Research of First Metro Asset Management, Inc. (FAMI).

How the Philippines stacks up

In the Philippines, the first batch of vaccines arrived on March 1, 2021, and was followed by the sporadic arrival of supply and inoculations.

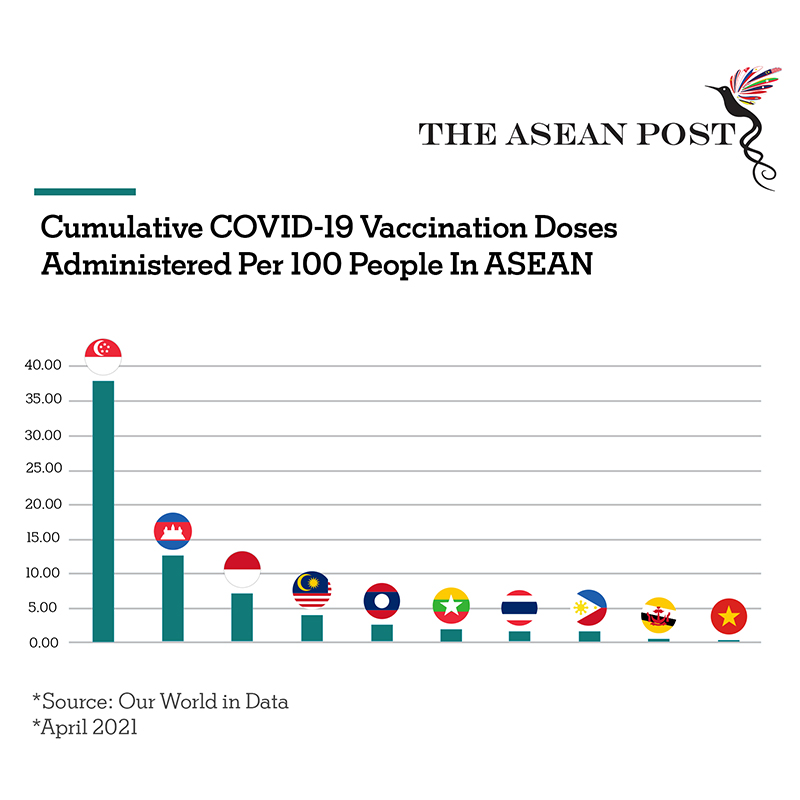

Two months after the rollout, the country continues to lag behind its neighbors in the ASEAN, according to The ASEAN Post, a digital media organization that tracks regional developments. Citing figures from Our World in Data, it showed the Philippines ranking third to the last among 10 ASEAN member-countries based on COVID-vaccination doses administered per 100 people.

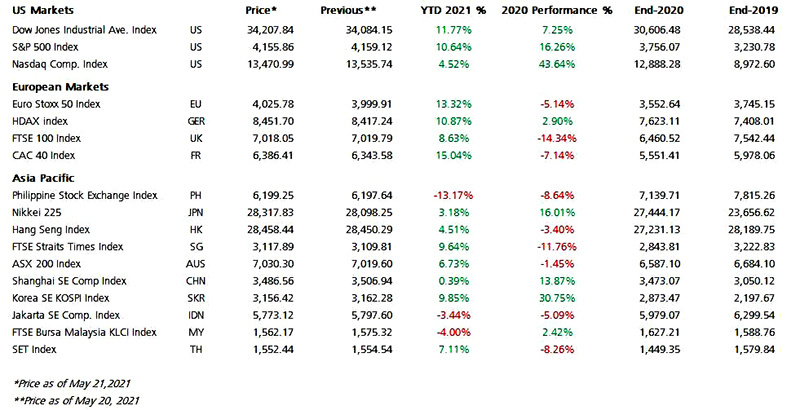

The slower than expected vaccine rollout is reflected in the Philippine stock market’s performance versus its regional peers. Year-to-date, the Philippine Stock Exchange index (PSEi) had contracted by 13.17%— the worst among the 10 bourses in the region. The index has dipped by 8.6% year-on-year—the second worst performance after Singapore’s FTSE Straits Times Index, which lost 11.7%.

In the case of the Philippines, there are several reasons for the weak performance of the PSEi.

Apart from the vaccine rollout and procurement, analysts are also closely monitoring the number of COVID-19 cases in the country, as this serves as an important indicator of the pace of economic recovery. As the table shows, the stock market of countries that have successfully contained the spread of the virus and have started to open up their economy have been posting strong performance.

Another reason is inflation. Investors are worried that the Bangko Sentral ng Pilipinas (BSP) may tighten liquidity by raising policy rates to stave off inflation. This can affect the borrowing cost of companies which, in turn, can scuttle the country’s recovery efforts. Consumer appetite, which remains weak because of the pandemic, can also be further dampened.

For the fourth month, inflation in April remained above the BSP’s target, with headline inflation staying at 4.5%. While it was unchanged from March, inflationary pressures from the index-heavy food component and transport costs persist.

Where’s the light?

The proverbial light at the end of the tunnel depends on the changing dynamics of the crisis.

However, the picture might change by the second half of 2021, as more vaccines become available for the local population. This is expected to speed up the easing of lockdown restrictions, and allow the economy to function at full capacity. Consequently, the economic recovery will generate more jobs and improve household income, leading to higher spending power and better corporate earnings.

A swift recovery for the local bourse may also be expected, given that the average foreign ownership on listed companies is now at a 10-year low. This means local investors, including retail, are seen to fuel market sentiment as positive developments on the vaccine availability and rollout trickle in.

According to First Metro Securities Research, investors must keep an eye on key sectors that could benefit from the sudden pent-up demand. These are those related to transport and mobility, tourism, events and social gatherings, mall foot traffic, and food services.

It also pays to keep track of other markets, particularly those in the region, said FAMI’s Trinidad. “Given that economic interdependence among countries is higher than ever, it is important for a stock market investor to pay attention to what is happening in other markets as it provides a big picture of what is happening in the global economy, which can eventually impact the local market,” he said.

Looking at the regional markets also provides a glimpse on how foreign investors behave, including in which markets they prefer investing. Several regional markets have managed to perform better than the Philippines largely because of foreign investment inflows. Due to the strong performance of these markets, foreign investors may be on the lookout for other markets that have lagged behind but the fundamentals are still improving or about to improve, he added.

While the speed of economic recovery among regional markets may be uneven, there are still opportunities that the Philippines can take advantage of. “Once the COVID-19 surge has been contained and a substantial number of vaccines starts to arrive, then it will be just a matter of time for foreign investors to return to the Philippines,” said Trinidad.