Behavioral Economist Richard Thaler wins the Nobel

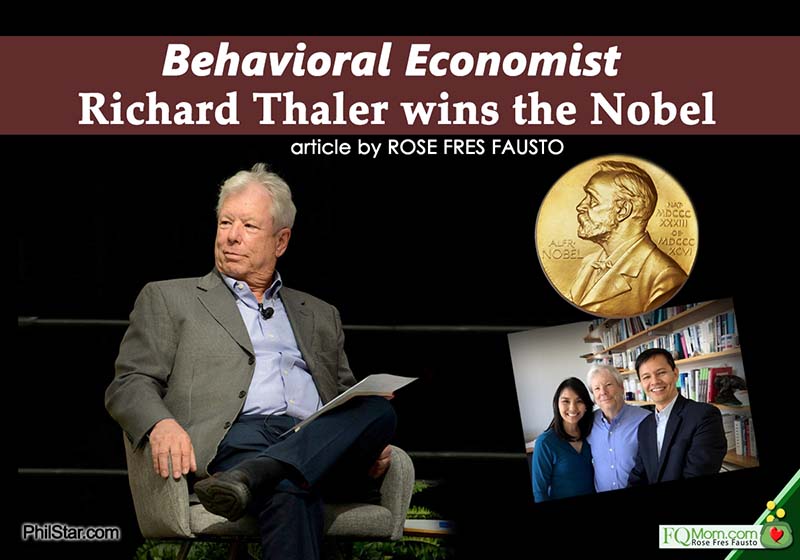

Richard Thaler, the Father of Behavioral Economics, is the 2017 Nobel Prize winner for Economics.

Richard Thaler, the Father of Behavioral Economics, is the 2017 Nobel Prize winner for Economics. I am happy because honestly, I’ve long been waiting for him to receive this prestigious award.

Richard Thaler, Father of Behavioral Economics, is the 2017 Nobel Prize Winner for Economics.

Behavioral Economics is a relatively new field of science that studies the effect of psychological, social, cognitive and emotional factors on the economic decisions made by individuals and institutions, instead of assuming that humans always decide rationally.

The Nobel prize is a set of annual international awards bestowed in several categories by Swedish and Norwegian institutions in recognition of academic, cultural and social advances.

There have been others who received the Nobel in the past because of their work in the field of Behavioral Economics. In 2002, it went to Daniel Kahneman, a psychologist whom Richard closely worked with, received the award for his “Prospect Theory,” a seminal study in the field of B.E. In 2013, the award went to Robert Shiller, economist, Yale professor and author of “Irrational Exuberance,” a book published at the height of the dot com boom and updated in 2005 to include the housing bubble. He received the award in a three-way tie with Eugene Fama (traditional economist, “Efficient Market Hypothesis”) and Lars Peter Hansen (“Empirical Analysis of Asset Prices”).

Other Nobel Prize laureates awarded for their work in Behavioral Economics: Left: Daniel Kahneman, 2002; Right: Robert Shiller, 2013.

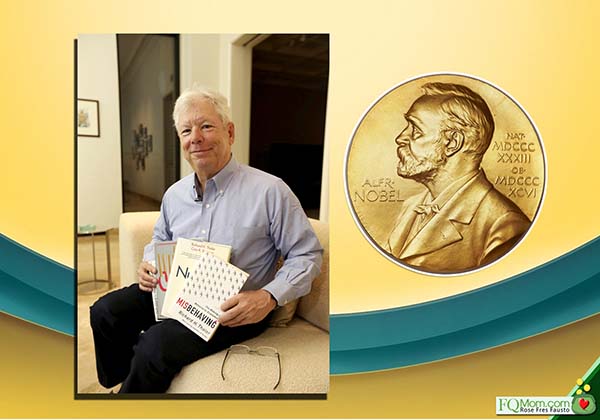

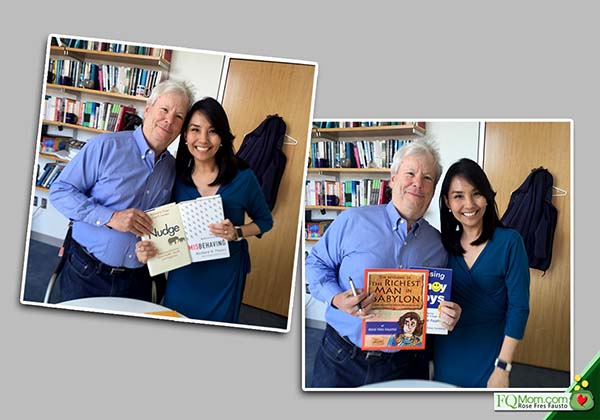

And why am I thrilled for Richard to win the award? Because I’ve been following his work since I “discovered” Behavioral Economics in 2010. His first book that I read and continue to re-read is entitled “Nudge (Improving Decisions About Health, Wealth and Happiness).” He co-wrote it with Harvard law professor Cass Sunstein. This book also caught the attention of many global leaders who have been using it as their guide in policy making.

You know how it is when a book has a great impact on you that you end up writing to its author? I did just that. I wrote to Richard Thaler in 2012 when my husband Marvin registered to run the New York City Marathon and I was going to be his cheerleader. I requested for a possible meet up. This was his reply: “I may be in New York at that time. Unfortunately, it might not work because the marathon is shortly before election day and all of us involved in the Obama campaign will be busy worrying full time!”

The NYC marathon was canceled while we were already there, due to the massive damage caused by Storm Sandy. The registered runners ran anyway at the Central Park. The elections went on smoothly and Obama was given his second term. I kept my online communications with Richard.

Fast forward to 2016 - Marvin was invited to be one of the judges at the CFA (Chartered Financial Analyst) Society’s IRC (Institute Research Challenge) to be held in Chicago. When he asked me if I wanted to join him, I thought of getting in touch with Richard once again, who happens to be a professor at the University of Chicago Booth School of Business.

And so once again, I wrote to him asking for a meeting as early as January 2016 with fingers crossed. I had to remind him of our almost meeting in 2012 and jokingly said, “I know you might even be busier now, what with your new status as a “Hollywood celebrity” acting with no less than the teen sensation Selena Gomez in ‘The Big Short!” Remember that movie about the financial crisis in 2007-2008? Richard Thaler appeared as himself – the Father of Behavioral Economics – in a casino scene together with Selena Gomez to explain Synthetic Collateralized Debt Obligations (CDOs) and the “Hot Hand Fallacy.” Watch this short clip. You may start in minute 1:32.

I remember the day I received his reply. I was in Ilocos Norte for the Diamond Wedding Anniversary of my parents. My persistence paid off, he said yes.

The meeting

A day after the CFA Society event, Marvin and I headed to the beautiful campus of top ranking University of Chicago.

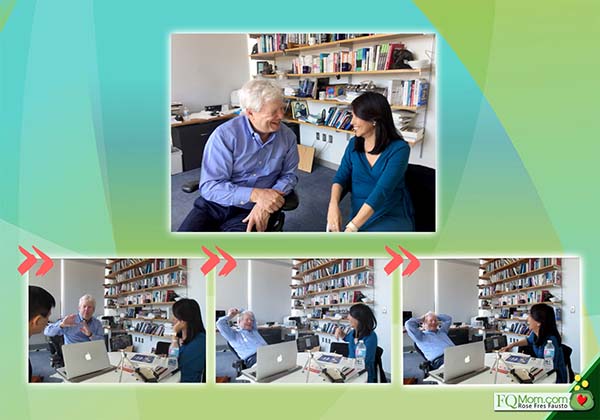

Upon seeing us at the waiting area, Richard gave us a warm handshake and hug, and a buzz on my cheek. Inside his room, he led me to his desktop computer, “Come Rose look at this. My wife France, who’s a photographer, has been to the Philippines! She has taken great pictures there.” He showed me beautiful photos alright, but they were all slums and other dramatic images of poverty. I said, “Wow! Beautiful photos! But the Philippines is much more than that. You should come and see for yourself.” (See FranceLeclerc.com to see France’s soulful culture and documentary photography)

During the meeting, we discussed about the Philippine story and what Marvin and I are trying to do at IFE (Investing For Everyone). He discussed with us the studies that he and his other colleagues have done that could help us. He was particularly interested in policy making.

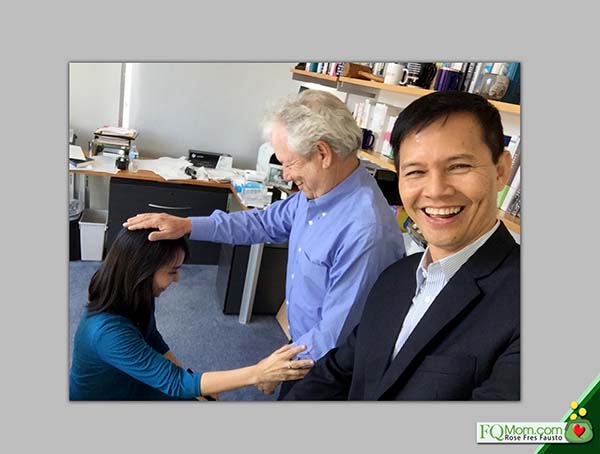

The meeting with Richard Thaler and Marvin Fausto at the University of Chicago.

There was one point in our conversation when I asked Richard, “How can I become a full-fledged Behavioral Economist? Do I have to take up a course?” And this is what he answered, “No! You don’t have to come here and waste four years of your life studying. You’ve read and studied everything you need to know. You are a Behavioral Economist! Just get to work!” I asked in jest, “So can the Father of Behavioral Economics bestow that title on me now?” He said, “Yes! Let’s do that!” We both stood up, then I knelt down while he made the gesture of bestowing the title of The First Filipino Behavioral Economist on me! It was hilarious but yes I’m taking that seriously. As he said, “The most important thing is to get to work!”

The Father of Behavioral Economics and 2017 Nobel Prize Winner for Economics, Richard Thaler, “anointing” the author as the first Filipino Behavioral Economist!

And so I continue to spread the use of Behavioral Economics principles in my articles, talks, workshops, interviews and client consultancies.

Left: Richard Thaler with the author and his books "Nudge" (useful for both policy makers and everyday life) and "Misbehaving" (this is the making of Behavioral Economics); Right: This time with the authors own books "The Retelling of The Richest Man in Babylon" and "Raising Pinoy Boys."

Watch tomorrow’s FQwentuhan to listen to Richard Thaler’s message to the Filipino people.

***

ANNOUNCEMENTS

1. Watch tomorrow’s FQwentuhan with Nobel Prize Winner Richard Thaler at 12 noon.

2. Marvin and I will be giving a talk on retirement on Oct. 24, 2017 in Cagayan de Oro.

3. Want to know your FQ score? Take it today and focus on the behavioral part. Click link to take the test. http://tinyurl.com/FQTest

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom Rose. She is a behavioral economist, a certified gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter & Instagram as theFQMom.