Filinvest REIT dividend continues to crumble

Filinvest REIT [FILRT 3.23 unch] [link] declared a Q4/23 dividend of P0.067/share, payable on March 26 to shareholders of record as of March 11. The dividend has an annualized yield of 8.3% based on FILRT’s previous closing price. The total amount of the dividend is P328 million, which is nearly 100% of the P329 million in distributable income that FILRT reported for the quarter on its dividend declaration document. Relative to FILRT’s IPO price, the dividend increased FILRT’s total stock and dividend return to a 39.87% loss, up from its pre-dividend total return of a 40.83% loss.

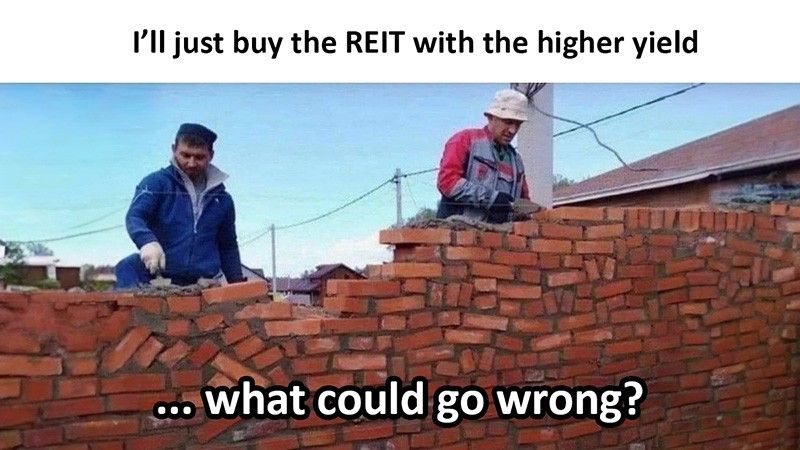

MB bottom-line: Shenanigans? Unsustainable? What’s going on with FILRT? In preparing for today’s write-up, I went back through FILRT’s first three dividend declarations of this year and noticed that all three stated the exact same amount of distributable income (DI) attributable to the quarter (P347 million). I checked the Quarterly Reports for each quarter and found that what they’ve been reporting as DI in their dividend declarations does not match what they’ve been reporting in their Quarterly Reports. My suspicion is that whoever is filling out the dividend declaration form has mistakenly put the total amount distributed by dividends in the “Distributable Income” section of the form, instead of the actual DI for that quarter since P347 million is the amount of each of FILRT’s total distributions by dividend for each of Q1, Q2, and Q3. However, even if that were the case, I don’t know how to explain Q4, where FILRT has distributed P327.8 million but claimed P329 million in DI? Since we’re going to have to wait for FILRT to post its audited financial statements to know for sure, I feel like the best path forward is to take FILRT’s Quarterly Report data as the best representation of its DI in Q1 through Q3, and then take its Q4 reported DI at face value. When we do that, we are left with a situation where FILRT has distributed 130% of its cumulative FY23 DI. In Q1, FILRT reported P304.1 million in DI and distributed P347.4 million (114%). In Q2, FILRT reported P257.2 million in DI and distributed P347.4 million (135%). In Q3, FILRT reported P163.1 million in DI and distributed P347.4 million (213%). And in Q4, FILRT reported P329 million in DI and distributed P327.8 million (99.6%). Cumulatively, FILRT declared P1.37 billion in FY23 dividends based on P1.05 billion in FY23 DI, for a ratio of 130%. Based on this performance, I’d expect FILRT’s yield to be sitting somewhere in the mid-9% range at least, which would imply a stock price of around P2.80/share, which is about 13% lower from its closing price of P3.23/share. Am I missing something, or is the story for FILRT even worse than I’ve been saying?

-

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest