Axelum reallocated P350-M of its IPO proceeds away from 'network expansion'

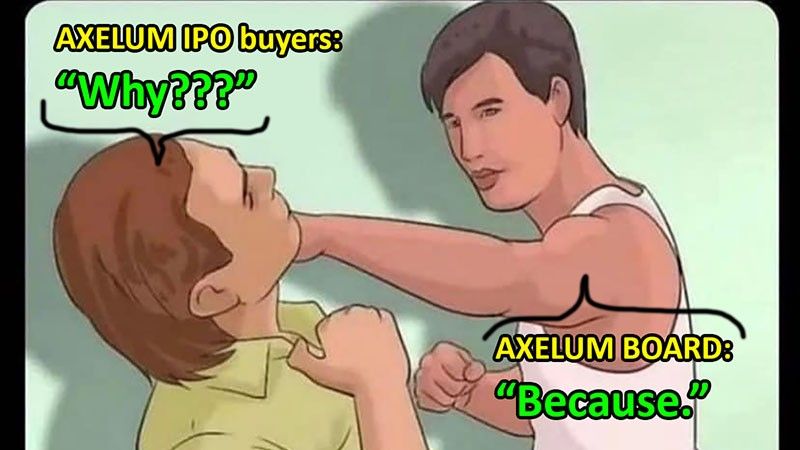

Axelum [AXLM 2.32, up 0.4%; 49% avgVol] [link] said that its board approved a measure to reallocate P350 million in IPO proceeds away from the original purpose (“international and domestic network expansion”). The money will now be split between product development and marketing (P200 million) and capex (P150 million). AXLM’s justification for the move is that it gives “additional amounts to support product development, marketing expenses and for other capital expenditure requirements that may be needed by the corporation.”

MB bottom-line: While AXLM’s board has done nothing wrong according to the PSE’s rules, I hate (with a passion) that it is so easy for a board to unilaterally make sweeping changes about how IPO proceeds will be spent. And that circular logic justification (akin to “we put more money into marketing to put more money into marketing”) completely fails to make any kind of case as to why this is the best use of the money that AXLM took from its investors. No talk about why network expansion is the account being raided. Nothing about what they’ll build with the capex, or if this is to support some new marketing push (or backfill a surprise deficit). In my ideal world, these kinds of changes would require the board to obtain approval from a vote of the public float.

-

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest