Philippine peso edges closer to record low

The Philippine peso is trading precariously close to its all-time low against the US dollar. This is driven by the nation’s central bank signaling a potential policy shift toward looser monetary policy. The dovish pivot comes amidst a fragile economic recovery and persistent inflation. The current strong US dollar environment is also putting pressure on the peso and most currencies worldwide.

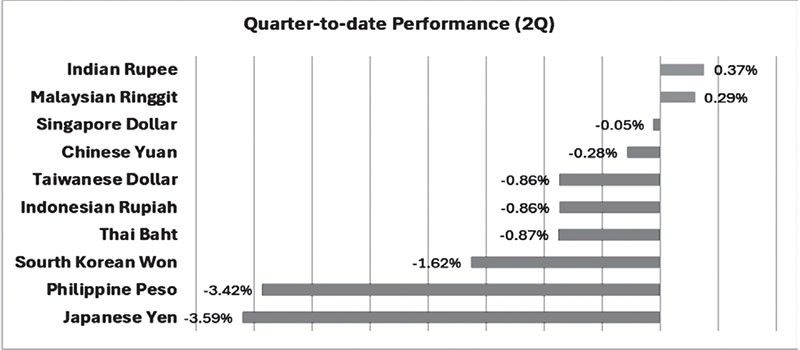

The peso has already breached the key 57 per dollar in April. This is a threshold that was previously defended steadfastly by the BSP. It is now hovering around 58.20, edging closer to the record low of 59.20 set in October 2022. This decline marks the peso as one of the worst-performing currencies in Asia this quarter.

Source: Tradingview.com, Wealth Securities Research

Dovish BSP?

In a recent Bloomberg interview, BSP Governor Eli Remolona signaled that the central bank is “somewhat less hawkish than before” and suggested that a rate cut could come as early as August. This marks a stark contrast to the US Federal Reserve, which has stressed its resolve to keep interest rates higher for longer to tame inflation.

“We are beginning to see a negative output gap,” Remolona said. “That means it’s possible we are tighter than necessary in containing inflation.”

The central bank chief also hinted at the possibility of cutting the key interest rate this year by as much as 50 basis points, depending on incoming data. He indicated that the first cut may happen in the third quarter, followed by another in the subsequent quarter.

Data-driven policymaking

Remolona further emphasized the BSP’s focus on domestic economic data rather than solely following the Fed’s lead. “We don’t care that much when the Fed cuts,” he told reporters last Wednesday. “We care more about our data.”

“We follow the Fed very closely and what they decide is one data point for us, one among many others,” he added.

Divergence with Fed

The BSP’s likely divergence from the Fed’s policy stance has put additional downward pressure on the peso, as US dollar assets become relatively more attractive. This is evident in the currency’s performance compared to other Asian currencies this quarter.

Source: Bloomberg, Wealth Securities Research

Balancing growth and stability

The central bank faces a delicate balancing act as it seeks to support growth while managing inflation, which remained at 3.8 percent in April. If the BSP prioritizes growth and proceeds with a rate cut in August, the peso may find itself in a vulnerable position. However, if it takes a firmer stance against inflation and refrains from cutting rates ahead of the Fed, the currency may finally find the support it needs.

Reserves and intervention

Remolona explained that the BSP had limited foreign exchange interventions to maintain market orderliness and not to influence the peso’s value. He added that the BSP does not intervene in the foreign exchange market daily and when it does the intervention is “very modest.”

Interest rate differential

If the BSP prematurely lowers interest rates ahead of the Fed, the interest rate differential between the two countries will narrow. This could potentially accelerate the peso’s decline. Forex traders may sell the peso and buy US dollars as they seek higher returns.

Market vigilance

As the BSP navigates the delicate balance between supporting a fragile recovery and containing inflation, the peso’s fate hangs in the balance. The central bank’s upcoming policy decisions will be closely scrutinized, as the peso teeters on the brink of its all-time low. The path ahead is fraught with challenges, but the BSP’s ability to navigate them effectively will be crucial in steering the Philippine economy towards stability and growth.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending