Divergent peso

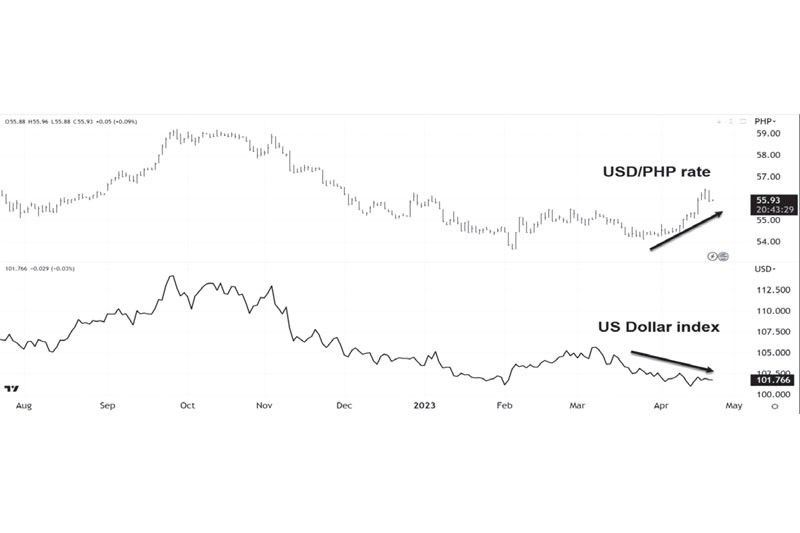

The Philippine peso has been weak in the past month, falling 3.7 percent from its March high. This came despite the recent decline of the US dollar against major currencies, and the 3.9 percent drop of the US dollar index (DXY) from its March high. This defies market expectation that the peso will strengthen when the US dollar falls. The divergent move of the peso thus appears to be a peculiar case and has drawn concern among keen market observers.

USD/PHP rate vs. US dollar index

Source: Tradingview.com, Wealth Securities Research Below, we enumerate the reasons behind the recent decline of the peso.

1. Diverging monetary policies: In an interview, the Bangko Sentral ng Pilipinas (BSP) Governor signaled a possible pause in rate hikes. On the other hand, the US Federal Reserve (Fed) is expected to deliver another 25-basis-point rate increase in May. These diverging monetary policies will result in a narrowing interest rate differential, thus putting pressure on the peso.

2. Weaker OFW remittances: OFW remittances came in at $2.86 billion in February, the lowest level since May. Remittance growth was at 2.4 percent, below the BSP’s full-year target of four percent and the slowest growth rate since July. Moreover, concerns of a possible global recession pose a key risk to the employment prospects of migrant workers.

3. Higher oil prices: The decision of OPEC+ to cut crude oil production has led to fears of oil price spikes, and this is particularly problematic for an oil-importer like the Philippines.

4. Decade-high rice prices: Fitch Solutions expects rice to post its biggest shortfall in two decades amid falling global production. This was caused by the war in Ukraine, the drought in China, and intense flooding in Pakistan.

5. Sugar spikes to 11-year high: S&P flagged the spike of sugar prices to 11-year highs due to lower production from India, Thailand, China, and Pakistan. This came with warnings from commodities experts that extreme weather conditions may take prices much higher.

6. El Nino: The El Nino phenomenon is expected to affect crop production. This can further stoke domestic food inflation and dampen the country’s agricultural output. In addition, El Nino will curtail the production of major agricultural countries, thereby putting pressure on global food prices and the country’s food imports.

7. Widening trade deficit: The Philippine economy’s sustained post-pandemic growth has given rise to a higher demand for imports, thus resulting in a wider trade deficit. For the first two months of the year, the country posted a trade deficit of $9.6 billion, up 13 percent year-on-year and 72 percent higher than 2021 levels.

Competitive peso

Last week, National Economic Development Authority (NEDA) Secretary Arsenio Balisacan commented that “there is a lot of misconception about the weakening peso.” He stated that although too much depreciation can cause instability, allowing the peso to weaken a bit can help improve the country’s trade position. He further explained that this could stimulate import substitution and boost export competitiveness.

Consolidation phase for peso

The Philippine peso has faced a notable weakening trend despite the recent decline of the US dollar (DXY). This divergent move has triggered concerns among investors about the possible resumption of peso depreciation. However, an analysis of technical indicators reveals that the exchange rate encounters significant resistance at its 200-day moving-average, which is at the 56.10 to 56.50 level. Unless there is a decisive breakout above its 200-day moving average, the technical outlook points to a continued consolidation of the peso.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending