2022 year-end review – Part 2

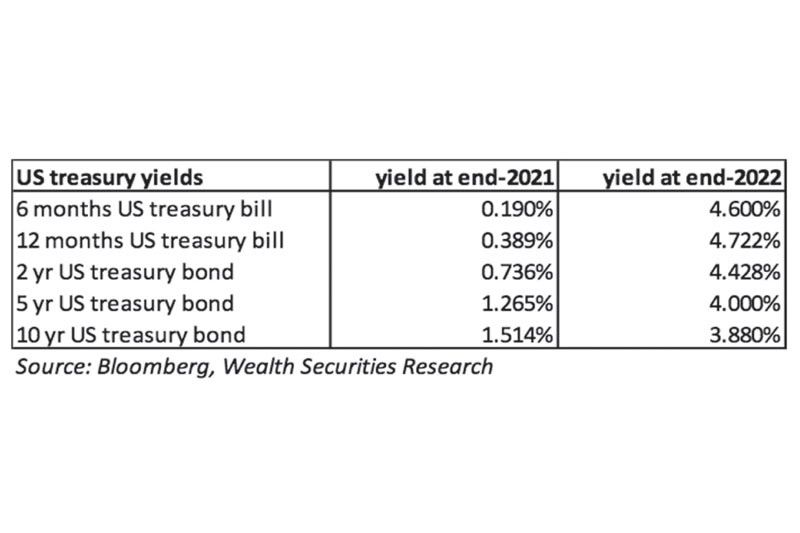

It was a tough and challenging year for investors in 2022 as the traditional 60/40 portfolio mix of stocks and bonds provided little defense against rising interest rates. Most suffered substantial losses. The MSCI All-country world index (ACWI) and benchmark US S&P 500 index suffered their worst year since the Global Financial Crisis of 2008. Global bond prices dropped as yields increased, fueled by persistently high inflation, hawkish monetary policy, and rising geopolitical instability. The two-year US T-bill yield saw a significant increase, going from 0.736 percent to 4.428 percent over the same period. The 10-year US government bond yield also rose from 1.514 percent at the end of 2021 to 3.88 percent at the end of 2022.

Worst year for US bonds

After a multi-decade run, global bonds suffered unprecedented losses in 2022. The Bloomberg Global Aggregate bond market index lost 13 percent, far and away the worst loss ever for this benchmark index. The next largest decline was 2.9 percent in 1994. US aggregate bonds fell 18.9 percent, making it the worst year on record for US bonds.

The rising interest rates impacted both stock and bond markets, leading to a 15.3 percent drop in the diversified 60/40 portfolio, the largest annual decline since 2008, when it fell 22.6 percent. At one point, the 60-40 portfolio was down as much as 34.4 percent, the worst performance in a century.

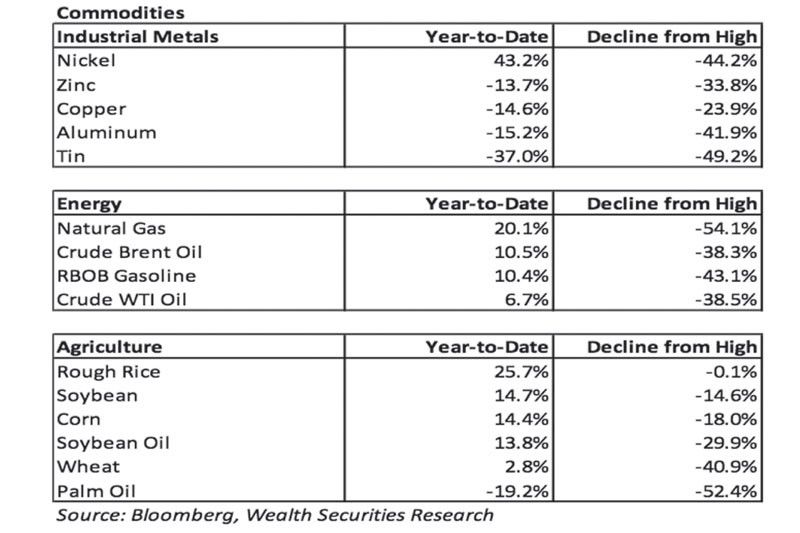

Topsy-turvy commodities

Last year was a topsy-turvy year for commodities. While it went up significantly in the first qaurter partly due to the Russia-Ukraine war, commodities declined substantially the rest of the year. Initially, the conflict exacerbated supply chain disruptions and caused energy and food prices to spike. As a result, wheat prices shot up 74 percent to a year-high of $1340/bu in March, while Brent crude oil skyrocketed 79 percent to a peak of $139.15/bbl likewise in March. Commodities like copper, nickel, aluminum, corn, palm oil and soybean oil peaked between March and April 2022.

Since then, the exact opposite happened as commodity prices crashed, returning to pre-war levels due partly to the resumption of grain exports from Ukraine. The potential for a global economic slowdown also weighed on market prices as the year ended. Industrial metals, including copper, aluminum, zinc, and tin, were heavily impacted by the economic outlook and saw 20 percent to 40 percent declines by year-end.

While energy commodities still posted gains for the year, crude oil and gasoline prices are down 40 percent, while natural gas is down more than 50 percent from peak levels. Likewise, agricultural commodities experienced double-digit declines from their highs, led by palm oil, wheat, and soybean oil, which fell 52 percent, 41 percent, and 30 percent, respectively. Only rough rice remains in an uptrend, ending 2022 with a 25.7 percent gain.

2023: A year of recovery

Last November’s US Consumer Price Index (CPI) report showed the decrease in inflation that the financial markets had been anticipating, leading many investors to expect the US Fed to pause its aggressive monetary policy in the first quarter of this year. This sentiment was reinforced by Friday’s December jobs report, which provided further evidence that inflation, particularly wage inflation, is cooling and moving toward the Fed’s target. This data boosted stocks substantially higher last Friday, with the Dow rising 700 points. While markets may continue to be volatile this year due to increasing recession risks, the declining inflation, less aggressive Fed, and weaker US dollar suggest a recovery in all major asset classes, including bonds and stocks in emerging markets such as the Philippines.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending