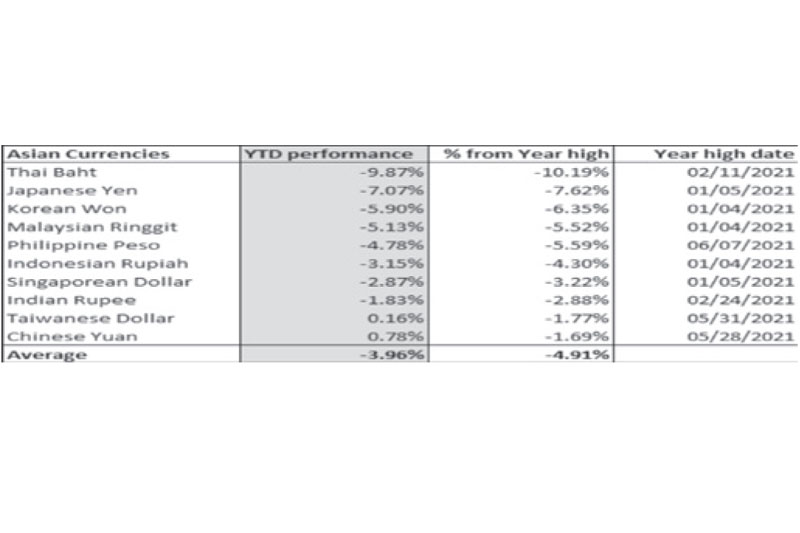

Weak Asian currencies

Investors have shown concern over the weakness of the Philippine peso in the past weeks. However, other Asian currencies have also dropped. In fact, the peso is not the weakest on a year-to-date (YTD) basis. In Asia, the Thai baht, Japanese yen, Korean won, and Malaysian ringgit have fared much worse.

Fed taper and slowing recovery

Since June, Asian currencies have weakened significantly. The threat of a Fed taper and concerns that global economic recovery is slowing have boosted the dollar’s appeal as a safe haven. The 10-year US Treasury yield cratered to as low as 1.13 percent last week, signaling that inflation expectations have peaked and that the reflation theme may have stalled.

Source: Bloomberg, Wealth Securities Research

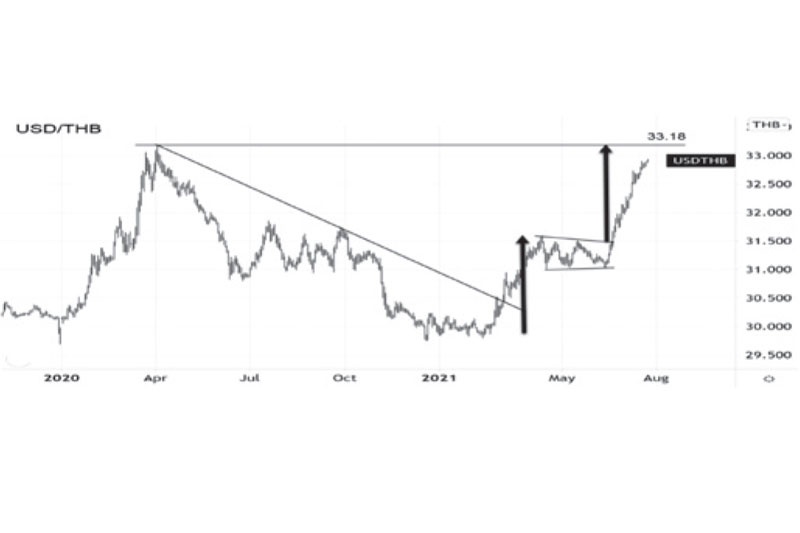

Thai baht

The Thai baht is the worst-performing Asian EM currency, declining 9.87 percent against the US dollar YTD. The sharp move in March broke the 11-month downtrend in USD/THB. After a two-month pause in April and May, the trend resumed with USD/THB now targeting the April 2020 high of 33.18 based on technical analysis.

Source: Tradingview.com, Wealth Securities Research

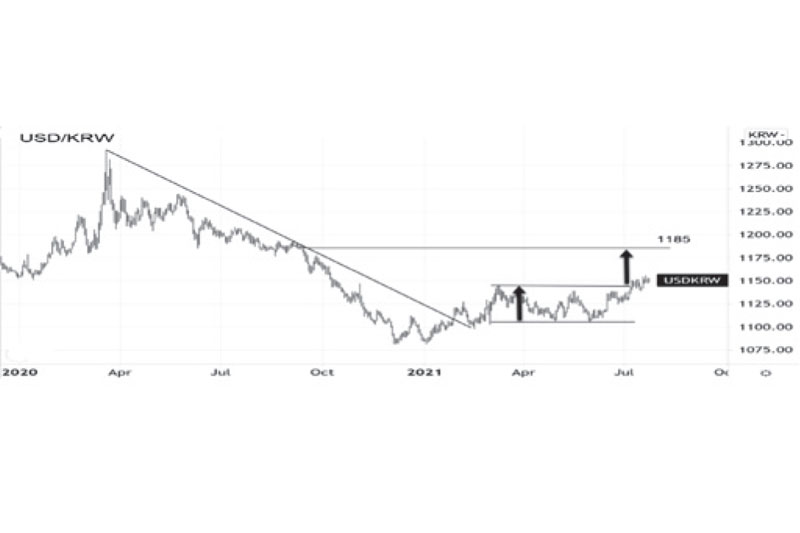

Korean won

Unlike the Thai baht, which has mostly retraced its move from April 2020, the Korean won has given back only 1/3 of the previous move. However, it has weakened 5.90 percent against the dollar year-to-date. Note that USD/KRW broke out of an 11-month downtrend back in January. Chart-wise, the recent break of the 1145 level points to a “measured move” target of 1185.

Source: Tradingview.com, Wealth Securities Research

Malaysian ringgit

The Malaysian ringgit is down 5.13 percent YTD. The USD/MYR broke its 11-month downtrend in February. A three-month ascending flag pattern that started in April, consummated in June. Based on technicals, the break above 4.15 points to a “measured move” towards 4.28.

Source: Tradingview.com, Wealth Securities Research

Delta threat

Recently, a resurgence of COVID-19 in the region due to the more transmissible and virulent Delta variant has caused renewed fears and angst in the populace. In addtion, news of local transmission of the Delta variant sent jitters to our stock market. Fears of a similar surge that happened to our neighbors Indonesia, Thailand, and Malaysia sent the PSE index down 2.6 percent last week.

The US economy now leads the world in terms of resilience and recovery against the COVID-19 pandemic. In fact, the US stock market is making new highs, while Philippine stocks have been dropping. Thus, if he US proceeds with its planned tapering and its economy continues to diverge from the rest of the world, expect the US dollar to stay elevated. And if coutries in Asia continue to fall behind in vaccination and reopening, their respective currencies may weaken further.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending