Loan books shrink further with banks still not lending

MANILA, Philippines — Bank lending disappointed anew in February, exacerbating an unusual slump as lenders stayed wary extending credit while elevated joblessness put them at risk of not getting paid back.

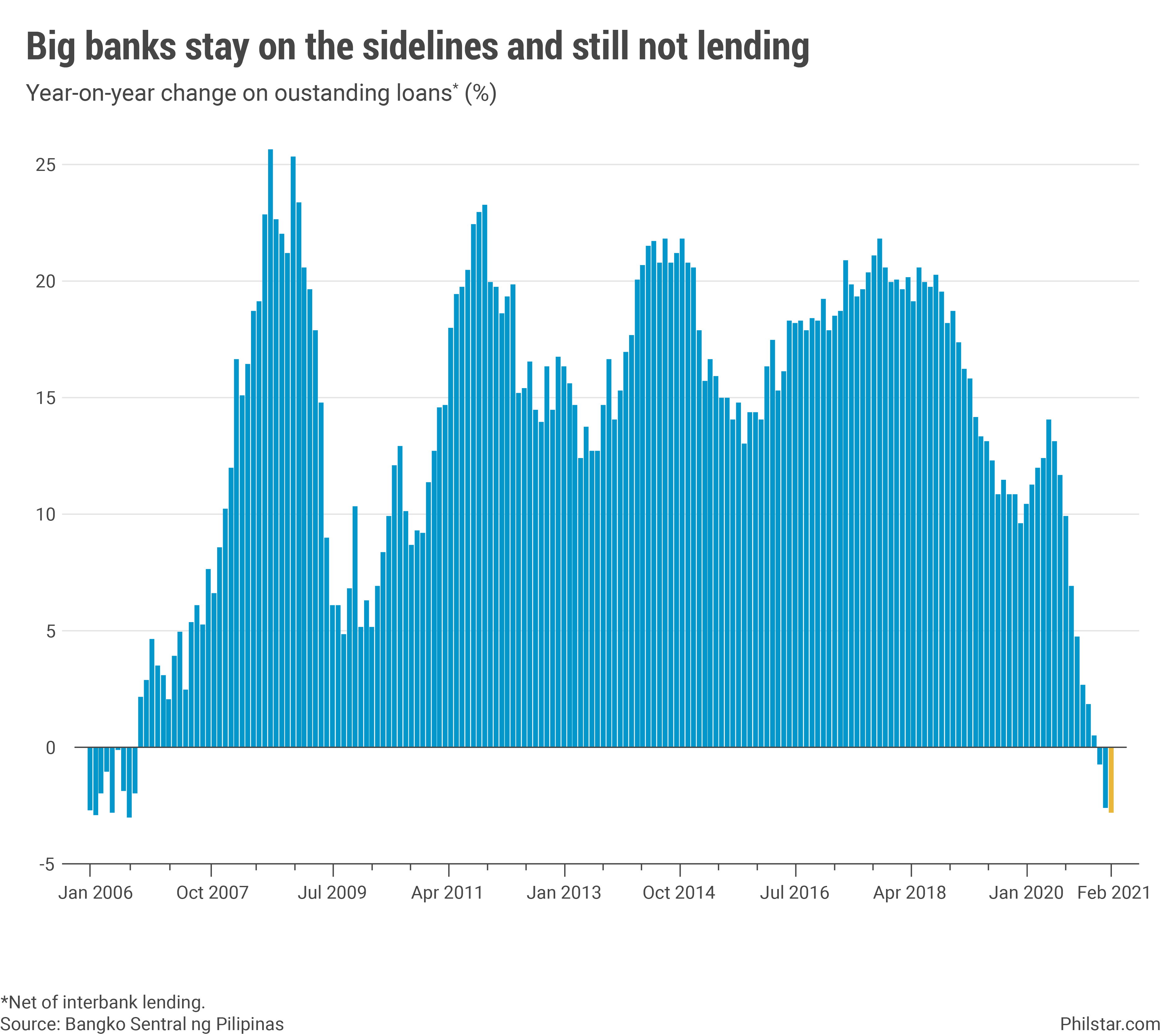

Outstanding loans of big banks, excluding their lending to each other, contracted 2.7% year-on-year, deeper than the revised 2.5% decrease in January, the central bank reported on Wednesday. This marked lending’s worst reading since declining 2.9% in August 2006.

Consumers are the ones losing out the most from banks’ reluctance to lend. Household loans plunged 8.3% from a year ago, worse than the 7.3% dip a month ago which was the first slump on record. To be fair, borrowers themselves are also found to be hesitant to file loan applications over fears of defaulting.

Even bigger production activities and businesses, some of which were shuttered by the pandemic, are not being supported with lending to this segment inching down 1.3% year-on-year. A roll back to tighter lockdowns that saw some loan offices of banks close down only meant the bottom has not been reached.

A key constraint is the worry that with people getting laid off, loans will be left unpaid in the balance sheet of an otherwise healthy banking system. This is especially true for larger real estate loans, which Fitch Ratings, a debt watcher, assessed to have growing risk of default from developers unable to pay for credit used for their building because of weak demand and falling property prices.

“Fitch Ratings believes that rated Philippine banks are able to withstand moderate stress in the property market, and many large real estate developers boosted their liquidity in 2020 to help weather the COVID-19 crisis,” Fitch said in a separate report.

“Nevertheless, protracted economic weakness could expose the banks to lumpy impairments and diminish their loss-absorption buffers – given their high large-borrower concentration and the strong correlation of the property sector to the broader economy,” it added.

The central bank has tried so hard to convince banks to lend by lowering the benchmark rate where funds they borrow from the Bangko Sentral ng Pilipinas (BSP) are charged. In exchange, BSP was hoping lenders would extend the same benefit to its customers, only to be blunted by tepid consumer confidence and a bleak economic outlook.

In total, BSP has aggressively cut policy rates by 200 basis points last year to a record-low of 2%, augmenting that by a commensurate decrease in mandated reserves. This, in turn, helped boost money supply by 9.4% year-on-year in February, faster than January’s 8.9%, although instead of loans, government spending and borrowing facilitated the increase.

“The BSP is prepared to take immediate measures as appropriate to ensure ample liquidity and credit in the financial system, consistent with its price and financial stability objectives,” the central bank said.

- Latest

- Trending