The Philippines, best house in a sliding neighborhood

When China surprised the markets with the devaluation of the Chinese yuan on Aug. 11, .sharp declines in the Indonesian rupiah, Malaysian ringgit, Singapore dollar, as well as in regional equities markets brought back fears of contagion and memories of the 1997 Asian Currency Crisis. Many investors fear the yuan’s devaluation appears to be “the spark that will spread the fire” just like what the Thai baht did when it devalued against the dollar 18 years ago (see Contagion, Aug. 24).

1997 Asian Currency Crisis redux

In the early 1990s, short-term foreign capital looking for higher returns found its way into emerging Asian economies. The easy credit environment coupled with inadequate financial supervision eventually led to excessive investments in real estate triggering property bubbles. When the bubbles burst, it resulted in a massive non-performing loan (NPL) problem which led to a number of bank and corporate failures.

Asian countries which acquired a burden of dollar-denominated debt, especially those with currencies pegged to the dollar, succumbed to the pressure. The Asean-4 (Thailand, Indonesia, Philippines and Malaysia) grew their foreign debt to GDP ratios from 100 percent to as much as 180 percent at the height of the crisis.

These Asean-4 countries, together with South Korea, were the countries most affected by the crisis as panic among lenders led to large withdrawal of credit which caused a credit crunch. This triggered currency devaluations and recessions across much of the region.

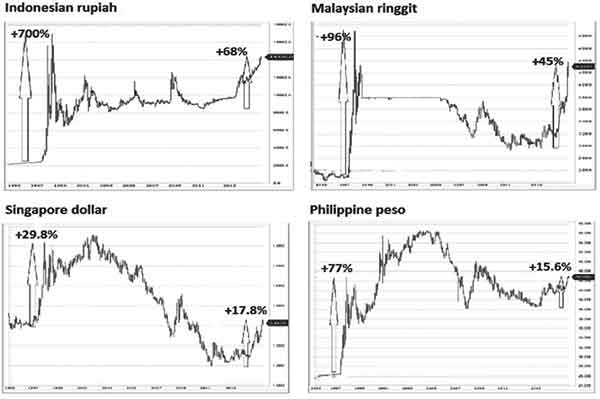

Source: Investing.com, Wealth Securities Research

Indonesian rupiah – back to 1997 Asian crisis levels

The Indonesian rupiah lost as much as 700 percent when the exchange rate hit 16,950 at the height of the 1997 Asian currency crisis. The rupiah’s woes were compounded by a political crisis which ultimately led to the ouster of President Suharto in May 1998.

Today, the rupiah’s 68 percent weakening against the US dollar pales in comparison with the 700 percent move in 1997-98. However, the rupiah is now back at the 1997 crisis the levels.

The Indonesian economy which rely greatly on commodity exports has suffered from plunging commodity prices and the slowdown of China. Moreover, it continues to have a current account deficit which the Bank of Indonesia expects to amount to three percent of GDP this year.

Malaysian ringgit – above the 1998 peg of 3.80

After the Thai baht’s devaluation in 1997, the Malaysian ringgit was heavily traded among speculators, leading the Malaysian government to peg the rinngit to the US dollar. A war of words ensued between then Malaysian Prime Minister Mahathir and George Soros with the former PM calling Soros and other currency speculators “unscrupulous profiteers” while Soros called Mahathir a “menace” to Malaysia. The ringgit dropped as much as 96 percent during the height of the 1997 Asian currency crisis.

During the past couple of years, the ringgit has declined 45 percent against the US dollar. But what is important to note is that it is now back above the 1998 peg and is almost at historic lows.

Like Indonesia, Malaysia is a nation rich in natural resources which has suffered in recent years from low commodity prices. Additionally, the 1MDB corruption scandal involving current PM Najib Razak has put further strains on its currency.

Singapore dollar – no longer a bastion of stability

When the 1997 Asian crisis spread throughout Southeast Asia from Thailand, Indonesia, Malaysia and the Philippines, Singapore was not spared. It suffered a mild and short recession which was credited to the active management of the government. The Singapore dollar’s depreciation was relatively milder compared to its Asean counterparts, declining by as much as 29.8 percent at the height of the crisis.

The Singapore dollar is supposed to be a bastion of stability, but it finally capitulated when the yuan devalued last Aug. 11 because its biggest trade partner and top export destination is China. Since topping out against the US dollar in 2011, it has given back as much as 17.8 percent against the greenback, although much of the move was made after the yuan devaluation.

Morgan Stanley included the Singapore dollar as part of its “Troubled 10” list because of its high export exposure to China.

Philippine peso – dragged down by contagion

In the case of the peso, it dropped as much as 77 percent at the height of the 1997 Asian financial crisis when it reached 46.79 to the dollar. Unlike its Asean counterparts which started to recover by 1999-2000, the peso continued to depreciate to 56.50 vs. the dollar after the country fell into political crisis in 2001 and a fiscal crisis in 2004.

Today, the peso continues to be one of the strongest currencies in the world. Even so, the peso has not been immune to the recent currency turmoil. We believe the Philippines has been dragged down by the general strength of the US dollar and by the contagion in emerging market and Asean currencies. Please refer to our book, Opportunity of a Lifetime, Chapter 7 – The Peso Tops Out.

With the Chinese yuan and the Singapore dollar yielding to the dollar, the peso has no choice but to adjust and re-align itself with the global “dollar strengthening” trend. Since topping out in 2013, the peso has weakened by 15.6 percent against the US dollar.

1997 vs. 2015

While the 1997 and 2015 markets situations are comparable in the sense there were sharp depreciations among regional currencies and declines in the equities markets, the underlying conditions are very different from 1997 and also diverse from country to country.

In the case of the Philippines, we now enjoy current account surpluses compared to deficits back in the 1990s. The country’s FX reserves now stands at $80 billion as of August 2015 which is about 8x what we had back in 1997. This is now equivalent to 10-11 months of import cover compared to two to three months of import cover in 1997. FX reserves now covers 6.3x short-term external debt. In addition, our external debt to GDP ratio has fallen from a high of 68.6 percent in 2003 to 26 percent as of May.

This time around, the Philippine economy has stronger current account balances, fiscal positions and foreign exchange reserves to provide the peso a buffer against turbulence in external conditions.

Best house in a sliding neighborhood

The Philippines is in a totally different situation since our economy is more of domestic consumption-based as opposed to the export-driven and commodity-based economies now suffering from a global economic slump and China slowdown.

Our economy is also underpinned by OFW remittances and BPO revenues which boost our current account balance and provide the country with additional FX reserves. Also, the Philippine presidency is not tainted with corruption, unlike Malaysia and Brazil.

In addition, Washington Sycip noted in our board meeting last Saturday we have a well-respected, honest and competent central bank that can manage the situation better.

We believe the Philippine equities market and the peso will slide less than most other emerging markets because of its totally different fundamentals. We also believe that if the US dollar strength reverses course or if the Chinese yuan and other EM currencies stabilize, Philippine equities and the peso will be one of the first to recover.

For all we know the US dollar may reverse after a Fed rate hike (typical of sell on news).

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending