It’s the strong dollar, stupid! – Part 2

Many have been asking these questions recently. Why is the peso weak? Why is the peso back at the 45 level vs. the US dollar (even reaching an intraday low of 45.267 last week) when just two months ago it was threatening to break below 43?

The answer: THE STRONG US DOLLAR.

The US dollar index is currently up eight percent year-to-date after registering a record 12 consecutive weekly gains. The US dollar index has climbed to a four-year high last week and is on track for its best yearly gain in nine years.

Dollar strength, not peso weakness

Since last year, we have written several articles about the resurgence of the dollar (The Peso Tops Out, May 27, 2013) and (It’s the Strong Dollar, Stupid, June 24, 2013). While we don’t see any change in the fundamental underpinnings of the peso, the inherent strength of the US dollar is causing the peso to depreciate along with other currencies.

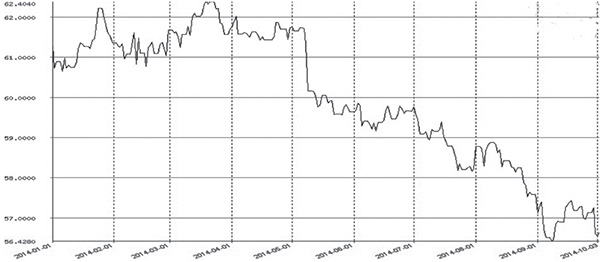

Peso vs. the euro

Since most people only monitor the peso-dollar rate, many are not aware of what is happening to the peso relative other currencies. Below is euro-peso chart. As you can see, the peso has appreciated 7.6 percent against the euro from 61.20 to 56.43 in less than a year.

Euro – Peso rate (January 2014 to present)

Source: www.fxtop.com

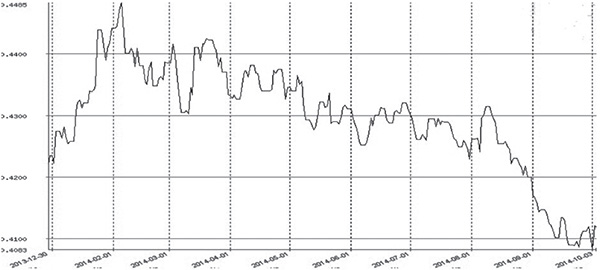

Peso vs. the Japanese yen

Meanwhile, a look at the peso-yen chart shows the peso gaining by 2.7 percent from 0.422 to 0.413 year-to-date.

Yen – Peso rate (January 2014 to present)

Source: www.fxtop.com

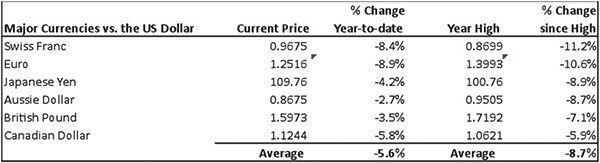

Major currencies vs. US dollar

Among the major currencies, the Swiss Franc has depreciated the most since recording its year high, down 11.2 percent vs. the US dollar. The 2nd and 3rd worst performers were the euro and the yen which are down 10.6 percent and 8.9 percent from their year highs, respectively.

On the average, major currencies have weakened 8.7 percent from their highs and are down an average of 5.6 percent year-to-date vis-a-vis the US dollar.

Source: Bloomberg, Wealth Securities Research

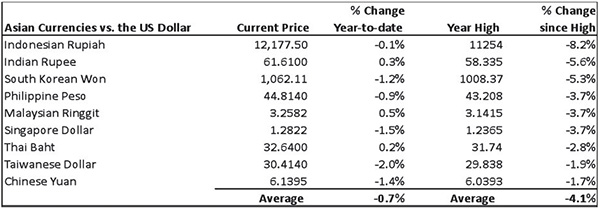

Asian currencies vs. US dollar

Asian currencies were also down against the US dollar with an average of 4.1 percent drop from their highs. The Indonesian rupiah has weakened the most because of recent political problems. Meanwhile, the peso is in the middle of the pack with a 3.7% decline from its year high as can be seen from the table below.

On the other hand, Asian currencies were basically unchanged on a year-to-date basis, declining by only 0.7 percent vs. the greenback.

Source: Bloomberg, Wealth Securities Research

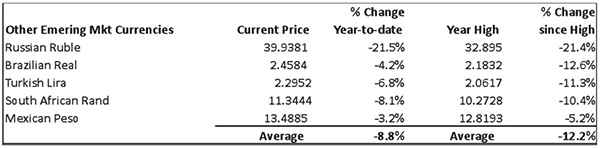

Other emerging Mkt currencies vs. US dollar

Other emerging market countries continue to have their own set of domestic problems, causing their respective currencies to underperform. Note that the Russian ruble is down a huge 21 percent because of economic sanctions brought about by the Ukraine crisis.

Source: Bloomberg, Wealth Securities Research

Peso near strong support at 45 – 45.50

While the US dollar continues to be strong, we must not lose sight of the fact that we are near very strong support for the euro at 120 which was the low in 2010 and 2012. Global central banks may start to react if the US dollar becomes too strong as it may become counter-productive to the world economy.

Similarly, the peso is also near strong support at the 45 to 45.50 levels which were the lows last year. What’s more important for the peso, however, is the absence of indiscriminate selling of emerging market assets and currencies last year which led to the sharp drop of the peso. It appears that investors have now learned to separate wheat from the chaff.

For further stock market research and to view our previous articles, please visit our online trading platform at www.wealthsec.com or call 634-5038. Our archived articles can also be viewed at www.philequity.net.

- Latest

- Trending