Adapt or perish

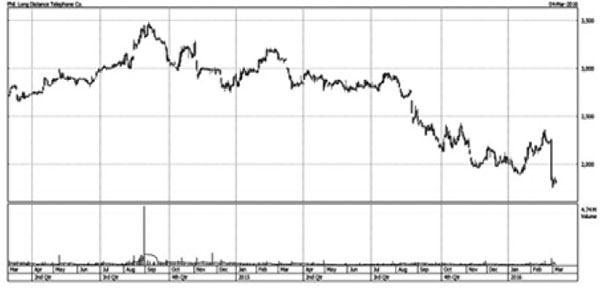

Exactly a week ago, Feb. 29, PLDT’s share price fell from P2,228 to P1,830 – a whopping 18 percent drop in a single day. This is PLDT’s largest percentage loss since 1987. On that day, P86 billion was wiped out from the company’s market capitalization. As of last Friday’s close, PLDT had shed 48 percent from its all-time high of P3,486. See below a chart showing PLDT’s descent from the high set in 2014.

PLDT price chart – two years

95 out of 100

On the day of PLDT’s momentous price drop, the index fell from 6,771 to 6,671, a 100-point decline. Looking at all the components of the index, the plunge was primarily due to PLDT. Being the 2nd biggest index component, PLDT accounted for 95 out of the 100 points the index lost that day. In fact, when the dust settled last week, PLDT had slid down to #3 in the PSE index in terms of market capitalization.

Analysts stunned

The reason behind PLDT’s historic price drop can be traced to the company’s earnings briefing on the same day. During the said briefing, it was reported PLDT failed to make a profit in the last quarter of 2015, its first quarterly loss in more than 12 years. However, excluding one-off items, core net income still managed to meet analyst expectations.

What eventually led to the record-breaking fall was PLDT chairman Manuel Pangilinan’s guidance for 2016. Given a more competitive environment and the company’s transition from legacy to digital, MVP announced that its 2016 core net income would be around P28 billion. This stunned the analysts who were present, since consensus was forecasting P34 billion for the year. Coincidentally, company guidance was 18 percent off consensus estimates, which is identical to PLDT’s share price drop that day.

Resetting the dial

Over the course of civilization, our mode of communication has been constantly evolving. In our quest to communicate with one another, mankind has resorted to delivering messages through hand-delivered letters, carrier pigeons, post office deliveries, landline telephones, pagers, cellular phones, SMS messaging through mobile phones, email, and smart phones with their many apps (Facetime, Viber, Skype, Whatsapp, Twitter, etc.).

As such, companies have to adapt when technology evolves, lest they be rendered obsolete. Imagine what would have happened to Globe if they just stuck with telex instead of moving toward telephone communication. Examples of companies that failed to adapt to changing technologies are Nokia and Blackberry. These two corporations used to be market leaders in the mobile phone industry. By sticking to mobile phones and failing to ride the smartphone wave, both stocks are now trading more than 90 percent below their all-time highs. MVP is surely aware of what happened to companies that failed to adapt to changing times. In a statement to reporters, MVP said that they “really need to reset the dial of the company.”

Darwin’s Theory of Evolution

Recognizing Globe’s push toward the digital age and its thrust to regain market share, PLDT is embarking on an aggressive transformation program. However, drastic change is rarely painless. MVP expects it will take three years before PLDT sees a turnaround in its earnings. With no time to waste, MVP and PLDT’s management are approaching this very carefully and decisively. Just as Charles Darwin posited in his theory of evolution, PLDT has to adapt – or perish.

Stock market strong despite PLDT’s horrendous drop

Last Monday, when PLDT fell 18 percent, the PSEi lost 1.5 percent. With global markets on much better footing, it looked like PLDT was going to spoil the party. But lo and behold, the PSEi rose 4.7 percent over just three days, bringing us to 6,988.68, just a dozen points shy of the 7,000-mark. This goes to show that despite PLDT’s horrendous drop, the rest of the market was still very strong. The PSEi even saw net inflows of P1.4 billion last week despite foreign selling of TEL. In fact, if it were not for PLDT’s drop, the PSEi would be trading close to the 7,100-level.

A recovery, not a bear market bounce

After record-breaking stock market declines in the first few weeks of January, many market pundits and analysts have pronounced the arrival of a bear market. In fact, they forecast the market to hit 5,600 and advised people to sell on rallies because they believe that any rise in stock prices are just dead cat bounces. Two weeks ago, we wrote in an article that given the strong upmove in stock prices, we are witnessing a recovery, not just a bear market bounce (see The Bounce, 22 February 2016). Not only is the PSEi up 13 percent from its bottom this year, but it is also on the verge of erasing all its YTD losses.

Peso appreciates sharply

Last week, the peso staged a similar move, ending the week at 46.92. It is practically flat for the year after hitting a low of P48.06 to the dollar. Moreover, it broke the 47.50 and 47 levels in quick succession, a very bullish sign. It is also important to note that this strength is not just limited to the peso. In fact, other emerging market (EM) currencies have gained ground against the dollar as well. This indicates a reversal in dollar strength, or at least a pause. This augurs well for global stock markets, commodities and EM currencies.

PSEi has reached bottom

This strength in the peso and in equities further reinforces the view that we presented during our January 30 briefing and which we reiterated in the past few Philequity Corner articles. Though our stock market will experience bouts of corrections or consolidation as we near resistance levels, we believe the PSEi has reached bottom at 6,084.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending