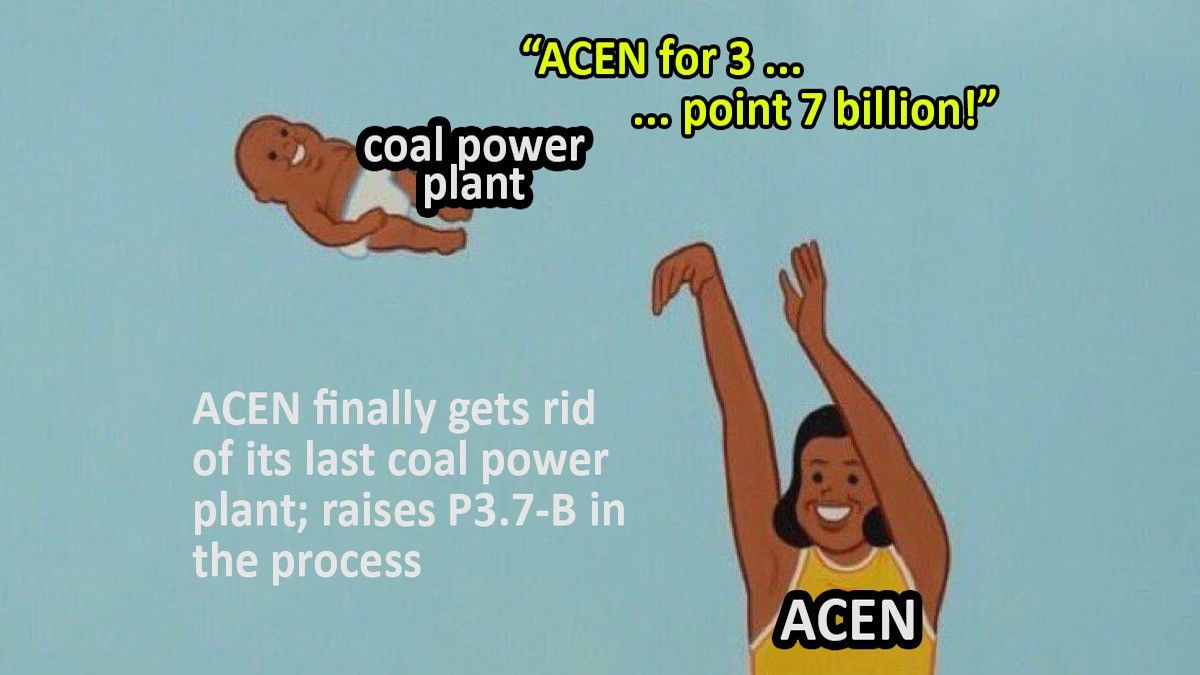

ACEN gets P3.2-B cash bump by selling coal plant shares

ACEN Corp [ACEN 6.09 1.50%] [link], the power generation arm of the Zobel Family’s group of companies, disclosed that its subsidiary, South Luzon Thermal Energy Corporation (SLTEC), will redeem 32 million SLTEC preferred shares owned by ACEN for a total redemption price of P3.2 billion.

ACEN said that the redemption would “enable the return of capital to ACEN”, which ACEN plans to deploy into “new renewable energy investments”.

The disclosure indicated that there are still 3,830,250 SLTEC preferred shares, worth P383 million, that have not yet been redeemed, but that redemption is expected to close by “end-2022”.

MB BOTTOM-LINE

The redemption was facilitated by the Energy Transition Mechanism (ETM), created by the Asian Development Bank.

At a high level, the ETM is a special corporation that is formed and cashed up using institutional investment funds, which is then deployed to encourage early retirement of coal-fired power plants.

The ETM will navigate SLTEC to early retirement in 2040, which ACEN says is 15 years before its originally-planned “end-of-life” date in 2055.

For its part, ACEN gets the dirty coal power plant off of its books through an orderly exit that provides nearly P4 billion in cash that it will spend on renewable energy projects that it was planning to build anyway.

This is a win-win, and infinitely better than SLTEC being acquired by some third party and operated at full blast until 2055.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest