Quick takes from around the market

VistaREIT [VREIT 2.50 pre-SEC] [link] REIT Plan projects a 5.6% dividend yield for 2022 and a 6.4% dividend yeild in 2023 based on the current P2.50/share offer price. That projected yield puts VREIT in a no-man’s land between the RL Commercial REIT [RCR 7.39 0.14%] and Megaworld REIT [MREIT 18.68 1.37%] 5% yield zone, and the Filinvest REIT [FILRT 7.30 1.96%] 6-ish% zone. As we saw with Citicore Energy REIT [CREIT 2.67 0.37%], a yield closer to 7% drives an awful lot of IPO interest. It will be interesting to see how VREIT prices this offering. Will Manny Villar give us some upside?

AC Enexor [ACEX 17.50 2.10%] [link] board approves application for shelf registration for the sale of common shares through a follow-on offering, a private placement with its parent company, AC Energy [ACEN 8.38 0.96%], and a later stock rights offering. ACEX has about 250 million shares outstanding, so the shelf registration to sell about 650 million more shares is very significant. If granted, ACEX will have the ability to make these sales over the next three years.

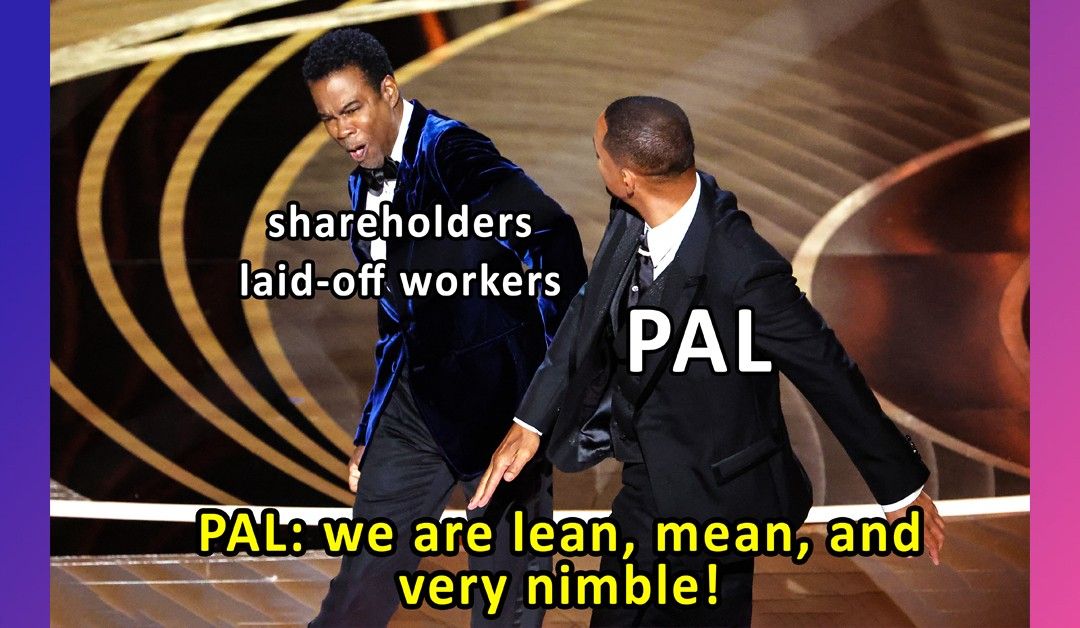

Philippine Airlines [PAL 6.61 9.26%] [link] VP refers to bankrupted airline as “streamlined to fit the new norrmal”, but still “full-service”. The article calls PAL “[l]ean, mean, but also very nimble”, which is pretty rich to say about the geriatric airline that went bankrupt last year, was able to negotiate sweetheart adjustments to its airplane lease terms, and was able to shed debts in exchange for more of Lucio Tan’s money. Most of those lease terms revert to the old, not-sweetheart, terms in 2023. What happens then? Feels kind of tasteless to hype these attributes that were gained by absolutely nuking shareholder value and laying off thousands of workers. I get it, that’s capitalism, but they haven’t even put out a quarterly report yet and their stock just started trading for the first time since June of 2021.

Jollibee [JFC 219.80 2.71%] [link] FY21 up 152% to P5.98 billion. JFC already reported its annual earnings, but disclosed that its audit determined its net income was actually 0.67% higher than it originally reported in its earnings teaser.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest