OFW savers declining in last 14 years

The number of overseas Filipino workers (OFWs) who save amounts from their foreign remittance incomes has been plummeting for the last 14 years, according to the data of an annual government survey.

This trend came from the annual Survey on Overseas Filipinos (SOF) of the Philippine Statistics Authority (PSA), which had been publicly releasing data on the number of OFWs who save since 2009.

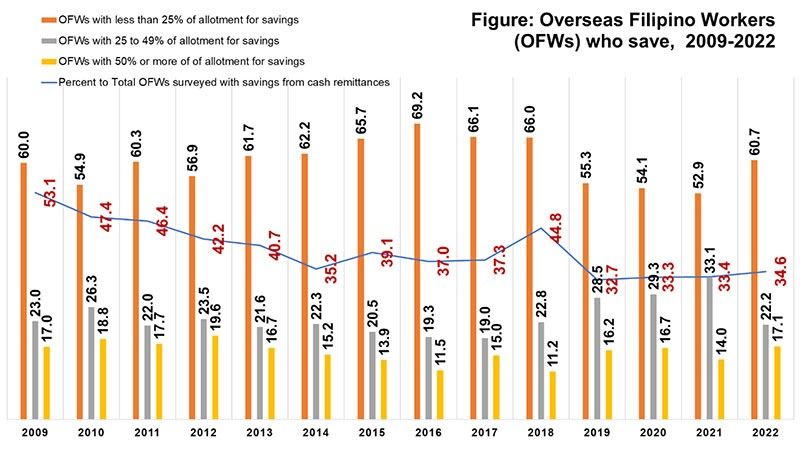

A year before COVID-19, the number of OFW savers went to its historic lowest at 32.7%. The last three pandemic years only saw marginal increases in the number of savers, reaching to 34.6% in 2022.

That four-year plateau all but sealed the downward trend on the number of OFW savers as per SOF data. OFW savers reached a high 53.1% in 2009, or after the 2007-2008 global economic crisis.

It was also in the last two decades that the Bangko Sentral ng Pilipinas (BSP), financial institutions and non-government organizations for OFWs have rolled out numerous financial literacy campaigns and savings, insurance and investment products and services tailored for OFWs and their families.

The Philippine Development Plans (PDPs) of former Presidents Benigno Aquino III and Rodrigo Duterte, and of current President Ferdinand Marcos Jr., have all mandated the launch of financial education and savings and investment products for the OFW market.

Even two rounds of the BSP’s National Strategy for Financial Inclusion (NFSI), a masterplan to make Filipinos open at least a savings account in order to save and invest, carried OFWs as target beneficiaries.

The diminishing number of total OFW savers “is definitely a concern,” said Ateneo de Manila University economist Dr. Maire Carroline Magante. This concern is given the Philippines’ reliance on foreign remittances and how “the influx of these remittances stimulates consumption locally, which has multiplier effects,” Magante added.

OFW money during the pandemic

The COVID-19 pandemic saw the return of over-2.2 million OFWs up until year two of the Philippines’ mandating of the first lockdown on March 16, 2020. Many of these returnees brought whatever savings they had accumulated from abroad, but were stuck at home given border closures and travel restrictions.

Surprisingly, cash remittances from overseas Filipinos in 2020 only had a 0.76% reduction year-on-year (US$29.9 billion versus US$30.1 billion). Then Filipinos abroad sent more money in 2021 (US$31.4 billion) and 2022 (US$32.5 billion), both historic highs according to BSP data.

But the COVID-19 pandemic stymied the savings habit of OFWs, including returnees. A 2021 survey of 8,332 returnee OFWs by the International Organization for Migration (IOM) showed that their return migration led to “lost remittances”, with nearly half of surveyed returnees claiming to have lost more than 60 percent of their household income.

A newer IOM survey two years after (of 1,244 returnees) showed that some 27.5% of surveyed returnees opened business ventures while some 30.3% got employed back home. Of the 27.5% of surveyed returnees who became self-employed, three-fourths of them (76%) used their savings from previous overseas work as capital.

Savings from previous overseas work, the 2023 IOM report finds, were also used as a source of household funds during the past year.

“Contrary to perceptions of low savings among OFWs, (they) have savings and that they are putting them to use during the pandemic,” the IOM’s Returning During the Pandemic report wrote..

A BSP report on the country’s flow of funds (year 2020) confirmed the overall decline of savings and real investments during the first year of COVID-19. Filipino households recorded a lower gross savings amounting to P983.2 billion in 2020, compared to P1.1 trillion in 2019.

“The decline in the (household) sector’s saving,” said BSP, “was due to the adverse effects of the pandemic on domestic and global labor market conditions as reflected through higher unemployment rates and low inflows of overseas Filipinos’ personal remittances.”

Reintegrating, ‘re-deploying’ OFWs

Since 2022, many host countries of foreign workers have re-opened their labor markets. The situation has led to some 1.2 million newhire and rehired OFWs deployed last year, based from the data of the Department of Migrant Workers (DMW).

The 2022 OFW deployment figure is a nearly 100-percent rise from the over-675,000 number in 2021. But both numbers still fall below the 2.2 million OFW returnees tabbed by government authorities during the first two years of the pandemic.

The droves of return migration prompted the Philippine government to pivot its policy efforts to migrant workers’ reintegration through cash grants, livelihood loans and psychosocial support services.

On its first fully-funded year as a government agency, DMW launched this year a six-pronged program for migrant reintegration.

This “sustainable reintegration” framework of DMW, said Assistant Secretary Venecio Legaspi, covers a skills inventory for returnees; databanking and monitoring reintegration programs; skills and business development services; a savings fund and a menu of investment options; an e-commerce platform for OFW entrepreneurs; and partnerships with private sector and NGOs.

But since some of these few OFW savers will retire at home and will confront current-day price increases for commodities, Magante thinks the post-pandemic return of OFWs “could possibly generate a massive welfare provision problem”.

The 14-year SOF dataset showed that at least half of OFW savers save less than a fourth of their remittances. Meanwhile, those who save at least half of their foreign remittance incomes hovered to around 11-to-17 percent in the last 14 years.

The SOF covers April to September annually, and is a rider to the October round of the now-monthly Labor Force Survey (LFS).

BSP just celebrated a national economic and financial literacy week from November 6 to 10.

Jeremaiah M. Opiniano is a reporter and co-founder of the Overseas Filipino Workers Journalism Consortium (OFWJC), a nonprofit news group covering the Philippines’ overseas migrants.

- Latest

- Trending