Separate entity eyed to absorb record bad loans seen from coronavirus

MANILA, Philippines — Soured bank loans are seen to hit their highest level in comparable record this year, prompting regulators and legislators to study the establishment of a separate entity where lenders can unload their bad assets and keep their healthy standing.

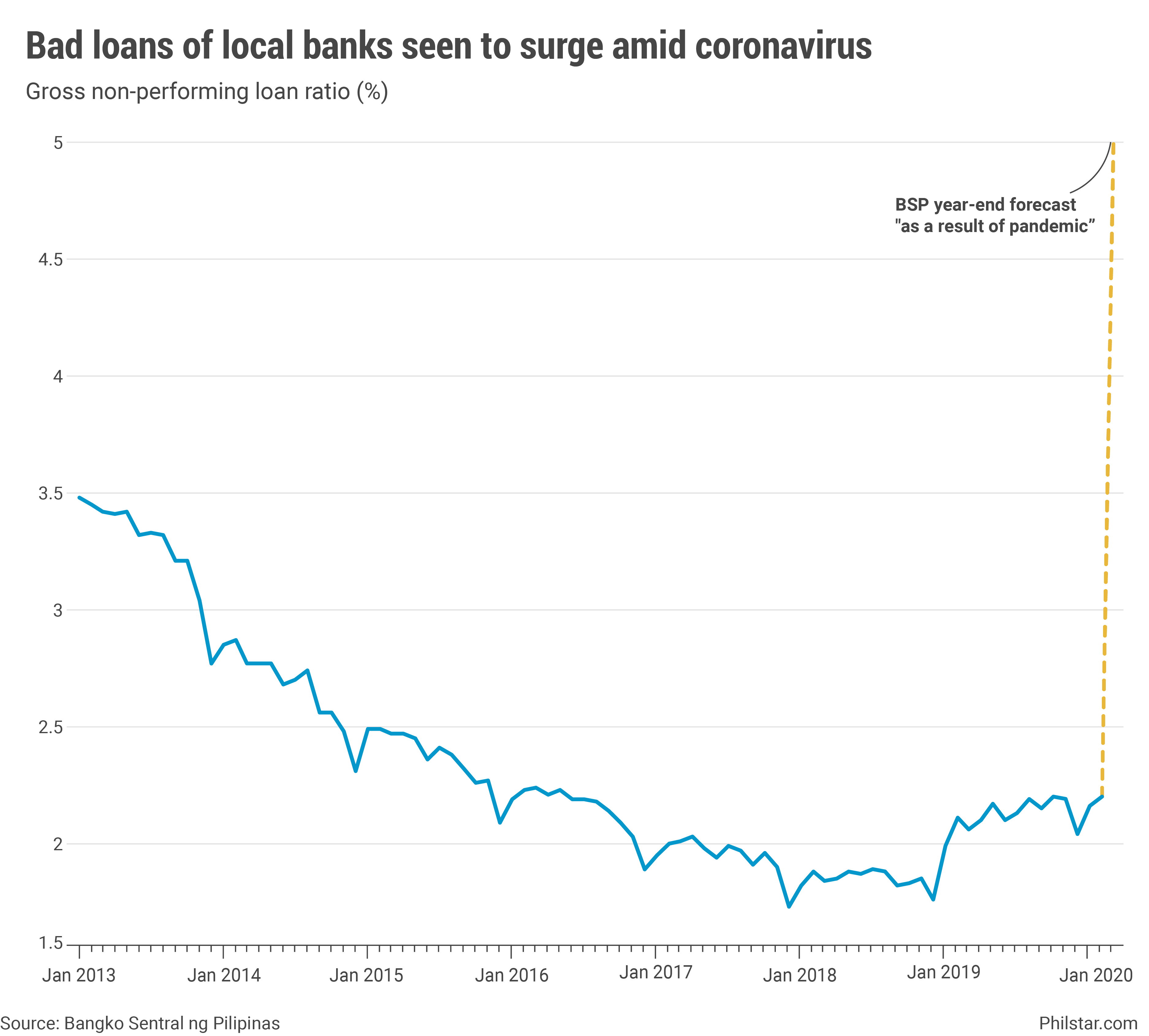

Gross non-performing loans (NPL), or bank credit which remain unpaid for 30 days past due, “might go up to 5%” of total loans this year from just 2.2% in February, Bangko Sentral ng Pilipinas (BSP) Governor Benjamin Diokno said in a text message on Monday.

If realized, the NPL ratio would be the highest on comparable record since 2013 when central bank made methodological changes on measuring bad loans.

Local lenders have been setting aside resources to cover for an expected surge in bad loans as borrowers remain stuck at home, unable to pay their dues. Companies getting shuttered due to the coronavirus outbreak and the lockdowns also mean loan payments may get delayed as a cash crunch hit some firms.

But discussions among industry groups, BSP and Congress are ongoing for a more industry-wide approach. Suzanne Felix, executive director of Chamber of Thrift Banks, said lenders have floated the idea of a special purpose vehicle (SPV) for bad assets before the BSP and lawmakers.

“This will aid in bank debt resolution so that the banks can focus on the business of granting loans,” Felix said in a separate text message.

An SPV is a separate corporate entity established through legislation with a specific task and a limited corporate life. In the Philippines, Congress put up an SPV in 2002 through Republic Act No. 9182 whose job is to sell soured bank assets that otherwise would have tampered with lenders’ books.

To further incentivize asset transfer from banks to SPV, asset disposals were exempted from taxes such as documentary tax and capital gains levies. RA No. 9343 also extended the SPV’s corporate life to November 2007.

With lenders free of bad loans, they were able to free up more credit for lending instead of covering for losses.

Diokno recognized an SPV for bad bank assets has helped lenders gain a stronger footing in the past, but added the situation is entirely different now with a “better capitalized” sector. “Congress should be circumspect and methodical in crafting the new law. It should start by having a clear understanding of the problem, industry by industry,” he said.

Industry-specific assistance?

As it is however, an SPV would come as a crucial reinforcement to lenders eyed by Finance Secretary Carlos Dominguez III to lend and save cash-strapped industries like aviation and hotels, which the government refuses to bailout.

Diokno appears to agree with the government strategy and said discussions with policymakers have also centered on how to craft rescue packages tailor-fitted for different sectors.

“BSP will look at the need for a financial rescue a particular sector from two interrelated questions: does the financial collapse of a particular firm pose a risk to the bank industry? Does it pose a systemic risk to the financial stability?” the governor pointed out.

“The answers to these questions have to be fact-based…The basic data will be based on information provided by individual banks,” he added.

- Latest

- Trending