Upson International FY23 profit: P464-M (down 13.7%)

Upson International [UPSON 43.45 unch] [link], the IT retailer primarily operating through the Octagon retail brand, teased its FY23 financial results headlined by a 13.7% dip in net income to P464 million. UPSON reported a 5.8% increase in revenues to P10 billion, which the company attributed to contributions from new stores, and a 1% increase in same-store sales. This topline uptick was unfortunately outweighed by an 8.9% increase in the cost of inventories sold, contributing to a 9.5% increase in operating expenses. UPSON said that it opened 25 stores in FY23, with 12 of those openings coming in just the 4th quarter alone. UPSON blamed the bottom-line underperformance on “lower gross margin” and “pre-opening costs” from its expansion efforts.

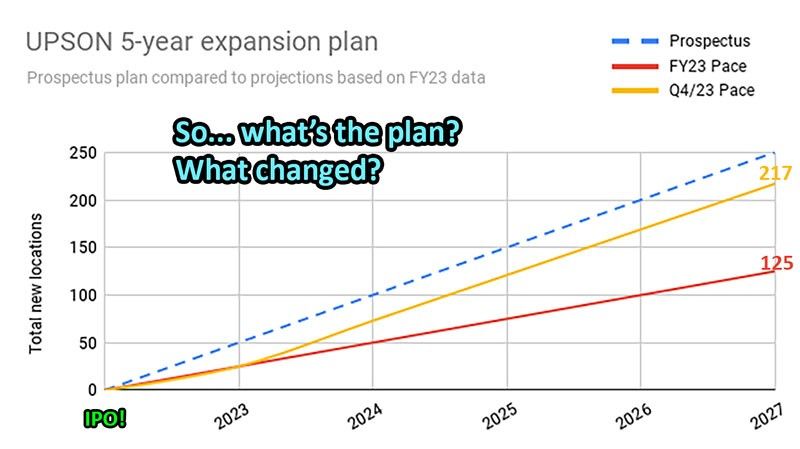

MB bottom-line: I’m going to ignore the financials for now, because (1) they’re not interestingly good or bad and (2) lower margins and lower net income amid aggressive expansion is something that shareholders should probably have expected in a low-margin business like IT retailing. What has drawn my eye, though, is UPSON’s expansion performance relative to its IPO prospectus. Back when UPSON went public in April of 2023, it said that it would open 50 stores that year as part of a 5-year, 250-store expansion drive. According to this press release, UPSON only managed to open 50% of the promised stores for this year, with just under half of those openings stuffed into the final quarter of the year. If we consider the full year, then it underperformed its goal by 50% and we might consider its 5-year plan to be in considerable trouble. The thing that gets me is that it’s even more problematic when we annualize its Q4 performance. At first glance, 12 stores in one quarter seems great compared to 13 over the previous three quarters, until you realize that even if UPSON had performed at its Q4 rate through the whole year it still would have only opened 48 stores and missed its goal. As a company that just sold this plan to the public, I was expecting to hear more about what it learned from its FY23 expansion results and how we as investors should contextualize its performance to the projections it pitched during the IPO offer period.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest