PayMaya propels MSMEs with best-in-class payment platforms

MANILA, Philippines — From sari-sari stores to online businesses - micro, small, and medium-sized enterprises (MSME) are embracing digital technologies to recover from the effects of the pandemic.

Empowering this shift is PayMaya, the country's leading financial technology company enabling MSMEs with digital payment acceptance solutions that are at par with the platforms utilized by big corporations.

Today, MSMEs can accept QR and any card payments in their physical stores, websites, social media channels and even via messaging apps like Viber and Facebook Messenger, with the help of PayMaya's solutions.

"As consumers go digital, so do businesses. With the steady reopening of the economy, we provide our MSMEs with the same best-in-class digital payment capabilities as larger companies," said Shailesh Baidwan, president of PayMaya.

"With PayMaya's solutions, sari-sari stores can now accept QR payments, just like the biggest supermarkets in the country. Small online stores can accept card and e-wallet payments, in the same way that the biggest e-commerce websites do," he added.

PayMaya has already seen an upward trend of MSMEs embracing digital payment acceptance solutions. The number of MSMEs empowered by PayMaya with its digital payment solutions in March 2021 grew by more than 3,000% compared to the same period last year.

Powering digital sari-sari stores

Among the entrepreneurs utilizing cashless solutions for their small businesses is Roald Casildo, co-owner of a sari-sari store in Pasig City. He uses PayMaya Negosyo to accept contactless payments via QR and bank transfer.

Apart from enabling digital payment acceptance, this platform also empowers him with "extra kita" services like bills payment, remittances, and selling telco load to their customers.

"Ang main advantage para sa'min ng pag-accept ng QR payments ay mas convenient ito compared sa cash. 'Di na kami kailangang magbigay ng sukli dahil sakto na ang bayad 'pag QR. Noong magkaroon ng lockdown, nagsimula rin kaming mag-accept ng orders via Viber at FB Messenger, at madali silang nakakapagbayad gamit ang bank or e-wallet transfer, at QR," he said.

(The main advantage of accepting QR payments is it is more convenient compared to cash. We need not handle loose change as transactions are in exact amounts via QR. When the lockdowns happened, we also started to accept orders via Viber and FB Messenger, and our customers are easily able to pay for their purchases via bank or e-wallet transfers, as well as via QR.)

"Community-based entrepreneurs like Roald are important to the economic recovery of the Philippines. It is the reason we aim to turn every sari-sari store in the Philippines into full-fledged digital sari-sari stores through our inclusive digital financial services platforms," said Baidwan.

Soon, Roald will also be able to accept QR payments from other banks and e-wallets with the roll-out of the QR Ph for merchants, the national quick response (QR) code standard for consumer-to-business payments launched recently by the Bangko Sentral ng Pilipinas (BSP). PayMaya is the first fintech firm to adopt it.

Enabling offline-to-online cashless convenience

Meanwhile, Mimi & Bros Restaurant owner Chef Ed Bugia also turned to PayMaya QR to offer his customers a convenient and seamless way to pay for their purchases online and offline.

"At the start of the pandemic, our customers were looking for safer ways to pay. By the second or third month into the lockdown, we were already utilizing PayMaya QR in our physical and online stores to address our shortcomings on the payment side,” he said.

“I knew we had to start early because the more payment options we provide to our customers, the more convenient their transactions will be," he added.

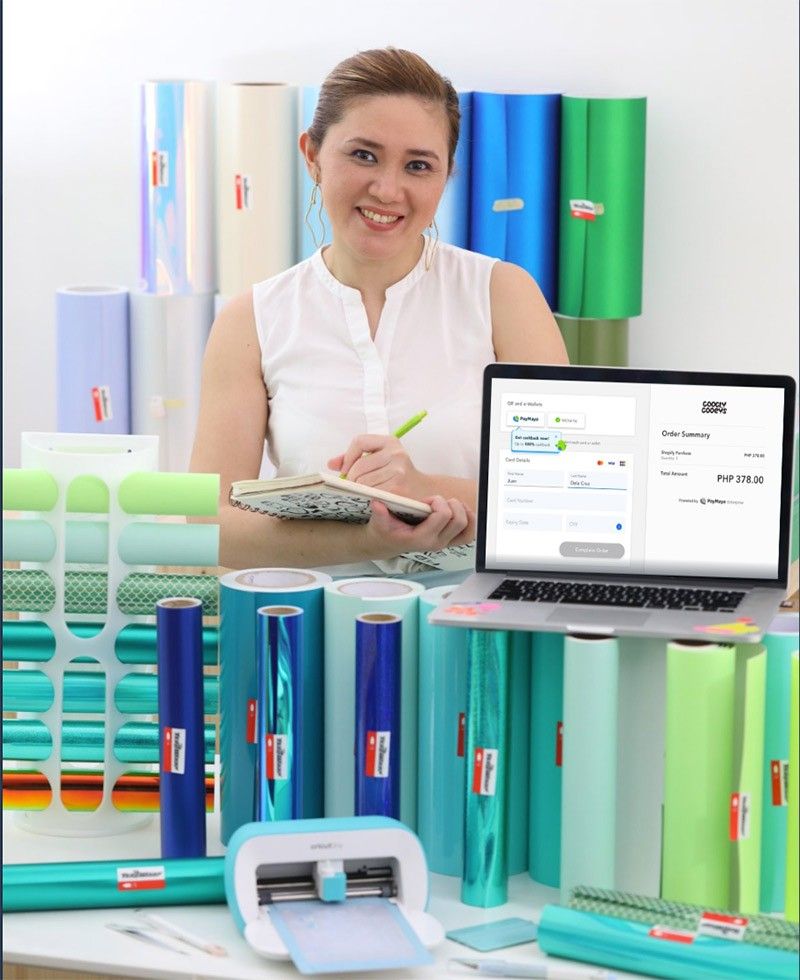

Apart from QR payments, PayMaya also enabled online business owners like multimedia artist Tippy Go of Googly Gooeys, to accept credit, debit, and prepaid card and e-wallet payments on her website through PayMaya Checkout and messaging apps like Viber and Messenger through PayMaya's payment links.

"Almost all of our customers now pay us via cashless means. Our shops are online, and for the safety of our team, we prefer to keep our transactions online via our website and messaging apps," she said.

"This impressive growth on digital payments adoption among consumers and MSMEs is a testament that it is here to stay. MSMEs are the backbone of the Philippine economy, and we will continue to empower them with relevant payment solutions as we all bounce back together towards a Better Normal," said Baidwan.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines, with platforms and services that cut across consumers, merchants, communities, and government.

Through its enterprise business, it is the largest digital payments processor for key industries in the country, including "every day" merchants such as the largest retail, food, gas, and eCommerce merchants, as well as government agencies and units.

PayMaya provides more than 35 million Filipinos with access to financial services through its consumer platforms. Customers can conveniently pay, add money, cash out or remit through its over 250,000 digital touchpoints nationwide.

Its Smart Padala by PayMaya network of over 39,000 partner agent touchpoints nationwide serves as last-mile digital financial hubs in communities, providing the unbanked and underserved access to digital services.

To know more about PayMaya's products and services, visit www.PayMaya.com or follow @PayMayaOfficial on Facebook, Twitter and Instagram.

- Latest