Philippine banks’ assets grow 8.8% to P17.7 Trillion in August

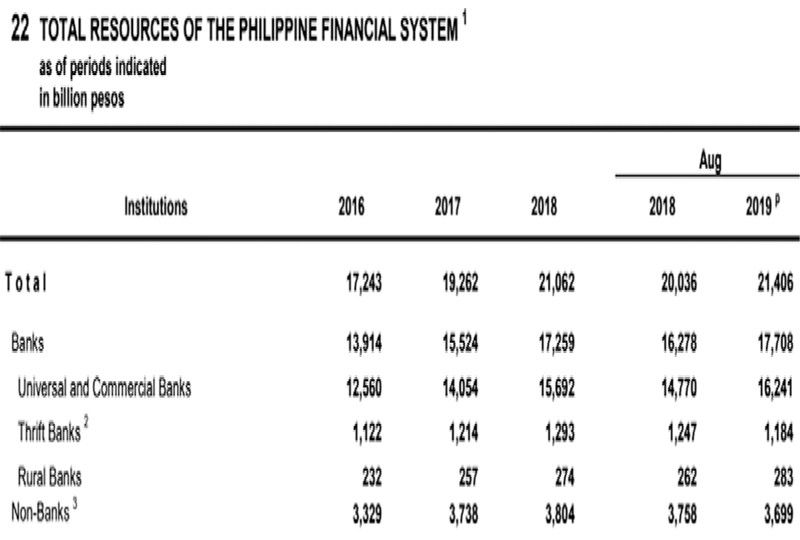

MANILA, Philippines — Total assets of Philippine banks went up by 8.8 percent to P17.71 trillion in end-August this year from P16.28 trillion last year as the country’s banking industry continued to lend support to long-term economic growth and stable financial condition.

Data from the Bangko Sentral ng Pilipinas (BSP) showed assets of big banks or universal and commercial banks booked a double-digit growth of 10 percent to P16.24 trillion from P14.77 trillion, while that of mid-sized banks or thrift banks declined by 5.6 percent to P1.18 trillion from P1.25 trillion.

Likewise, the total resources of small or rural banks went up by eight percent to P283 billion in the first eight months of the year from P262 billion in the same period last year.

BSP Governor Benjamin Diokno said total assets of the banking sector continued to grow.

“The banking sector is sound and stable, helping fuel growth of the economy through credit and other financial services,” Diokno said.

He added capitalization is more than sufficient, with the capital adequacy ratio (CAR) of universal and commercial banks staying at 15.9 percent in June 2019.

This is higher than the BSP’s minimum regulatory requirement of 10 percent and the internationally prescribed floor of eight percent, while exposure to bad debts is minimal, with the non-performing loans (NPL) ratio staying at a mere 1.7 percent in end-August.

The BSP said savings deposits remained the primary sources of funds for the banking.

“Philippine banking system exhibits steady growth in assets and deposits,” the central bank said.

More Filipinos continue to entrust their savings with banks as deposits rose 4.3 percent to P12 trillion in end-August from P11.5 trillion in end-August last year

Peso-denominated deposits inched up by 3.9 percent to P10 trillion in the first eight months of 2019 from P9.6 trillion in the same period last year

On the other hand, foreign currency deposits owned by residents went up by 5.6 percent to P2 trillion in end-August this year from P1.9 trillion in end-August last year.

The country’s banking industry is dominated by BDO Unibank of the family of the late retail and banking magnate Henry Sy, Metropolitan Bank & Trust Co. founded by the late taipan George SK Ty, Ayala-led Bank of the Philippine Islands, Philippine National Bank of airline and tobacco magnate Lucio Tan, and Sy-led China Banking Corp.

- Latest