Government lowers penalties for money laundering

MANILA, Philippines — The Anti-Money Laundering Council (AMLC) has finalized the guidelines slapping lower fines against covered entities including banks violating the anti-money laundering law.

Mel Georgie Racela, executive director of the Anti-Money Laundering Council (AMLC) secretariat, issued AMLC Procedural Issuance A, B and C containing the Rules of Revised Procedure on Administrative Cases (RPAC) under Republic Act 9160 or the Anti-Money Laundering Act (AMLA) of 2001, as amended.

Racela said the issuance covers not only administrative cases against covered persons, but also those against its individual officers, directors, and employees of the covered person.

Covered persons supervised by the Bangko Sentral ng Pilipinas (BSP) includes banks, quasi-banks, trust entities, pawnshops, electronic money issuers, foreign exchange dealers and money changers, while those supervised by the Insurance Commission includes insurance providers, pre-need companies, agents, brokers, professional reinsurers, holding firms, and mutual benefit associations.

Entities supervised by the Securities and Exchange Commission (SEC) covered by the new guidelines include securities dealers, brokers, investment houses, mutual funds, while designated non-financial businesses and professions include jewelry dealers, precious metals dealers, company service providers, lawyers, accountants, and casinos.

The guidelines also established the financial capability of respondents to comply with AMLA issuance in relation to the money laundering and terrorism financing risks and its impact on public interest.

Covered persons are now classified as micro for those with assets of P10 million and below, small with assets from P10 million to P100 million, medium with assets from P100 million to P1 billion, Large A for those with P1 billion to P50 billion, and Large B with P50 billion and above.

Under old rules, covered persons were classified as micro, small, medium, Large A and Large B with corresponding asset size of P3 million and below, P3 million to P15 million, P15 million to P100 million, P100 million to P500 million and P500 million and above.

The new guidelines also classified violations by gravity such as grave, major, serious, less serious, and light. The AMLC would also look into history of non-compliance, concealment or deliberate effort to hide, the violation, and material misrepresentation.

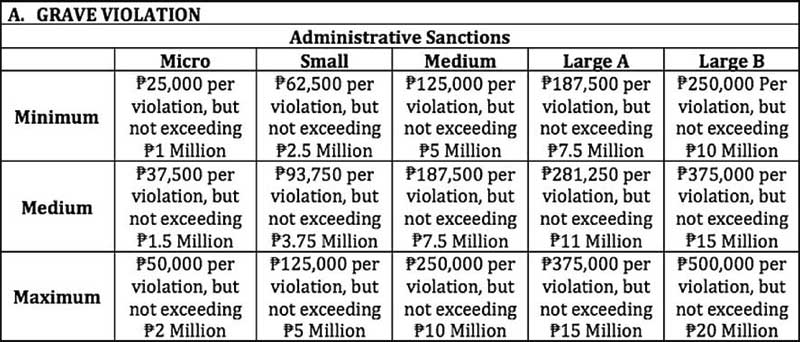

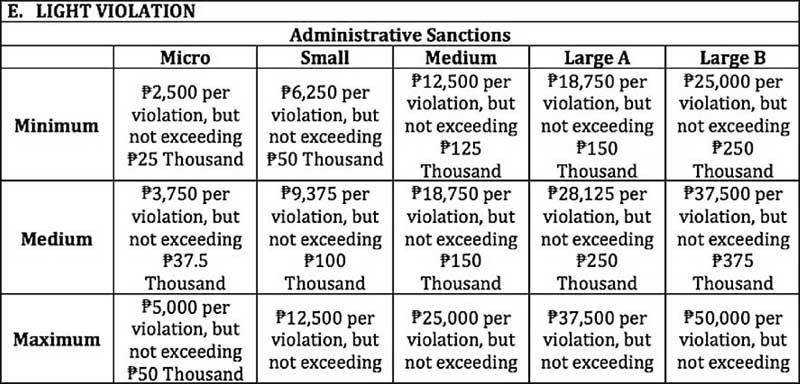

AMLC said the new guidelines impose lower monetary sanctions against violators of the AMLA.

“Monetary sanctions under the RPAC are based on the covered person’s asset size, and gravity of the violation or non-compliance, based on a graduated scale of the proportion or amount involved,” it added.

For grave violations, the fines for micro would range from P25,000 per and not exceeding P1 million per violation to P50,000 and not exceeding P2 million per violation, while fines for Large B would range from P250,000 and not exceeding P10 million per violation.

For light violations, fines for micro would range from P2,500 and not exceeding P25,000 to P5,000 and not exceeding P50,000 per violation, while that of Large B would range from P25,000 and not exceeding P250,000 to P50,000 and not exceeding P500,000 per violation.

For non-compliance with submission of covered transaction reports within the required period, micro entities would be fined P1,500 to P3,000 and not exceeding P2 million per covered transaction, while Large B entities would be penalized P15,000 to P30,000, but not exceeding P20 million for major violations.

Under existing rules, the maximum amount of penalties for failing to comply with the regulatory and reporting requirements of covered transactions is P500,000 per violation.

The old 2017 circular also slapped fines ranging from P50,000 for micro to P500,000 for Large B for grave violators.

The Philippines was used for money laundering two years ago when $81 million stolen by hackers from the Bangladesh central bank found its way to the country via a local bank acting as conduit to casinos.

- Latest