Trump’s impeachment and the stock market

Last week, the Democrat-controlled Congress finally voted to impeach President Donald Trump. In the entire history of the US, Trump has the distinction of being the 3rd president to be impeached. The first was Andrew Johnson in 1868, the second was Bill Clinton in 1998 and now, Donald Trump. Contrary to popular belief, Richard Nixon was not impeached. As the Watergate scandal deepened and the impeachment process uncovered more evidence, it was all but certain that he would be impeached and convicted. Thus, before Congress could vote on the matter, Nixon decided to resign.

US stock market ignores Trump’s impeachment

While Trump has countered impeachment charges with combative rhetoric and aggressive bluster, the stock market shrugged off impeachment concerns. Since Trump’s impeachment inquiry started on Sept. 24, the S&P 500 is actually up 8.6 percent. In fact, after closing flat on the day Congress voted to impeach Trump, the S&P 500 went on to gain 0.45 percent the day after.

S&P 500 all-time high

Not only did the S&P 500 rise despite Trump’s impeachment, but it also closed at a new record high of 3,221, breaching the 3,200 level for the first time in its history. Up 28.5 percent for the year, the S&P 500 is on track for its highest annual return since 2013.

US impeachments in the past

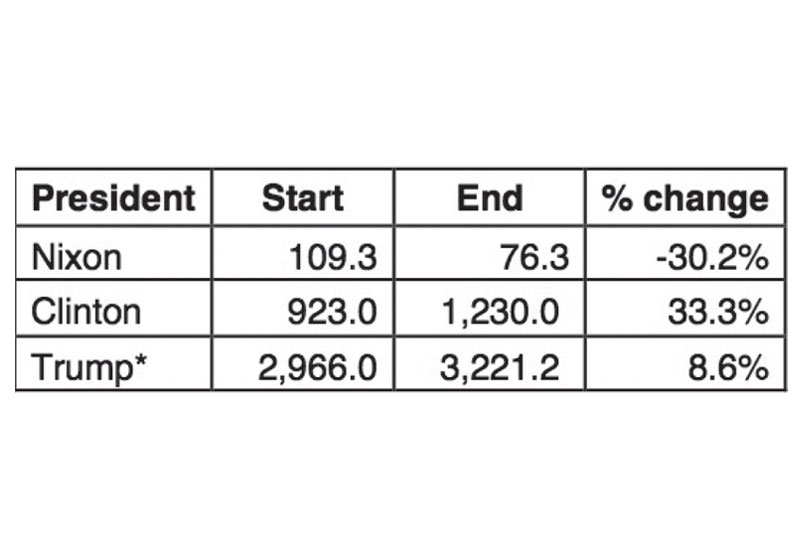

In the table below, one will see the performance of the S&P 500 during the start of each impeachment inquiry until its conclusion. The first US president to be impeached was Andrew Johnson in 1868. However, there was no comparable index to the S&P 500 at the time.

In the case of Nixon, the S&P 500 lost 30 percent of its value in nine months as the impeachment inquiry coincided with the Arab oil embargo. With oil prices nearly quadrupling in less than six months, inflation spiked and economic growth tanked.

During Clinton’s impeachment, which started in October 1998, the S&P 500 was quite volatile as it coincided with the Russian ruble crisis and the meltdown of LTCM. Moreover, the Senate then was controlled by the Republicans, while Clinton was a Democrat. However, with no Democrat senator switching sides, Clinton was acquitted. The S&P 500 eventually went on to gain 33 percent.

The impeachment process for Trump has just started. The impeachment inquiry was launched on Sept. 24. Hearings began on Nov. 13, with Congress eventually impeaching him on Dec. 18. However, investors believe that Trump will not be convicted as the Senate is controlled by the Republicans. As markets recognize that getting a conviction is an uphill battle, the stock market ignored the impeachment noise with S&P 500 making new highs after new highs. History shows that each impeachment has a different impact on the stock market depending both on the economic situation and political landscape at the time.

S&P 500 return from start of impeachment inquiry

Impeachment rules – US vs. Philippines

In the Philippine setting, only 1/3 of Congress is needed for impeachment, while 2/3 of the Senate is needed for conviction. However, in the US, majority of Congress is needed for impeachment. Like the Philippines, a 2/3 vote is needed for a Senate conviction. Though it was fairly certain that Trump would be impeached by Congress, a conviction by the Senate is extremely unlikely as 53 out of the 100 senators are Republican. This is one of the reasons why investors largely ignored Trump’s impeachment proceedings.

Weakness in Asean MSCI rebalancingand regulatory risk drags PSEi

While the US is market making new highs, ASEAN markets are in the doldrums and underperforming their developed market peers. Foreign selling brought about by a flight to safety and MSCI rebalancing pushed down index stocks (see MSCI rebalancing fuels foreign selloff, Dec. 2. Finally, regulatory risk concerning water concessionaires caused certain index stocks to plunge sharply, dragging down the PSEi.

Not an abrogation, but a review of contracts

The sell-off in water-related stocks only stopped when DOF Secretary Sonny Dominguez calmed markets by saying that “this is not an abrogation of contracts, but a review of contracts.” DOJ Secretary Menardo Guevarra also assured investors that government is “not even thinking of replacing” the water concessionaires. This caused AC, MPI, DMC and MWC to rise by four percent, 21 percent, 29 percent and 48 percent from their lows, respectively.

Risk-off to risk-on

As many Philippine stocks fell significantly, valuations have become attractive. With the US and China agreeing to a Phase One deal, the risk of a recession has been substantially reduced. Foreign investors who went risk-off and went to safe havens like bonds and US stocks may switch to risk-on mode. This may drive them back to emerging markets, including ASEAN and the Philippines.

Merry Christmas and Happy Holidays!

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending