SM Prime Holdings 1H profit up 12%

SM Prime Holdings [SMPH 32.30 2.70%] recorded 1H/21 profit of P11.6 billion, up 12% from 1H/20 profit of P10.4 billion.

SMPH said that residential (condo development through SMDC) was its largest business segment (60% of consolidated revenues), with residential revenues up 3% y/y and net reservation sales up 30%. SMPH’s mall business, which accounts for about 26% of consolidated revenues, saw revenues increase 55% y/y, but the recovery was somewhat blunted in the areas that were impacted by the March-May ECQ restrictions (though, notably, not as blunted as back in Q2/20, when nobody was going to malls and tenants were not paying any rent).

Despite improvements, however, SMPH reported that 1H consolidated revenues were actually 6% lower y/y.

MB BOTTOM-LINE

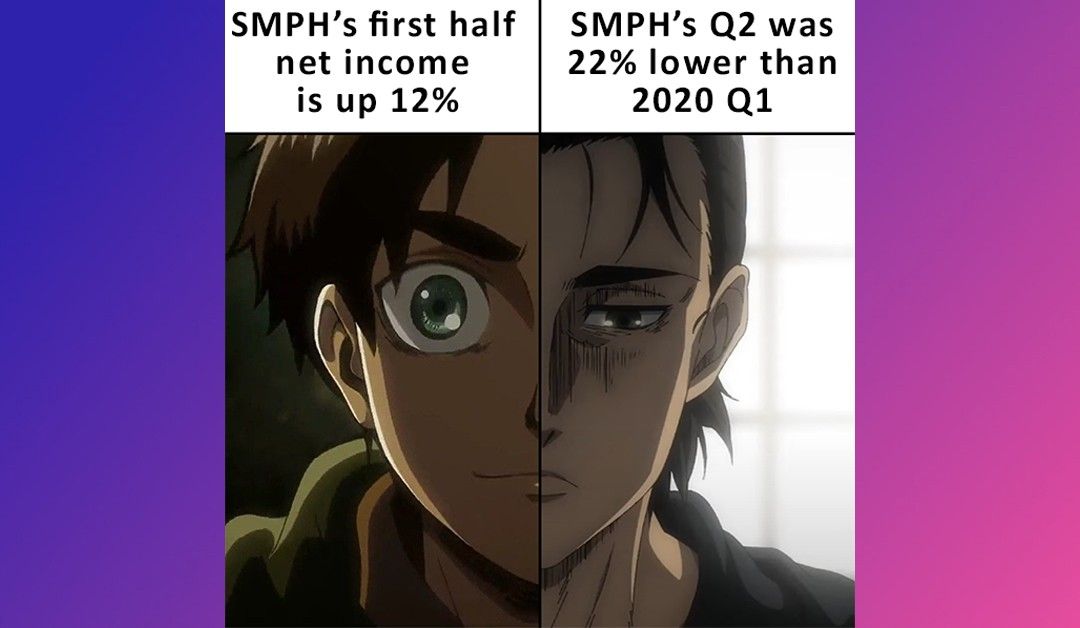

It’s pretty easy to just consume the numbers that SMPH provided, and be done with it. 12% increase in 1H net income? Wow! 55% increase in the malls business? Wow wow! 30% increase in net reservation sales? Wow wow wow! But that doesn’t tell a story that investors should care about. SMPH dunking on its Q2/20 and 1H/20 stats is like a parent being proud of blocking his toddler’s jump-shot attempt.

Of COURSE that 3 year-old shouldn’t put up any points against a grown-ass man. That’s what we’re dealing with here. Think back to that time when the lockdown was first implemented, then extended, then extended again. Do you remember the anxiety, desperation, and uncertainty of that time? Remember how we did absolutely nothing, stuck in our homes, manically sanitizing paper bags from delivery food before bringing them into the house? Remember how the major landlords like SMPH gave tenants rent holidays to help keep the tenants solvent? Of course SMPH should absolutely dominate those numbers.

It’s just not that helpful to determine how well SMPH is doing right now. Setting the period to 1H is a better indication, but half of the timeframe that we’re comparing against is firmly within the first lockdown (which was definitely quite different from the March-May lockdown in NCR+ this year). The better comparison would be to measure this year’s Q2 against last year’s Q1 (mostly before COVID). This year in Q2, SMPH made P6.5 billion in net income. In Q1 of last year, it made P8.3 billion. That’s a 22% drop. That’s a very significant difference, and (to me) gives us a far better idea of how far SMPH is from its pre-COVID performance level.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest