FDI inflow slows as inflation stings

MANILA, Philippines — Elevated inflation and challenging global economic conditions continue to take their toll on the country as the net inflow of foreign direct investment (FDI) plunged last year, the Bangko Sentral ng Pilipinas said.

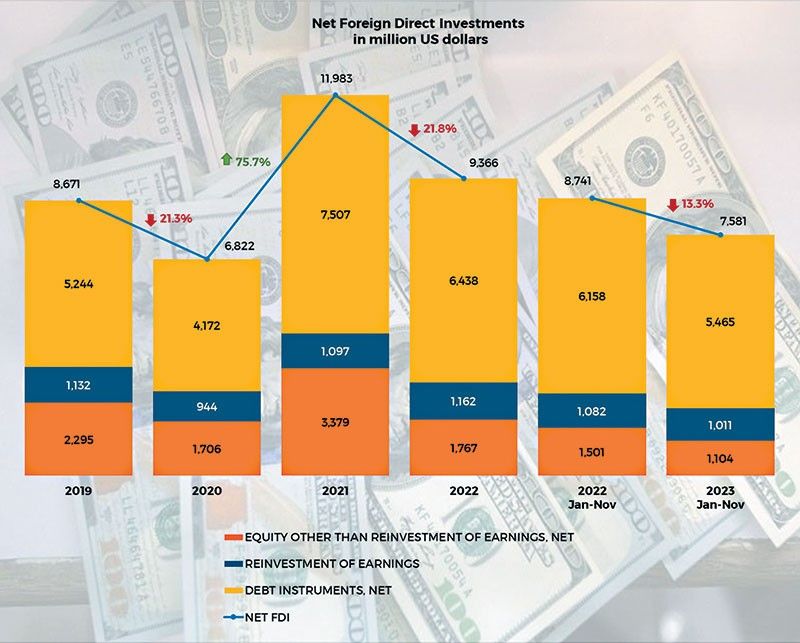

BSP data showed that in the 11 months to November last year, net FDI inflow slipped by 13.3 percent to $7.58 billion from $8.74 billion in the same period in 2022.

This is almost 95 percent of the $8 billion total expected FDI inflow for 2023. FDI can be in the form of equity capital, reinvestment of earnings and borrowings.

“Notwithstanding the country’s sustained economic growth, FDI remained subdued due to the lingering impact of high inflation and low growth prospects globally,” the BSP said.

Investments in debt instruments went down by 11.3 percent to $5.47 billion in the 11-month period.

These consist mainly of intercompany borrowing between foreign direct investors and their subsidiaries in the Philippines.

Also covered are investments made by non-resident subsidiaries in their resident direct investors.

Likewise, total reinvestment of earnings declined by 6.5 percent to $1.01 billion from the $1.08 billion generated in 2022.

Similarly, equity other than reinvestment of earnings dropped by 26.4 percent to $1.1 billion from $1.5 billion.

Equity capital placements during the 11-month period mainly came from Japan, the US, Singapore and Germany.

Half of these inflows went into manufacturing. Others include real estate and financial and insurance.

Meanwhile, equity withdrawals more than doubled to $504 million from January to November 2023 from $231 million in the same period in 2022.

- Latest

- Trending