Banks, swamped with unpaid loans, are not lending

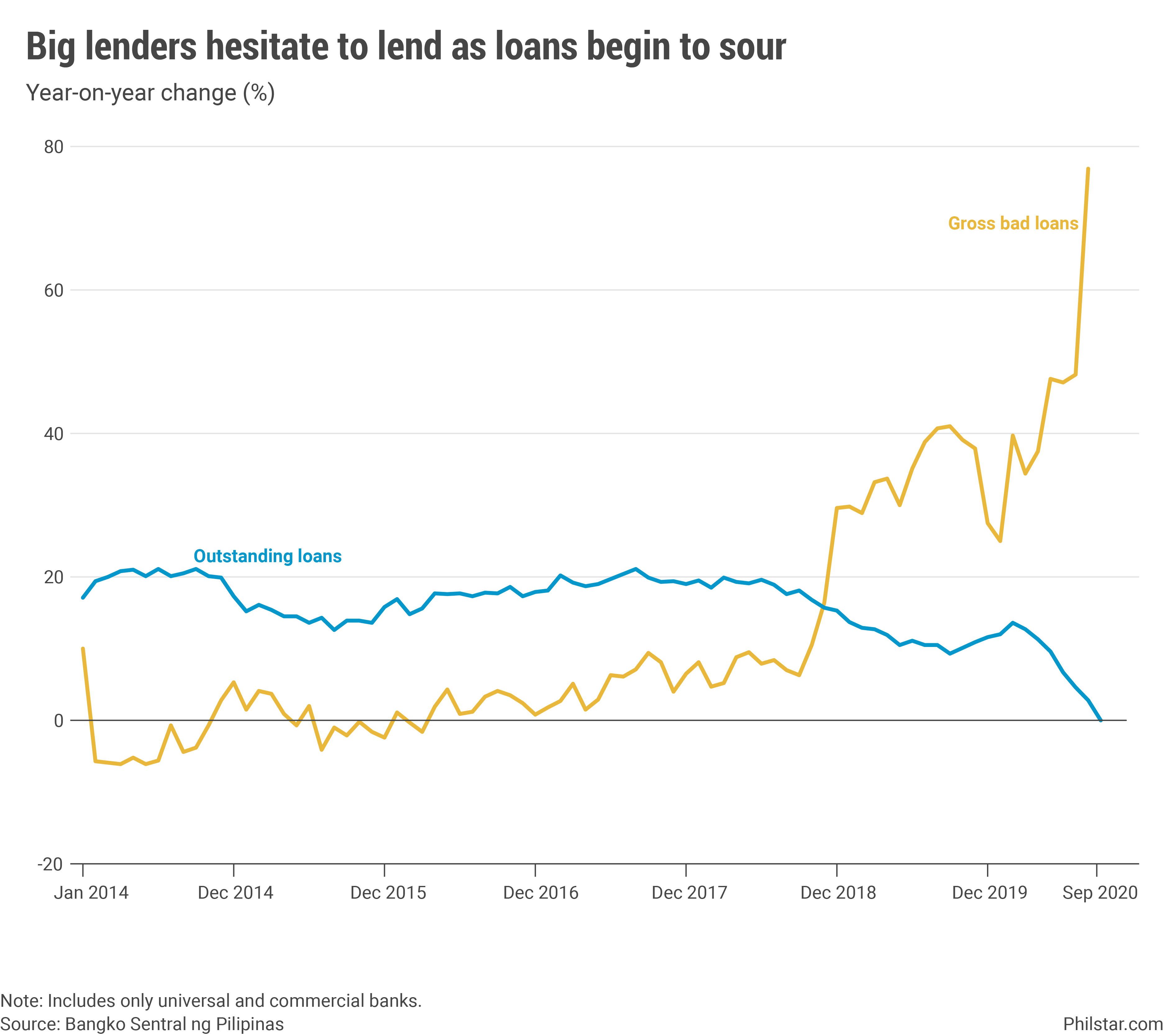

MANILA, Philippines — Banks continued to hold back from lending as loans in their books start to sour with the unwinding of regulatory relief extended to customers battered by the pandemic.

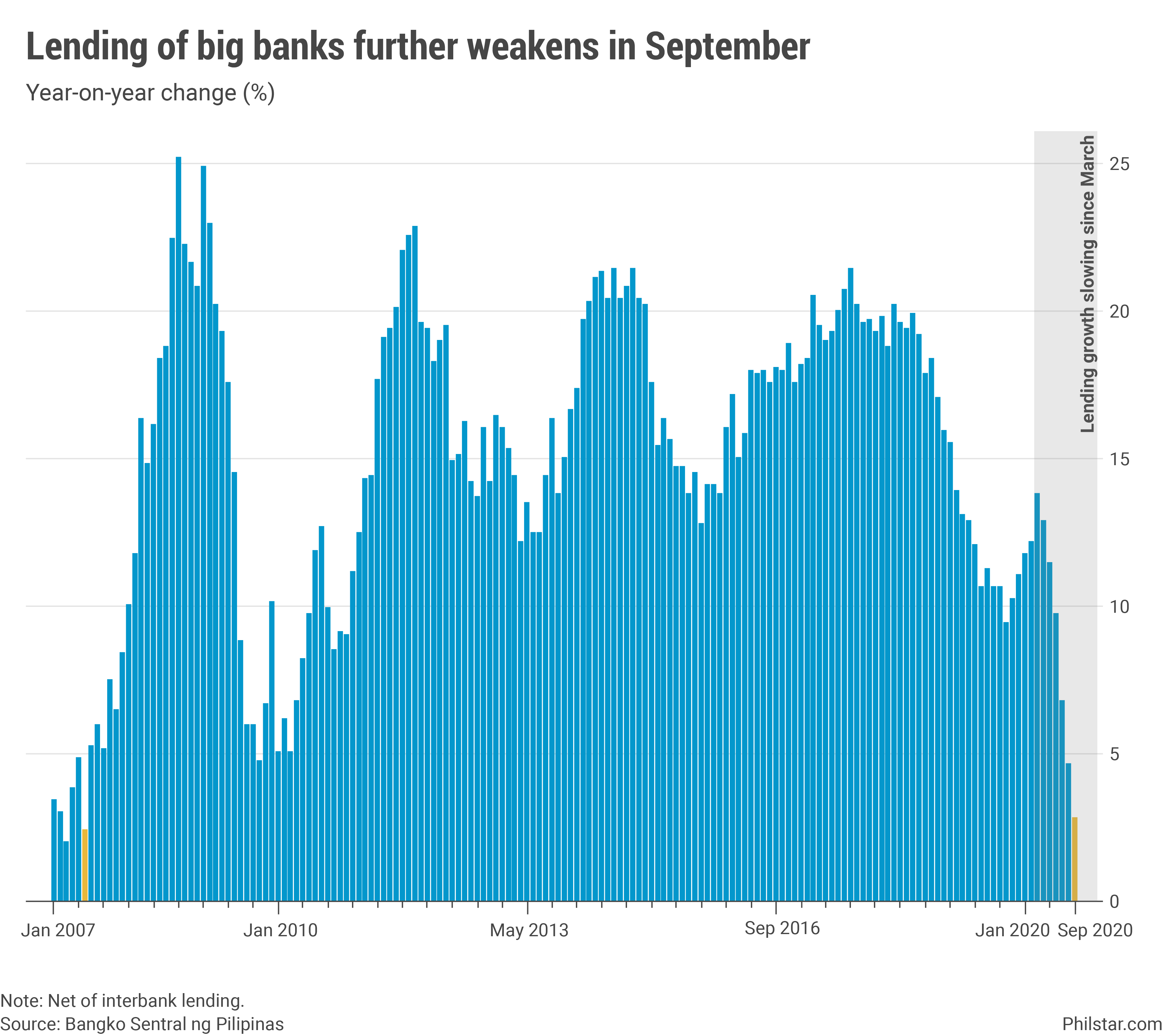

Outstanding loans by big banks, net of their lending to each other, inched up 2.8% year-on-year as of September, sustaining a weakening trend that started last March. The latest data was also the worst performance since June 2007’s 2.4% growth.

Lending is slowing down as banks, big or small, had to contend with a surge in unpaid credit. Non-performing loans (NPL), or those unpaid at least 30 days past due date, soared 60.2% year-on-year to P364.67 billion last month. That brought NPL to account to 3.4% of the entire loan books, the highest since May 2013.

NPL increased as 60-day grace periods on loan payments under the Bayanihan to Recover As One Act began to taper off. While banks have also stepped up defenses from potential NPL losses, these are slowly getting eroded, albeit remaining sufficient at 91.75% of bad loans. The ratio was down from 107.4% in August.

In a statement Tuesday evening, the Bangko Sentral ng Pilipinas (BSP) said lenders are pulling back from doing their primary business of lending because of “reduced tolerance for risk,” apart from a general weakness in business and consumer sentiment with the economy mired in recession.

Such statement is recognition of the challenge ahead for BSP Governor Benjamin Diokno who lowered interest rate to record-lows as he took up the cudgels for his former colleagues at the Duterte Cabinet refusing to embark on a massive fiscal push. Government is being asked to spend more to salvage the economy that contracted 10% in first 9 months, but has been hesitant to do so because of widening deficit.

The problem is BSP’s latest data showed aggressive monetary easing is not doing the trick. While by central bank estimates P1.7 trillion had been released to the economy by low rates and a 200 basis-point cut in reserves since March, most funds have only gone to the bond and stock markets— the latter rose to a 9-month high last Tuesday— and not to businesses and consumers they intend to help. Some funds even went back to BSP through its bond and term deposit auctions which consistently enjoyed high demand.

“From here, we can only expect downward trends in lending across most sectors to fall, household into single digits soon and overall lending to edge closer to zero with the economy in pandemic,” Nicholas Antonio Mapa, senior economist at ING Bank in Manila, said in client note.

Patrick Ella, economist at Sun Life of Canada (Philippines) Inc., agreed. “3Q (Third quarter) looks bad and doesn’t indicate if the loan trend will change as of now,” he said in a separate e-mail.

Breaking down the numbers, loans by universal and commercial banks to big production activities grew 2.4% year-on-year in September, down from 4.1% previous month. Under this segment, credit to manufacturing sector contracted 2.6%, while that for wholesale and retail trade slumped a bigger 3.4% annually.

On the flip side, loans to information and communication sector, which benefits from a digital shift, rose 9.7% year-on-year, while bank credit to the booming property sector expanded 7.3% on-year and utilities by 3%. Pandemic response, meanwhile, pushed up loans to health and social work activities by a staggering 44.5% year-on-year.

In other segments, household loans rose 10.2% year-on-year, and while still in double-digit, was a dramatic slowdown from 22.9% expansion last March just when the health crisis was unfolding.

BSP Deputy Governor Chuchi Fonacier believes the slowdown in loan growth has reached its bottom and should gain pace in the final 2 months of the year with holiday spending. Emilio Neri Jr., lead economist at Bank of the Philippine Islands, agreed, but also tempered his expectations given rising bad debts.

“Soured loans will still rise. History shows it’s the year after or even 2 years after (recessions) that NPL tend to peak. My sense is that provisioning of banks early in the year was insufficient at the moment,” Neri said in an online exchange.

The good news is legislators passed on Tuesday the Financial Institutions Strategic Transfer Act, which aims to absorb lenders’ bad loans so they can proceed with lending. The measure will still go through consolidation by House and Senate leaders before reaching President Rodrigo Duterte’s desk for enactment.

Based on an early BSP survey of lenders, banks expect NPL to peak to 4.6% of total loans by yearend, but Fonacier said regulators polled them again last month for updates, the results of which are currently unavailable. “We’re still waiting for some of the banks. We’re also engaging them to better understand the assumptions used,” she said.

- Latest

- Trending