Pandemic spending fails to impress in May

MANILA, Philippines — Government spending grew at a “disappointing” pace in May when the response to the coronavirus pandemic should have accelerated it further, worrying economists that the Duterte administration’s hesitation to boost spending risks delaying a much-needed economic recovery.

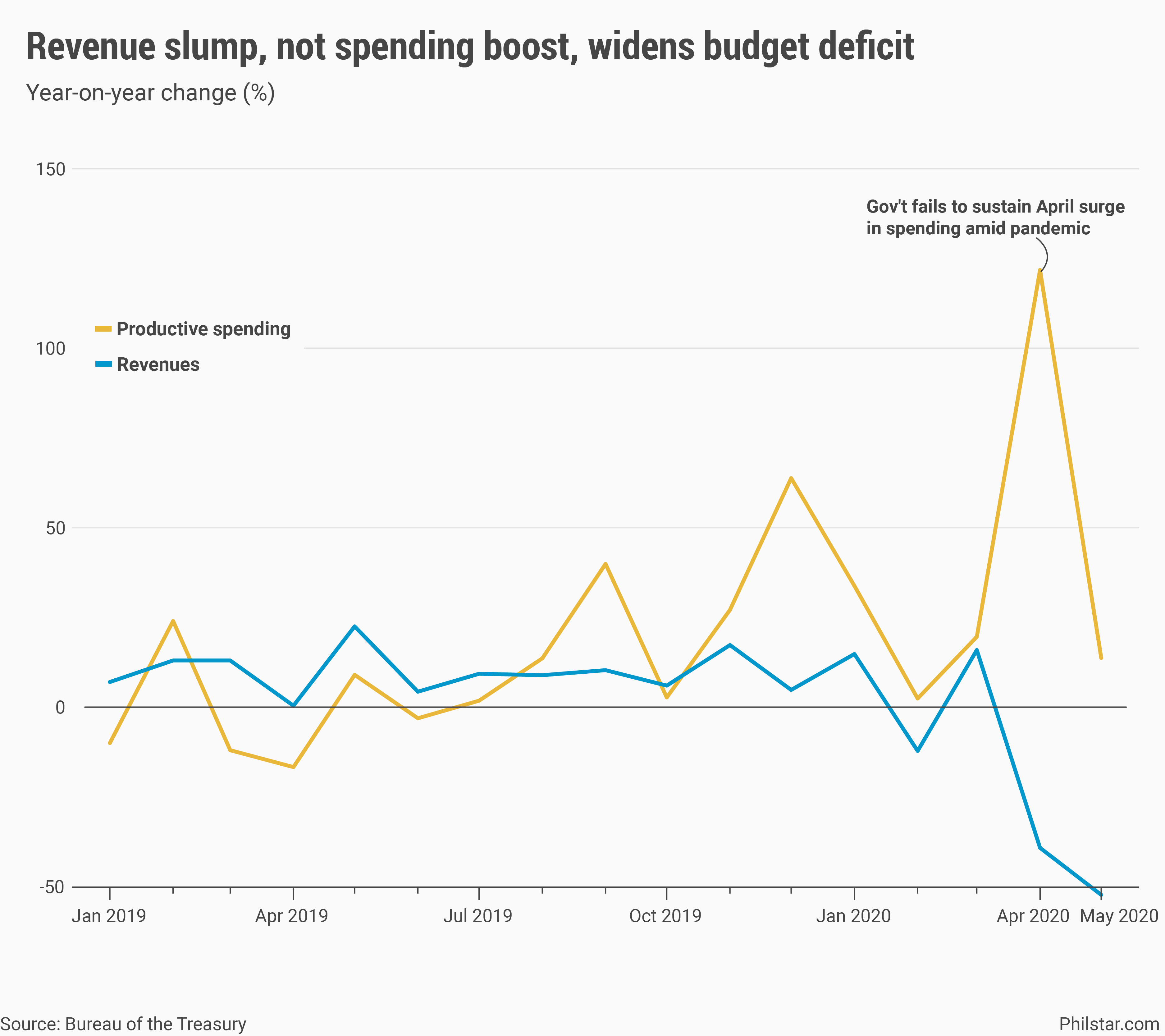

While expenditures were contained at just about normal levels, revenues plummeted as expected, widening the budget deficit to P202.1 billion last month, a reversal of previous year’s P2.6 billion surplus, the Bureau of the Treasury reported on Tuesday.

“We can say the deficit is being driven more by plunging revenue collection more than the base effect driven year-on-year growth of expenditure,” Nicholas Antonio Mapa, senior economist at ING Bank in Manila, said in an online exchange.

Broken down, revenues dropped 52.3% year-on-year to P151.5 billion in May, while disbursements expanded 12.4% to P353.6 billion in the same period. Compared with April, the decrease in revenues worsened from 39.2%, while the rise in disbursements tempered from 108.1% the previous month.

The revenue performance was expected. Collections by the Bureaus of Internal Revenue (BIR) and Customs, which collectively account for 90% of tax revenues, sank 61.6% and 33.4%, respectively in May. Non-tax revenues decreased three times from year-ago levels.

On the flip side however, expenditures were “disappointing” to say the least, according to Mapa. Apart from an annual growth slowdown from April, spending also contracted 23.4% month-on-month. Broken down, the so-called productive spending by agencies in May grew 13.7% year-on-year, much slower than the 121.8% expansion in April.

“It’s disappointing that on a month-on-month basis, spending fell as government officials await the still pending fiscal rescue plan,” he said.

Not the time to control spending

In normal times, getting spending under control to keep the deficit in check is welcome, but with a lingering pandemic that inevitably increased the need for government services, Mapa said the May spending figure “may not be enough to plug gaping holes in the economy.”

The Treasury said spending last month was “propelled by the releases for the second tranche of the Small Business Wage Subsidy” of the finance department. The program costs P51 billion and assists displaced formal workers in two tranches.

When one considers last year’s election ban on public projects, as well as delays in the passage of the 2019 budget that prevented outlays, Emilio Neri Jr., lead economist at Bank of the Philippine Islands said the May spending growth is also “too low.”

“With the base for the balance of the year likely to be higher due to 11th hour agency spending in 2019, there is a risk that the economy doesn’t get enough spending support from the national government to the point where major economic activities could enter an unmanageable downward spiral,” Neri said in an online exchange.

The repercussions could be severe. With the economy poised to enter recession this quarter, after a 0.2% contraction in the first three months, Neri said the kind of May spending “risks that we will be late in the recovery in Asia.” “This is despite the potential to recover faster,” he added.

For the first five months, spending grew 26.6% year-on-year, while revenues dipped 16.1%. So far, the deficit amounted to P562.2 billion, nearly 35% of this year’s widened limit of P1.61 trillion. The deficit cap was widened supposedly to accommodate more spending, but Neri said that is not happening.

“There is a risk that spending growth could slow down in a downward economic cycle, an unnecessary waster of our high credit ratings,” he said.

Robert Dan Roces, economist at Security Bank Corp., however was more optimistic. “Constraints are present chief of which are lower collections from the revenue-generating agencies, and thus leaving government with a precarious balancing act to spend within said constraints and hence may be prudent but not enough of a nudge in the meantime,” Roces said.

“But I would expect expenses to be higher moving forward if government were to ramp up its pandemic-related expenses,” he added.

- Latest

- Trending