Currencies 2019: Volatility sinks to record lows

Last year was relatively calm for currency markets. Monetary policy convergence among major central banks resulted in a year of extremely low volatility. Compared with 2017 and 2018, the US dollar index traded in a tighter range between 95.06 – 99.67 or a range of less than five percentage points last year. That was the lowest range that the US dollar index has traded going back to 1980.

US dollar index, flat for the year

The US dollar index is up just 0.24 percent for the year, its smallest yearly move. It ended 2019 on a bearish note, hitting a five-month low of 96.389 on Dec. 31. This level is now well below the 200-day moving average, indicating a possible change in the dollar’s upward trend. Easing trade tensions between the US and China after the Phase 1 deal and investor optimism about global growth prospects have diminished the demand for the dollar as a safe-haven asset.

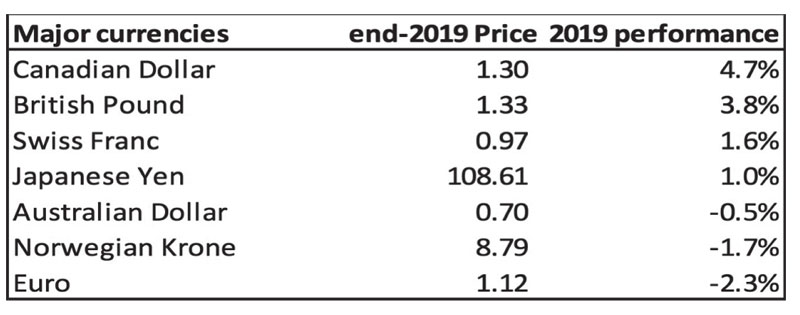

Canadian dollar, 2019's best-performing major currency

The Canadian dollar is the best-performing major currency in 2019, up by 4.7 percent vs. the US dollar. The next best is the British pound, which gained 3.8 percent against the greenback. Bank of Canada’s decision to keep rates steady and the recovery in commodity prices aided the strength of the loonie. Meanwhile, the pound ended the year higher following pro-Brexit Boris Johnson’s election victory.

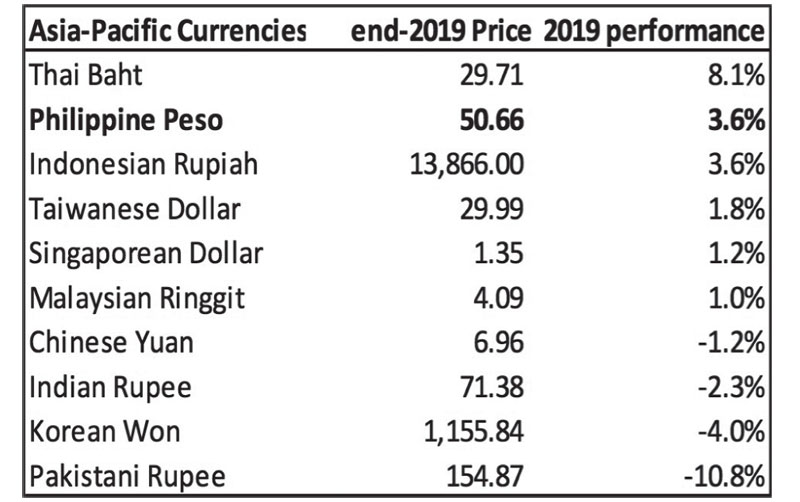

Phl peso, 2nd best-performing currency in Asia

The Philippine peso ended 2019 at 50.66 vs. the US dollar, appreciating 3.6. It outperformed nearly 90 percent (or 125) out of the 139 global currencies tracked by Bloomberg in 2019 and tied with Indonesia as the 2nd best performers in Asia. In past articles, we noted that the attractive “carry trade” has boosted the demand for Philippine bonds and the peso, especially when the global bond market is carrying a pile of negative-yielding debt.

The peso also benefitted from the record-high GIR, narrower current account and trade deficits, and a balance-of-payments (BOP) surplus. The higher tourist arrivals, the steady OFW remittances, BPO and POGO revenues have contributed positively to the peso.

Geopolitical risks escalate in the 1st week of 2020

Last Friday, geopolitical tensions in the Middle East flared after a US airstrike in Iraq killed a top Iranian commander. Qassem Soleimani, head of the Iranian Revolutionary Guards’ overseas forces, was accused of developing plans to attack American diplomats and service members in Iraq. Oil prices gained more than four percent to reach $69 per barrel, the highest since the drone attacks on Saudi Arabia’s oil facilities in September.

EM currencies drop the most since September

Emerging market (EM) currencies fell the most since September on Friday as the US air attacks on Iran triggered a flight to traditional “safe havens” such as the US dollar and the Japanese yen. In Asia, the Korean won dropped 0.76 percent, while the Philippine peso weakened 0.71 percent to close at 51.08, its softest level in two months. The South African rand fell 1.51 percent, while the Brazilian real declined 0.84 percent.

Will volatility return to the currency market in 2020?

Last Friday’s move has rattled the currency markets, making volatility return to EM currencies. Geopolitical events in the Middle East will determine how currencies and other assets will move. If the situation escalates and there is a material threat to oil supplies, then we shall see more serious ramifications especially to countries importing oil. We have to follow the events in the Middle East carefully as they will determine the direction of stocks and currencies.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call 8689-8080 or email [email protected].

- Latest

- Trending