Liquidity normalizing, says BSP

MANILA, Philippines — Liquidity continues to normalize with the actual disbursement of the proceeds of the recent fund raising activities undertaken by the national government, according to the Bangko Sentral ng Pilipinas.

BSP Deputy Governor Diwa Guinigundo said liquidity is normalizing as special events like the tax season, Holy Week, and the forthcoming mid-term elections are boosting higher public spending following the budget impasse.

Liquidity in the financial system, however, continues to normalize after a series of fund raising activities by the Bureau of the Treasury (BTr), he said.

“This time around we shall be seeing the actual disbursement of the proceeds of the fund-raising exercises of the BTr including the recent retail treasury bonds which were deposited with and mopped up at the BSP,” Guinigundo said.

Last March, the Treasury raised P235.93 billion from the sale of five-year retail treasury bonds as the national government continues to borrow heavily from both foreign and local sources to plug the budget deficit and finance the massive infrastructure build up under the Build Build Build program.

With improving liquidity, the BSP auction committee has raised the volume of the term deposit auction facility (TDF) on Wednesday to P30 billion from last week’s P20 billion.

The yield of the six-day term deposits eased for the fifth straight week, declining by 3.69 basis points to 4.7198 percent last Wednesday from last week’s 4.7567 percent, while the rate for the 14-day tenor likewise slipped by 2.65 basis points to 4.7524 percent.

Latest data showed the level of liquidity in the financial system slowed down by 4.2 percent to P11.38 billion, its weakest growth in more than six years.

BSP Governor Benjamin Diokno said the reversal of the tightening cycle last year and the reduction of the level of deposits banks are required to keep with the central bank are “inevitable.”

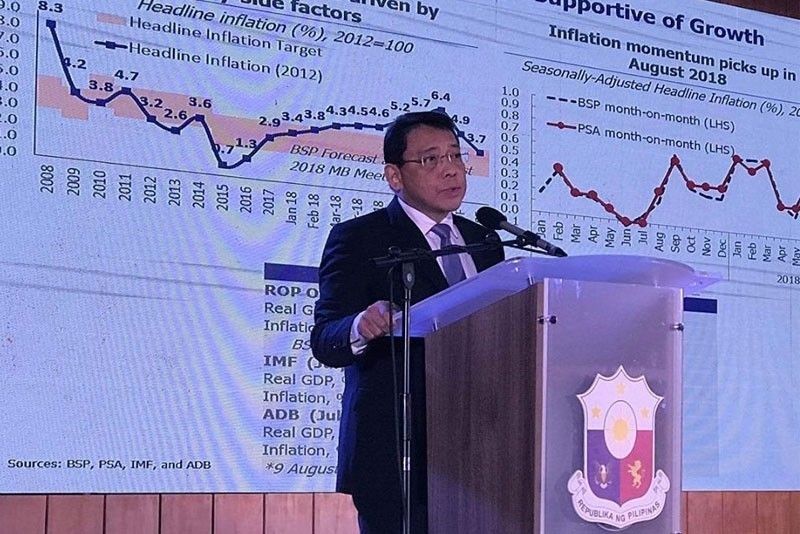

The BSP’s Monetary Board lifted rates by 175 basis points in five straight rate-setting meetings between May and November as inflation accelerated to 5.2 percent last year and exceeded the central bank’s two to four percent target range due to elevated oil and food prices as well as weak peso.

Easing inflation allowed the BSP to take a breather from the tightening episode as it managed to keep rates steady since December. Inflation eased for five straight months to 3.3 percent in March after peaking at 6.7 percent in September and October last year.

The regulator intends to reduce the RRR as the late BSP governor Nestor Espenilla Jr. committed to bring down the level to single digit by 2023.

“To me, that is also clear because we have one of the highest reserve ratios in this part of the world. So its clear that we need to reduce that to be more competitive,” Diokno said.

Last year, the BSP slashed the RRR level by 200 basis points in March and June to 18 percent from 20 percent, releasing P190 billion in additional funds into the financial system to support the growing economy.

- Latest

- Trending